Is the NFT boom over? Trading volumes hit a 12-month low

Important takeaways

- NFTs are struggling to maintain the parabolic growth they experienced during the bull market.

- OpenSea trading volumes have fallen, falling from $3.1 billion in May to $826 million in June.

- Despite the lack of NFT trading activity, some established projects have held their value in ETH terms.

Share this article

Interest in NFTs has fallen in line with the broader cryptocurrency market as trading volumes hit their lowest levels in a year.

OpenSea NFT Trading stagnates

NFTs haven’t escaped the crypto bear market, trade data shows.

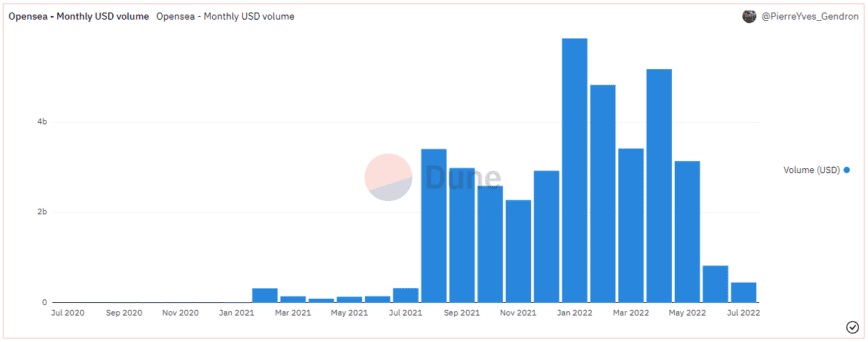

The non-fungible token market is struggling to maintain the parabolic growth it experienced during the bull run of 2021. Data from top NFT trading venues such as OpenSea reveal that trading volumes have fallen off a cliff in recent months, now at their lowest levels since July 2021.

According to Dune data compiled by PierreYves_Gendron, OpenSea’s trading volume peaked at around $5.8 billion in January. However, trading on the platform has fallen steadily through the first two quarters of the year, falling to $3.1 billion in May. June saw the most significant drop in the exchange’s history compared to previous months as trading volumes fell 74% to $826 million. To extend the slide, OpenSea has seen $456.9 million so far this month with four full days to go.

OpenSea’s daily trading volume reveals a higher resolution decline in activity. After registering $543 million worth of trades on May 1, days after Yuga Labs’ highly anticipated Otherside drop went live, daily volumes throughout June and July have brought in close to $20 million. The number of unique NFT transactions on OpenSea also reinforces the decline in interest. In May and early June, transactions regularly exceeded 150,000 per day. Now they haven’t managed to go past 75,000 in over a month.

While OpenSea has faced strong competition from other newer exchanges, it is clear that overall trading volume is still in decline. The latest trading volumes from X2Y2 and LooksRare, the top two exchanges behind OpenSea, are nowhere near enough to make up the difference. According to Dune data compiled by cryptuschrist, X2Y2 currently handles around $27 million in daily trading volume, while LooksRare sees around $9 million. Additionally, since both exchanges offer token incentives to traders, it has been speculated that much of their overall volume comes from wash trades by market manipulators looking to make money from tokens (the exchanges reward the most active users).

Top collections are holding strong

Despite a lack of NFT trading activity, the floor prices of established projects have held steady in recent weeks, and in some cases increased in ETH terms. Dune data compiled by hildobby shows that NFT avatar originator CryptoPunks has seen a price increase of 62% in its floor price from 45 ETH to 73 ETH in the last two months, while the entry price of Bored Ape Yacht Club has fluctuated between 80 and 90 ETH in the same period. Although both collections continue to trade down from their highs, their ability to hold above six figures in dollars points to ongoing interest in the NFT market.

Elsewhere, several NFT trends have gained traction despite low trading volumes. The Ethereum Name Service, a protocol that allows users to register human-readable Ethereum domain names as NFTs, saw trading volume explode in May and June as enthusiasts rushed to secure rare 3-digit and 3-letter ENS domains. Certain generative art collections have also resisted the decline in trading activity. Like the best NFT avatar collections, highly sought-after Art Blocks sets such as Tyler Hobbs’ Fidenza and Dmitri Cherniak’s Ringers have surged in ETH terms over the past two months.

The relative success of ENS domains and generative art shows that a dedicated community of NFT enthusiasts remains despite the NFT market experiencing a steep decline. The drop in trading activity can be attributed to more casual participants who have lost interest in cryptocurrencies and NFTs due to the falling prices of top cryptocurrencies such as Bitcoin and Ethereum.

While some NFT collections are still attracting attention throughout the downturn, the overall trend is negative. After a wild run fueled by an explosion of mainstream interest in 2021, the so-called “tourists” have left, with the market now mainly supported by crypto diehards. The latest data indicates that the kryptonite has a long way to go before it regains the staggering heights it reached last year.

Disclosure: At the time of writing, the author of this piece owned ETH, some NFTs, and several other cryptocurrencies.