HT, QNT, ENS OKB and LUNA give better results

These digital assets have taken the spotlight on the crypto news and crypto market:

- Huobi Token (HT) price is up 87.30%

- Quant (QNT) price is up 22.56%

- Ethereum Name Service (ENS) price is up 19.39%

- OKB (OKB) price is up 11.70%

- Terra (LUNA) price is up 9.07%

Huobi Token Price Reaches Crucial Resistance

The Huobi Token price began a massive upward movement on October 19th, increasing by 85% in just five days. This led to a peak of $8.20. However, the price of Huobi Token was rejected by the horizontal resistance area of $8.10 and created a long upper wick. The $8.10 area had previously served as support since November 2021. Therefore, it is considered a crucial level. Until the HT price manages to break above it, the trend cannot be considered bullish. A move above this range can greatly accelerate the rate of increase.

Huobi Token price chart. Source: TradingView

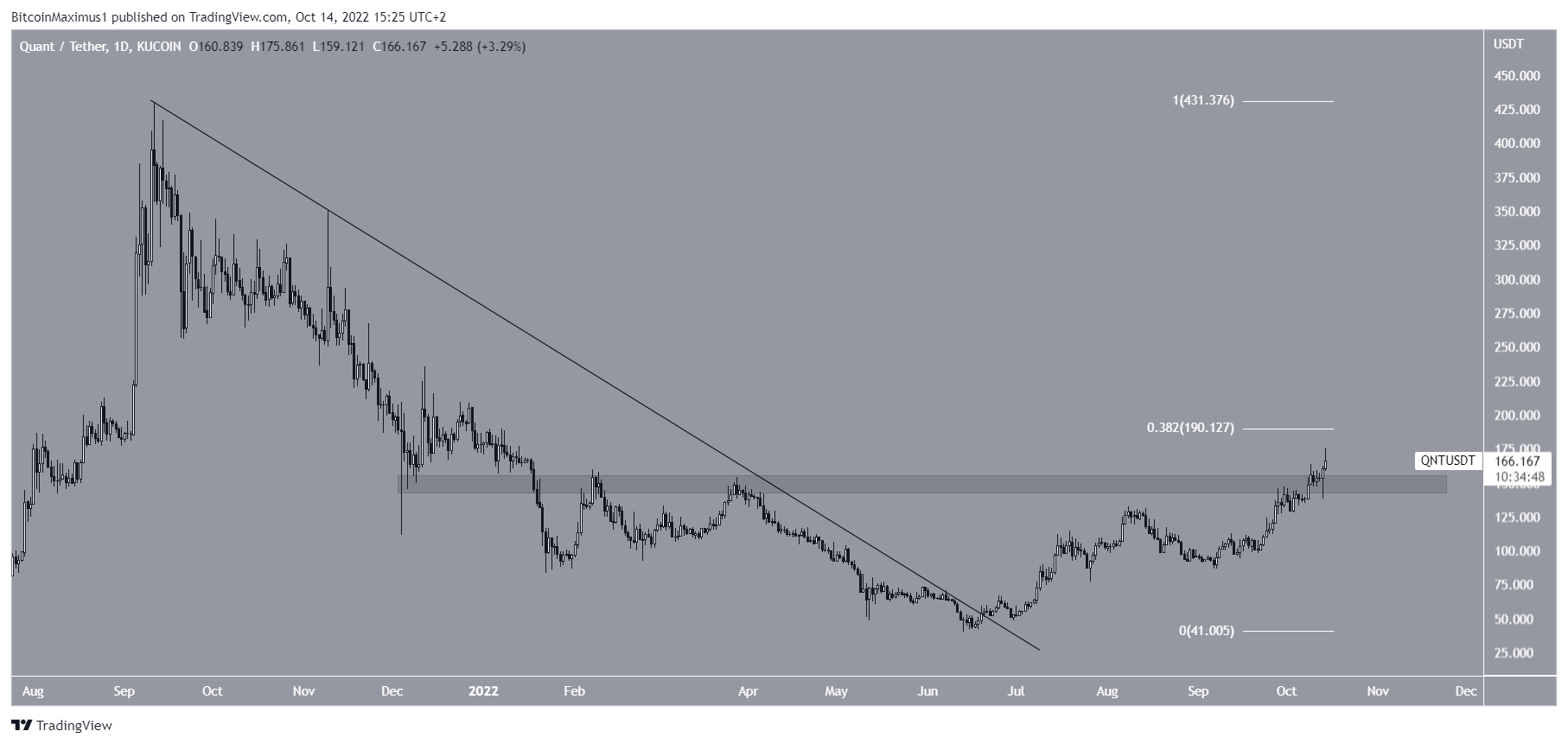

The Quant price regains an important level of $145

On June 19, the QNT price broke out from a descending resistance line. Previously, the line had been in place since the all-time high. Breakouts from such long-term structures usually precede a significant upward movement. On October 14, the price of Quant reached a new annual high of $176.30. The high was made above the $145 horizontal area and just below the 0.382 Fib retracement (white) resistance level at $190. Now the $145 area is expected to provide support while the $190 area is likely to act as resistance.

