Is the Bitcoin Bull Market Here? This metric can say no

A pattern in the Bitcoin exchange reserve ratio that has historically preceded the start of bull runs has not yet formed for the cryptocurrency.

The Bitcoin Exchange Reserve Ratio has continued to decline recently

As pointed out by an analyst in a CryptoQuant post, recent bull markets have started with US exchanges increasing their holdings. The relevant indicator here is the “currency reserve ratio”, which measures the ratio between the currency reserves of two exchange platforms or groups of them.

The “exchange reserve” here refers to a metric that tells us the total amount of Bitcoin currently sitting in the wallets of a centralized exchange (or in the combined wallets of multiple platforms).

In the context of the current discussion, the foreign exchange reserve ratio is taken between the combined reserve of the US-based platforms and that of the foreign ones.

When the value of this ratio increases, it means that the total number of coins on the US exchanges is going up compared to the global platforms right now. On the other hand, a decrease means that offshore platforms are receiving more deposits (or simply observing fewer withdrawals) at the moment.

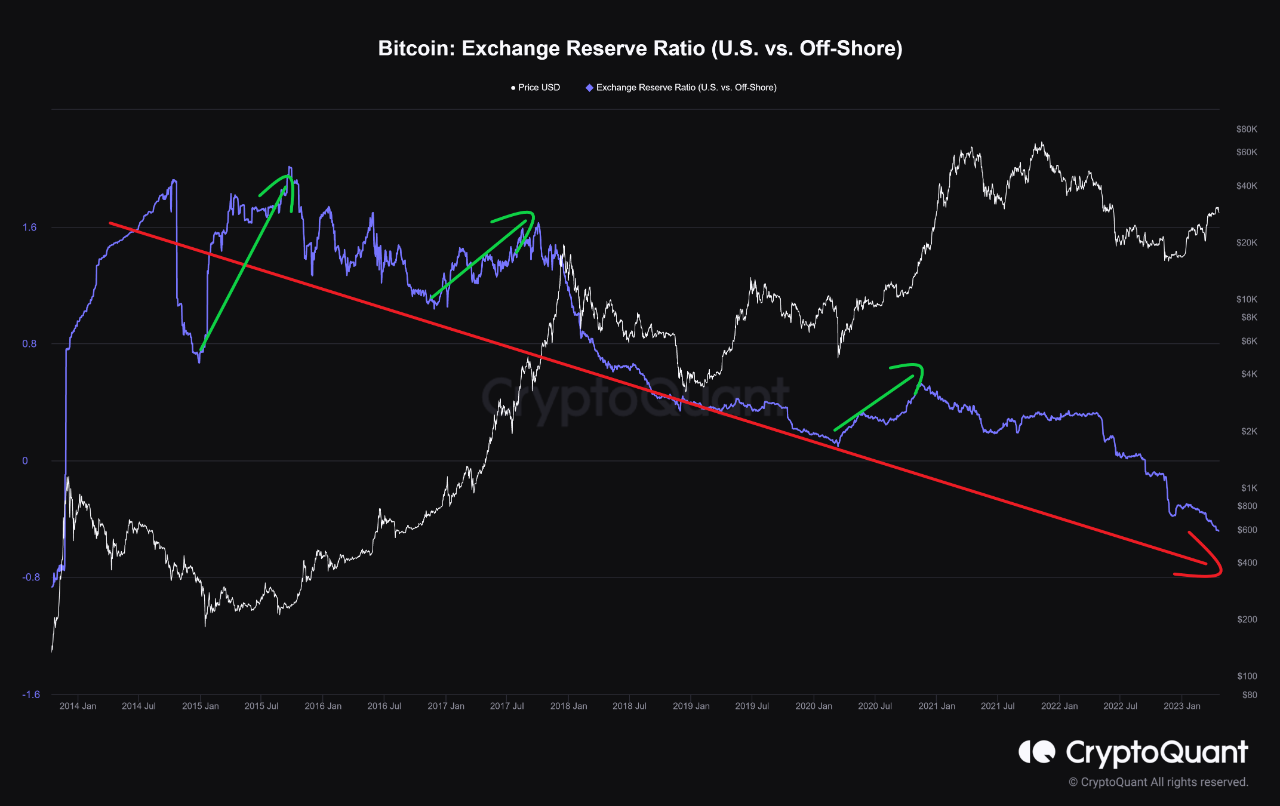

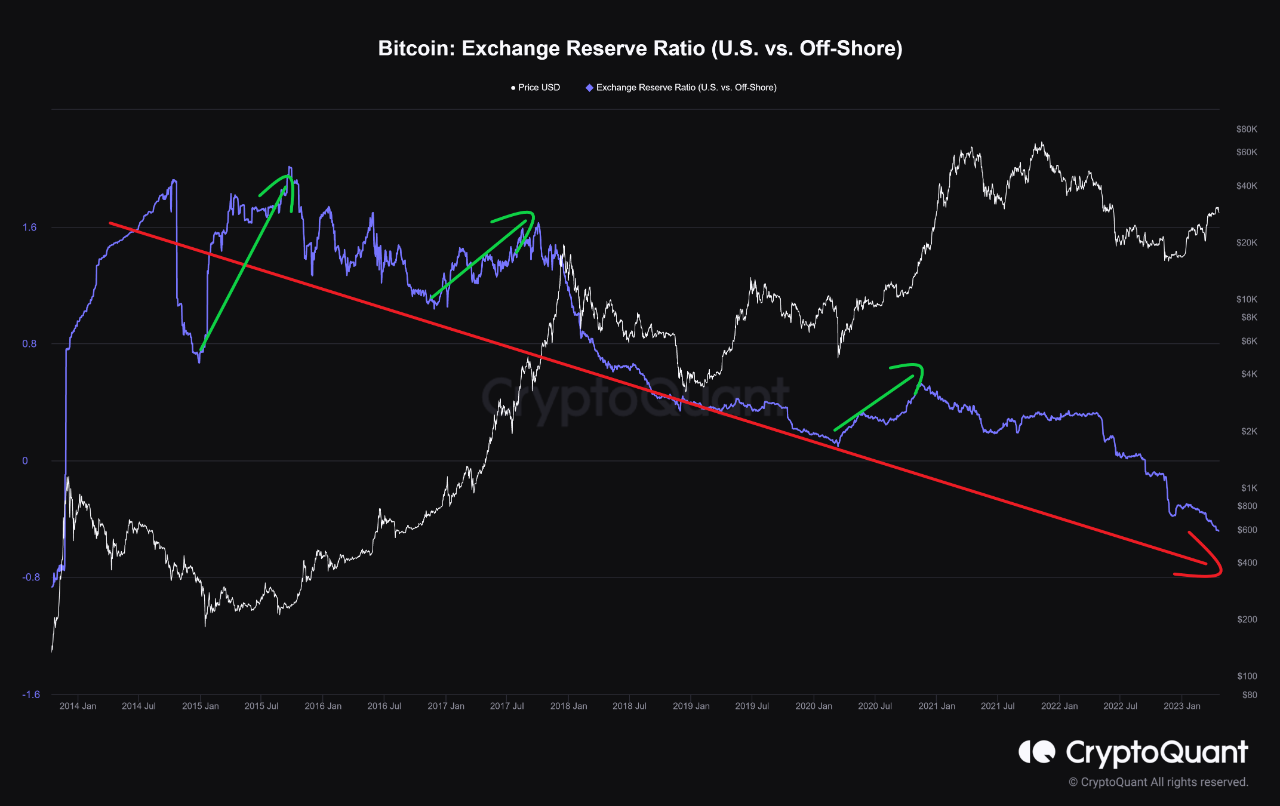

Now, here’s a chart showing the trend in the Bitcoin exchange reserve ratio for US vs offshore platforms over the last couple of cycles:

The value of the metric seems to have been going down in recent months | Source: CryptoQuant

