Lido, Kraken Bank and Jimmy Fallon

Crypto News: We give you an overview of what has happened in crypto this week. And what a week it was!

The biggest news of the week was rumors from a Bankless podcast that the US Securities and Exchange Commission (SEC) had issued the decentralized liquid investment protocol Lido a Wells Notice. The rumor was later debunked, but not before Lido’s original LDO token dropped 20%. A Wells Notice is a formal notice from the SEC that legal action is about to begin.

All’s Wells That Ends Wells

Bankless host David Hoffman’s guest during the week falsely suggested the SEC could come after Lido. This claim prompted many holders of Lido’s LDO tokens to dump the asset, lowering the price to $2.41.

The token rebounded to $2.67 after Hoffman clarified that the protocol had not received an SEC warning. He later opined that, according to course, at least one DeFi protocol had recently received a well alert.

The agency issued a Wells notice to BUSD stablecoin issuer Paxos in mid-February, alleging that the asset is a security.

Crypto News – Socially

Kraken Banking on the future

Kraken’s legal chief confirmed this week that the exchange will launch its own bank “very, very soon,” although crypto-friendly bank Silvergate said it would begin winding down operations amid challenging market conditions and scrutiny of its involvement with collapsed crypto exchange FTX.

Kraken’s former CEO, Jesse Powell, recently came out and opposed the SEC’s enforcement action against Kraken for offering its stake program to US clients as unregistered securities.

Ethereum’s potential security of status also came under the spotlight this week, with arguments for and against heating up as the SEC hammers home.

Arguments for Ethereum being a security include the initial coin offering in 2017, which raised capital through the sale of Ethereum to investors expecting a profit. Some also argue that tokens represent network ownership, similar to company shares. Others note that the tight-knit group of developers responsible for maintaining and upgrading the network centralizes it too much, making ETH a security rather than a decentralized currency.

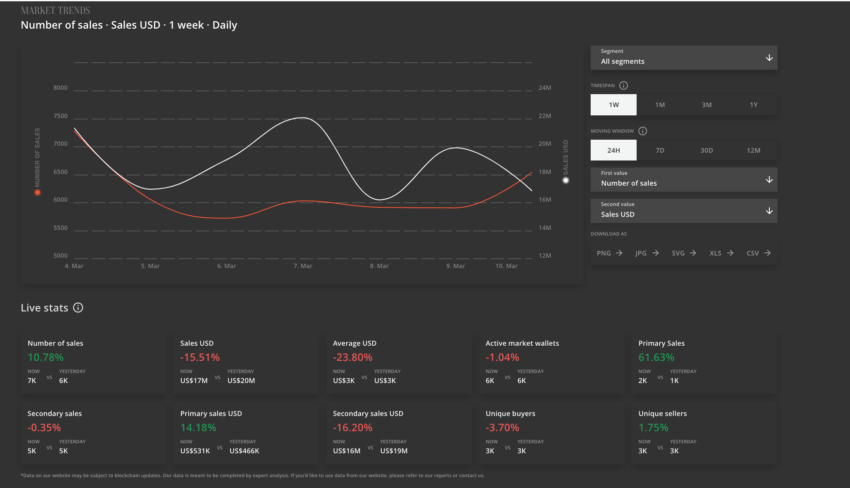

This week in NFT Sales

Jimmy Fallon denies links to Ripp Ryder

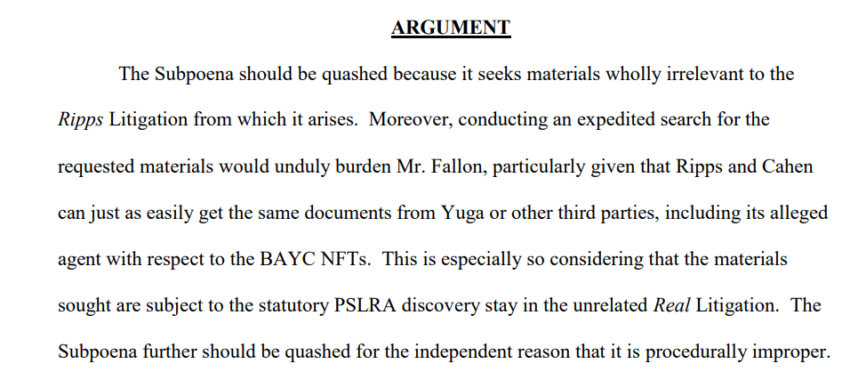

In non-fungible token (NFT) news this week, celebrity talk show host Jimmy Fallon sought to have a subpoena against him dismissed in Yuga Labs vs. The Ripps case.