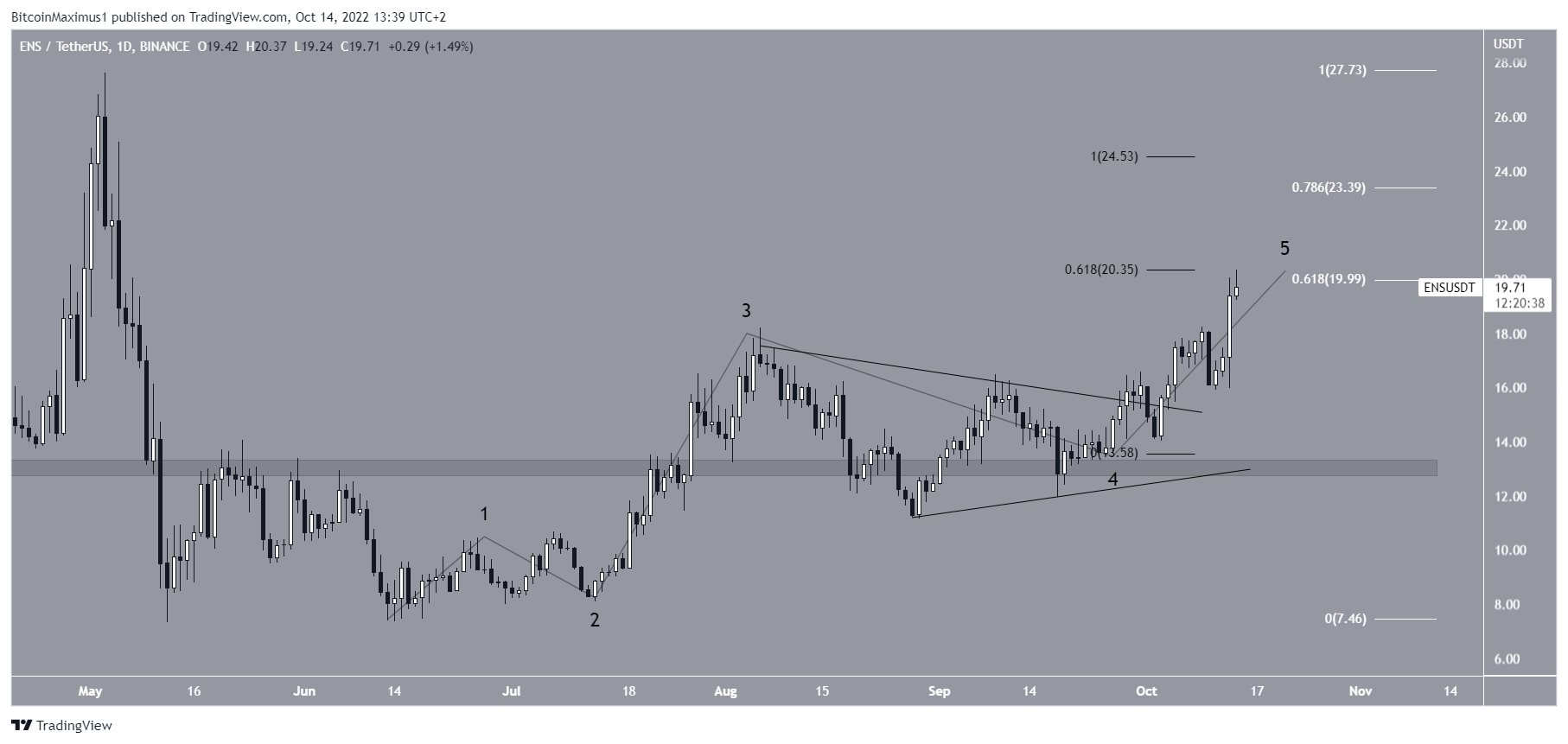

Ethereum Name Service price attempts to break out above $20

The wave count suggests that the ENS price started a five-wave upward movement on June 14. On October 4, the price of Ethereum Name Service broke out of a symmetrical triangle, thereby confirming that wave four had come to an end. Therefore, the ongoing increase is part of wave five. Currently, the ENS price is trading within a confluence of Fib resistance levels, created by the 0.618 Fib retracement resistance (white) and the 0.618 length of waves one and three (black). If the ENS price succeeds in moving above it, the next resistance will be between $23.40 and $24.50.

