Maya puts PH on the global stage in Google Think FinTech 2022

Leading digital banking and finance app Maya took the global stage at the recently held Google Think Fintech 2022 in Dubai, as the only Southeast Asian Fintech player featured in the prestigious event.

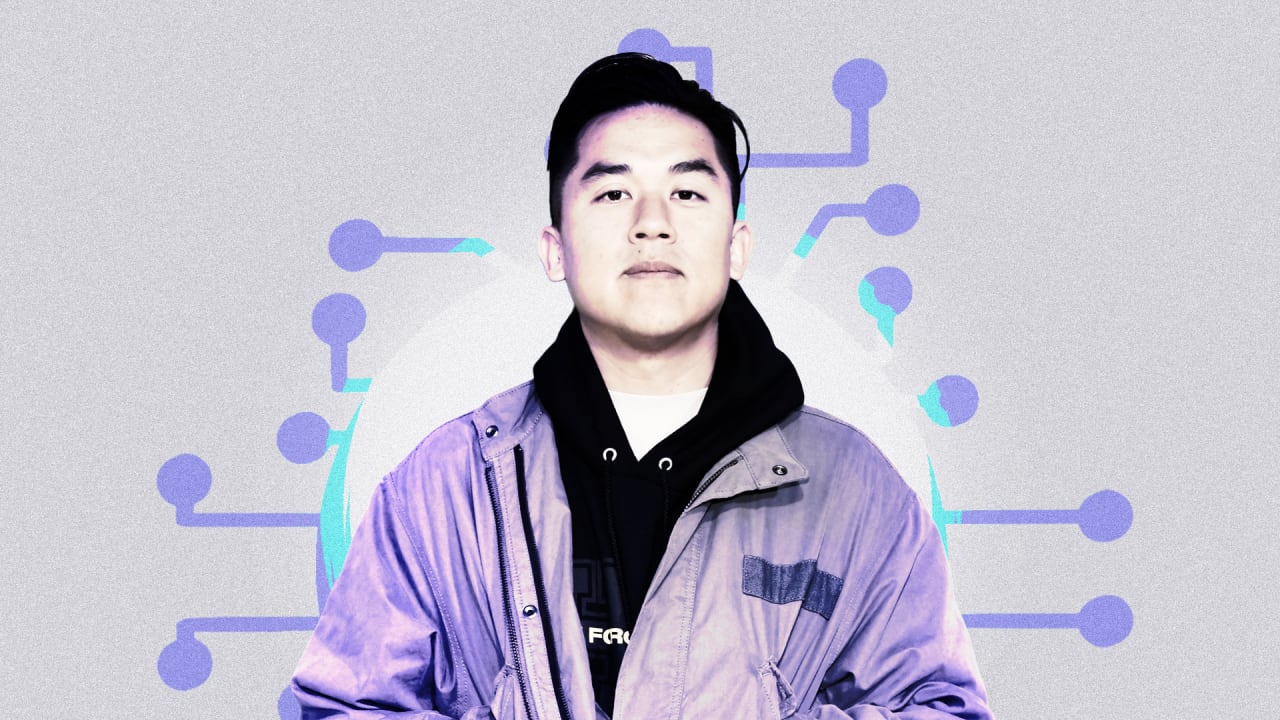

Maya Chief Marketing Officer Pepe Torres spoke at the tech giant’s exclusive fintech conference for emerging markets around the world. He shared how helping to address the pent-up demand for digital financial services that offer superior customer experiences enabled the company to spearhead fintech adoption in the second fastest growing economy in the region.

“The pandemic led to the acceleration of a wide range of apps in the Philippines. But post-pandemic, customers have been left with a messy financial experience with their money scattered across e-wallets, banking and investments. We don’t just have the unbanked; we now have the unhappily banked. We saw an opportunity to simplify all this complexity for the customer by transforming into an all-in-one banking app that is monitored by the BSP. And based on the market’s response, we are confident that Maya is on the right track, ” said Torres.

Since rebranding in April 2022, Maya has redefined the fintech landscape in the Philippines. It leapfrogged from pure payment play as the first and only integrated financial solutions platform to become the leading digital bank in the Philippines.

Maya’s ability to innovate at digital speed has fueled its phenomenal growth, acquiring over 1 million new banking customers and adding more than P10 billion in deposit balances five months after launch.

According to Torres, boldness was a key attribute in making Maya a brand that seizes the opportunity to serve the larger market of the unbanked and unbanked Filipinos.

The digital banking app continues to innovate with industry-high daily interest payouts to encourage customers to save, a feature to increase interest by paying for necessities using the app, creating personal goal sub-accounts for specific goals that customers want to save for, and hyper-personal experiences with @username that enables customers to send money to a customer’s chosen username instead of a mobile number or QR code. These features aim to empower Filipinos to make bolder choices in life through better money management.

Torres also highlighted the importance of translating such a bold move into equally ground-breaking and memorable branding and marketing executions. “We invested in a bold design identity that not only communicates our transformation into an all-in-one digital bank, but also helps our customers have a more delightful relationship with money,” explained Torres.

Maya’s presence at Google Think Fintech 2022 shines a spotlight on the Philippines as a hotbed of fintech innovation and world-class talent. The event provided insight into how the country’s journey for financial inclusion is progressing from access through ownership of e-wallet accounts to deeper use of financial services with seamless digital banking.

Maya has changed the financial services game with its integrated ecosystem approach with built-in digital banking that uniquely positions it among e-wallets, banks and fintech players in the Philippines.

Today, Maya is the only fintech brand serving all segments of consumers and businesses with the leading all-in-one digital banking app, the leading enterprise payment processing business and the most comprehensive agent network on the ground, Maya Centers.

According to the recently released Google, Temasek and Bain Southeast Asia e-Conomy 2022 report, the Philippine digital economy will continue its upward trend of 20% year-on-year to reach US$20 billion this year, with e-commerce as driving it to USD35 billion by 2025. The digital financial services industry is expected to maintain growth, with lending and payments accounting for 53% and 18% respectively.