Investors in HIVE Blockchain Technologies (CVE:HIVE) have seen an impressive return of 269% over the past three years

The worst outcome, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you choose a company that really thrives, you can do more than 100%. To know, the HIVE Blockchain Technologies Ltd. (CVE:HIVE) share price has soared 269% over the past three years. So nice for those who held the stock! It is also good to see the share price up 76% during the last quarter.

With that in mind, it’s worth looking at whether the company’s underlying fundamentals have been the driver of long-term performance, or whether there are any anomalies.

See our latest analysis for HIVE Blockchain Technologies

Because HIVE Blockchain Technologies posted a loss over the past twelve months, we believe the market is likely more focused on revenue and earnings growth, at least for now. When a company is not making money, we generally expect good earnings growth. That’s because it’s hard to be sure that a company will be sustainable if revenue growth is negligible and it never makes a profit.

HIVE Blockchain Technologies’ revenue increased by 64% every year over three years. That’s well above most pre-profit companies. Meanwhile, share price performance has been quite solid with 54% compounded over three years. This suggests that the market has recognized the progress the business has made, at least to a significant extent. Nevertheless, we would say that HIVE Blockchain Technologies is still worth investigating – successful businesses can often continue to grow for long periods of time.

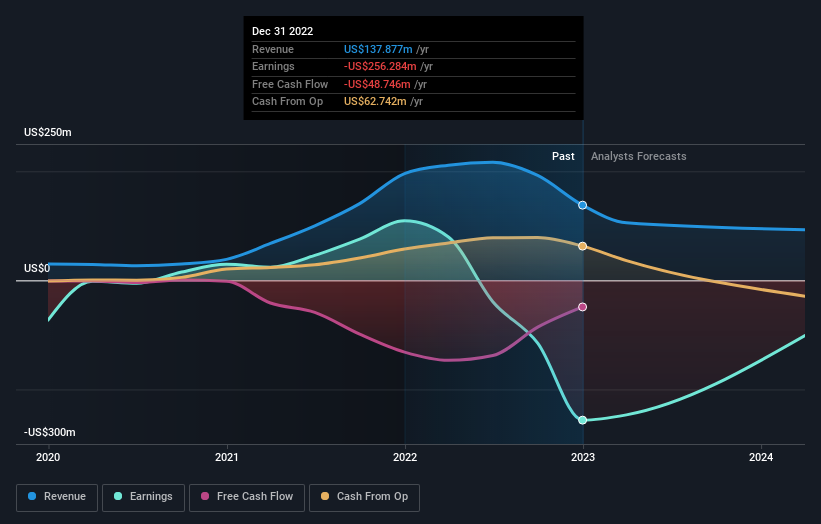

You can see below how income and earnings have changed over time (find the exact values by clicking on the image).

You can see how the balance has strengthened (or weakened) over time in this free interactive graphics.

Another perspective

We regret to report that HIVE Blockchain Technologies shareholders are down 65% for the year. Unfortunately, that’s worse than the broader market decline of 5.0%. That said, it is inevitable that some stocks will be oversold in a falling market. The key is to keep an eye on the fundamental developments. Unfortunately, last year’s performance caps a poor run, with shareholders facing a total loss of 5% per annum over five years. In general, long-term weakness in the stock price can be a bad sign, although contrarian investors may want to examine the stock in hopes of a turnaround. While it is well worth considering the various impacts market conditions can have on share prices, there are other factors that are even more important. Take risks, for example – HIVE Blockchain Technologies has 3 warning signs we think you should be aware of.

Of course HIVE Blockchain Technologies may not be the best stock to buy. So you might want to see this free collection of growth stocks.

Please note that the market returns provided in this article reflect the market-weighted average return for stocks currently trading on Canadian exchanges.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while helping us build better investment tools for individual investors like yourself. sign up here