Early this year, Ripps accused Yuga Labs of being a white supremacist group that launched the BAYC collection as a trolling stunt. Yuga Labs later sued Ripps for copyright infringement for copying Bored Ape Yacht Club images and branding them as NFTs on OpenSea.

Lawyers for the talk show host argue that Fallon does not know Ripps and that any documents required by the subpoena can be obtained elsewhere.

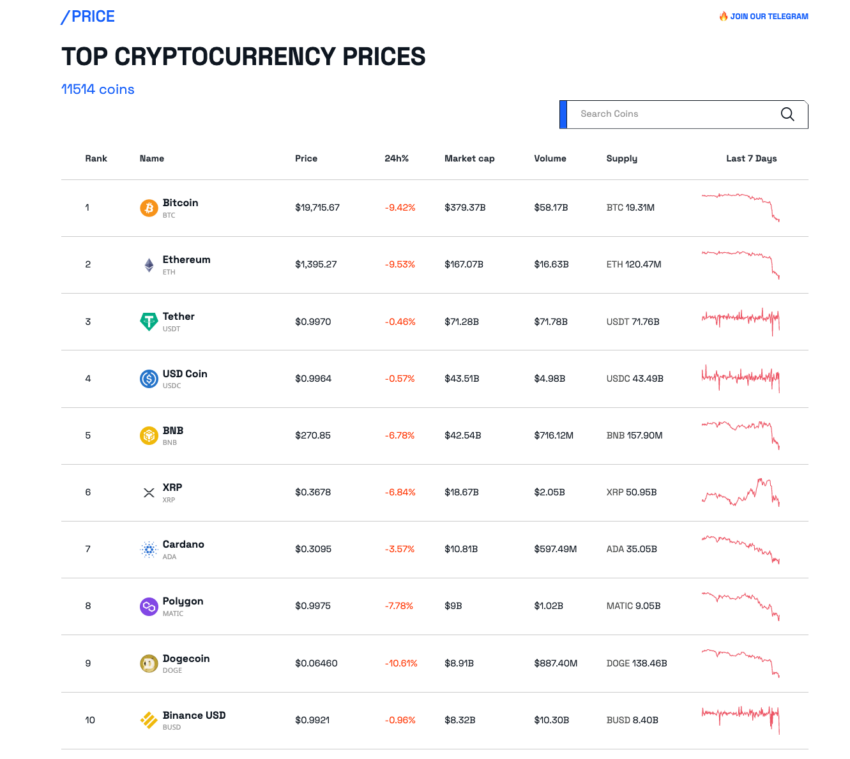

News about crypto coins

Crypto’s biggest gains this week include a 9.76% increase for KAVA, the governing and staking token of the Kava blockchain.

Decentralized autonomous organization DAO Maker’s token (DAO) rose 6.8%, while decentralized lending platform Liquidity’s LQTY rose 2.9%. Ripple XRP was up 0.45% this week, while Shiba Inu’s BONE token was up a fifth of a percent.

On the bearish side, Stacks (STX) fell 32.7%, while AI-centric token SingularityNET(AGIX) fell nearly 31% this week. Mina blockchain’s MINA token fell by 29%. ERC-20 utility token Render Network (RNDR) is down 28.77%, while DASH, the parent token of its namesake payments-focused blockchain, fell 25%.

Hedera (HBAR) On the way up?

Things were looking positive for HBAR. The price has broken out of a descending resistance line and is currently validating a new support. But which direction will it go in light of Thursday’s exploitation?

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.