It is the crypto king Sam Bankman-Fried who is the problem

In late 2008, the release of the Bitcoin White Paper introduced the world to cryptocurrency. In the years since, an entire industry called crypto has emerged. Within this industry, people are constantly creating what they claim is the next, better version of Bitcoin. A number of companies have also been created to serve as cryptocurrency exchanges, where people can buy and sell cryptocurrency, giving customers access to these assets and protocols.

Much of the crypto industry has deviated from the principles that were crucial to the development of Bitcoin itself.

Bitcoin was a genuine technological innovation. But much of the crypto industry has deviated from the principles that were crucial to the development of Bitcoin itself. As the stunning collapse of cryptocurrency exchange FTX highlights, the crypto industry is filled with scams, Ponzi schemes and bad actors. As a result, it has become increasingly clear that Bitcoin must be understood as something outside of this crypto industry.

The creation of Bitcoin was not a random discovery, but rather the product of decades of discussion and development by a group of people known as cypherpunks. This was an eclectic group of individuals concerned with issues of privacy in the digital age, and the way the digital world requires ledgers to keep electronic records of transactions.

Cypherpunks wanted an alternative: a private type of money. When thinking about how to design this kind of money, cypherpunks studied commodity money and free banking. Along the way, there were a number of attempts to implement this idea, but they either never got off the ground or ultimately failed.

Introducing money with the characteristics that the cypherpunks wanted would require something that was resistant to censorship. The creation of a new form of money will also have to deal with the issuer’s incentives, since someone who can issue their own money can potentially manipulate the supply to benefit themselves at the expense of others.

Bitcoin solved both of these problems. Anyone can download the Bitcoin software and operate a node on the network. The decentralized network maintains a digital ledger called a blockchain that keeps track of the balances of the cryptocurrency known as bitcoin.

To solve the issuer trust problem, the Bitcoin software is programmed so that there is a fixed supply of bitcoin. People don’t have to trust the issuer to be honest. Thus, Bitcoin solved the problem of trusting the issuer by removing trust from the system.

These new projects don’t aim to solve the practical problems that motivated the cypherpunks, but actually just treat blockchain as another thing for the tech industry to tinker with.

Whatever one might think of Bitcoin, it was clearly a significant innovation motivated by a practical problem. It was important not only as a technical question or curiosity about economic theory, but also as an important technology in Cuba, Afghanistan, the Palestinian territories and Africa – areas where mismanagement and corruption have plagued mainstream financial systems.

However, the modern crypto industry does not necessarily share the same vision that motivated the creation of Bitcoin. These new projects don’t aim to solve the practical problems that motivated the cypherpunks, but actually just treat blockchain as another thing for the tech industry to tinker with.

While these alternatives often provide additional “features” absent from Bitcoin, they do so at the expense of principles such as decentralization and censorship resistance that are central to Bitcoin. The most obvious of these is the second largest blockchain known as Ethereum, which allows people to write computer programs on the blockchain. Shortly after it was developed, someone found a bug in one of these programs and used the bug to transfer someone else’s ether (Ethereum’s cryptocurrency) to themselves. The Ethereum developers responded by creating an alternative version of the blockchain that functioned as if the hack had never happened. So much for decentralization.

This is more than a simple difference in vision. Crypto has spawned an entire industry of get-rich-quick schemes. Starting in 2017, this manifested itself in the form of initial coin offerings (ICOs). Various projects emerged to develop programs that could be written on the Ethereum blockchain. Each project created its own digital token that it would sell to generate funding for the project. Once successful, people who bought the token would be able to use it for the project (although often of questionable use) or sell the token at a profit once the project was successful. Most of these projects were failures or frauds, and the Securities and Exchange Commission went after many of them. The process became so violent that some mockingly created something called Useless Ethereum Token. Although the SEC crackdown curbed some of this dodgy, self-serving behavior, allegations remain that venture capitalists are still taking advantage of newbies.

In the last year, the planning has only gotten worse. The first domino to fall was a project called TerraUSD, launched on the Terra Network. TerraUSD was reportedly designed to be a stablecoin, or token that trades one-to-one with the US dollar. The creators came up with a convoluted scheme to exchange TerraUSD with another cryptocurrency to ensure that 1 TerraUSD always had a price equal to $1. As one can imagine, trading one worthless asset for another is not a sustainable strategy.

Nevertheless, the project became very popular due to a promise that investors could earn a 20% interest on their assets. This promise was nothing more than a Ponzi scheme. The current value of TerraUSD is only worth pennies, meaning anyone who continued to hold it has lost almost all of their money.

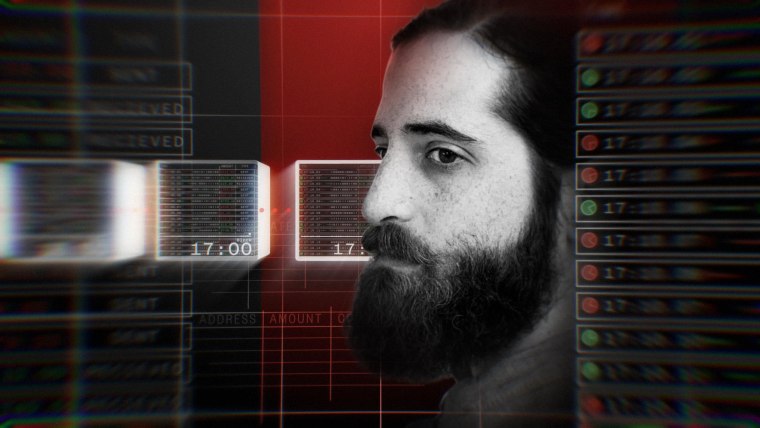

As if that wasn’t enough, last week one of the biggest crypto exchanges in the world was revealed to be insolvent. Led by quirky media darling Sam Bankman-Fried, crypto exchange FTX had experienced a meteoric rise since its founding in 2019. With an unprecedented marketing campaign that included naming rights to an NBA arena and a Super Bowl commercial, Bankman-Fried and FTX became major players in the crypto room. FTX offered people a way to deposit money and buy and sell crypto. It also allowed more advanced traders to speculate using more exotic trading strategies. Bankman-Fried also found himself a policy wonk, witnesses to Congress on crypto regulation.

Now it appears that the company may also have misused customer funds to speculate on its own profits. The Wall Street Journal and CNBC, citing anonymous sources, reported that a hedge fund owned and founded by Bankman-Fried, known as Alameda Research, was loaned billions of dollars in client funds to use for trading. According to CNBC, all this was done without the knowledge of FTX’s customers. Billions of dollars of customer money may simply have disappeared.

What this story reveals is that what is commonly known as crypto is distinctly different from both the cypherpunk vision that motivated the creation of Bitcoin and from developments in and around Bitcoin itself over the past decade. While Bitcoin was created to be a censorship-resistant, trustless digital form of money, crypto has become a space dominated by get-rich-quick schemes. Whatever this crypto industry is, most Bitcoin and Bitcoiners want no part of it.