As shown in the graph above, the Bitcoin exchange reserve ratio for these sets of platforms has been steadily declining over the past few months. In fact, the indicator has had a general downward trend since 2014, meaning that the share of the US-based exchanges has shrunk over the years.

This trend would make sense as many new offshore exchanges have come up (and have grown to significant sizes) during this period as the cryptocurrency has gained popularity worldwide.

However, there have been some stretches in the past where the metric has deviated from this downtrend line. The quantum has highlighted these occurrences in the diagram.

Interestingly, these periods of an uptrend for the Bitcoin currency reserve ratio have come as bear markets have ended and the build-up to bull markets has taken place.

This suggests that the US-based platforms have historically grown their holdings relative to foreign exchanges when the asset has been headed for bull markets.

Recently, however, the Bitcoin exchange reserve ratio has not shown any signs of a breakdown from the downtrend structure yet, suggesting that the holdings of these platforms are still declining.

“The percentage of Bitcoin held by US-based exchanges, banks and funds has yet to increase,” notes the analyst. “I think it’s still too early for a real bull market to come.”

BTC price

At the time of writing, Bitcoin is trading around $28,000, down 9% in the last week.

Looks like the value of the asset has plunged during the last few days | Source: BTCUSD on TradingView

Featured Image by Kanchanara at Unsplash.com, Charts by TradingView.com, CryptoQuant.com