Investors show the money to Latin American fintech startups – TechCrunch

Welcome to The Interchange, an overview of this week’s fintech news and trends. To get this in your inbox, subscribe here.

Greetings from Austin, Texas, where temperatures have been over 100 degrees for several days now and we are trying hard just not to melt.

The global funding boom in 2021 was unlike anything most of us have ever seen before. While countries around the world saw an increase in venture capital investments, Latin America in particular saw a massive increase in invested dollars. Not surprisingly – with so many people in the region being underbanked or without banking and digital penetration finally gaining momentum – fintech startups were among the biggest recipients of this capital.

The trend continued in the first quarter of 2022, according to LAVCA, the Association for Private Capital Investment in Latin America, which found that start-ups in the region raised $ 2.8 billion over 190 transactions during the 3-month period ending March 31. . This marked the fourth largest quarter recorded for investment in the region, the data showed, representing an increase of 67% compared to $ 1.7 billion collected in the first quarter of 2021. It was also up 375% against $ 582 million collected in the first quarter of 2020.

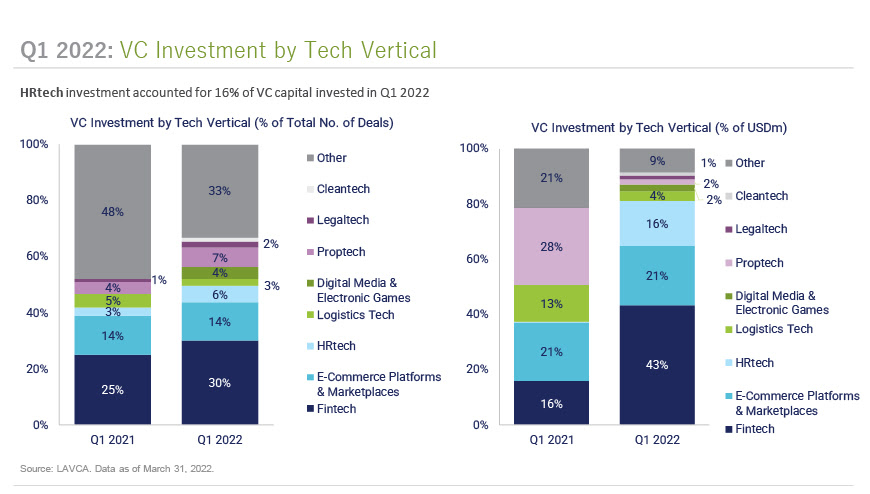

In particular, were fintech startups far on the way the largest recipients of venture capital financing in the first quarter of 2022, with 43% of dollars raised – or $ 1.2 billion – flowing into the category. This is up from 16% in the first quarter of 2021. In the meantime, investments in fintech accounted for 30% of all agreements in the second quarter, compared with 25% in the first quarter of 2021.

Photo credit: LAVCA

Carlos Ramos de la Vega, Director of Venture Capital at LAVCA, told TechCrunch: “We continue to see cross-pollination of business models in the sector: Payment platforms increasingly include BNPL options, lending platforms have become digital full-service banks, challenger banks have expanded the product package to include built-in credit products and working capital facilities. “

Now, with the global downturn in business, it is remarkable that Latin American fintechs continue to increase large rounds in the second quarter of this year. For example, this past week, Ecuador got its first unicorn when the payment infrastructure startup Kushki raised $ 100 million worth $ 1.5 billion. And the Mexico City-based digital bank Klar received $ 70 million in equity financing in a round led by General Atlantic, which valued the company at around $ 500 million. I first wrote about Ready in September 2019, when it wanted to be “Mexico’s chime”. You can read about how the model has developed here.

Does all this mean that LatAm is an outsider? Not necessarily. But it signals that investor appetite in the region is still.

Weekly news

Now we all know that insurtechs have taken a beating in the public markets. And last week, I covered a significant round of layoffs in the sector. So it’s extra interesting that a startup in space not only continues to raise capital and increase valuation, but also is reportedly actively working towards becoming cash flow positive.

I wrote about Branch, a startup based in Columbus, Ohio, which offers combined home and car insurance, which raised $ 147 million in Series C financing for a $ 1.05 billion valuation. I heard / wrote about Branch for the first time in the summer of 2020, and it has been wild to see the company continue to grow.

With the latest news, I wanted to take a closer look at what sets Branch apart from the other struggling insurance companies. CEO and co-founder Steve Lekas said to me in an interview: “Now we are on a scale where we sell more products than most of those who came before us. I think what we have created is what everyone thought they invested in to begin with. ” To learn more, read my story on the subject from June 8.

TC’s Kyle Wiggers and Devin Coldewey dug into Apple’s biggest move into financial services to date – to become a formidable player in the increasingly crowded purchases now, pay later (BNPL). This article covered the news to begin with. This one took a look at how Apple makes its own lending. And this went deeper into how other BNPL suppliers react to the news. And ICYMI, the week before, announced Square that they would start supporting Apple’s Tap to Pay technology later this year. It was a partnership that MagicCube founder Sam Shawki predicted despite buzz that Apple would kill Square. In his view, this partnership only continues to increase the need to offer a similar payment acceptance solution for Android.

Also this past week, two major players announced major crypto-related moves. I took a look at how PayPal users will (finally) be able to transfer cryptocurrencies from their accounts to other wallets and exchanges. “This move shows that we are in this in the long run,” a leader told me in an interview. And Anita Ramaswamy – who was on the ground at the Consensus in the inferno that is currently Austin, Texas – reported on American Express’ new partnership with the cryptocurrency management platform and wallet provider Abra. The card will allow US dollar traders to earn cryptocurrency rewards on their purchases through the Amex network. Amex users have been waiting for an announcement like this for some time, as competitors Visa and Mastercard have already launched their own crypto-reward credit cards through partnerships with companies with digital assets.

It feels like no more than a couple of weeks can go by without Better.com making headlines again. This time, the digital mortgage lender is being sued by a former manager who claims she was pushed out for various reasons, one of which includes expressing concern that the company and its CEO Vishal Garg misled investors when it tried to disclose via a SPAC.

Other interesting readings:

Banks and technology giants are losing skilled employees to flexible fintechs

Bolt, meet challenges, cut costs and lower the growth target

Empty for money 20/20 Europe

“The mood is very gloomy”: Once such a hot fintech sector is facing delays and consolidation of the listing

Stripe co-founder strikes back at rivals accusing company of unfair competition

Photo credit: Branch / CEO Steve Lekas

Financing

Watch TechCrunch

With millions in support, SecureSave Suze Orman’s not-so-surprising debut in startups

Fruitful emerges from stealth with $ 33M in funding and an app aimed at providing healthy financial habits

Ivella is the latest fintech focused on pair banking services, with a twist

Backbase raises $ 128 million in initial funding, valued at $ 2.6 billion, for tools that help banks with commitment

And elsewhere

PayShepherd secures $ 3 million in financing to update contractors’ billing systems

That was it for this week! Excuse me as I go to the pool with my family to try to cool down. Enjoy the rest of the weekend and thank you for reading. To borrow from my colleague and dear friend Natasha Mascarenhas, you can support me by forwarding this newsletter to a friend or follow me on Twitter.