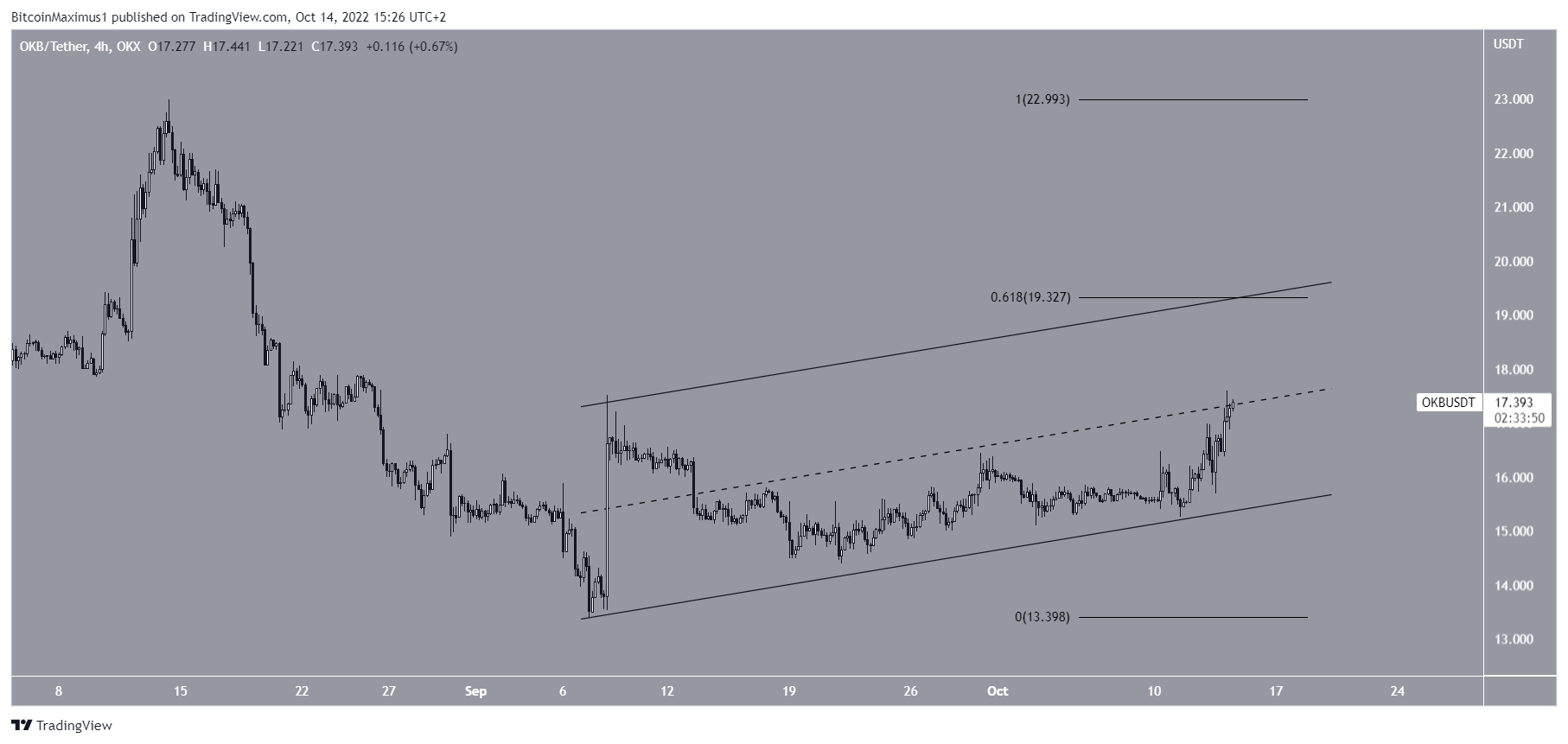

The OKB price struggles with resistance

The OKB price has increased in a rising parallel channel since September 7. Such channels usually contain corrective movements. The OKB price started an upward movement after jumping at the support line of the channel on October 10. It is currently trying to move above the center line. The resistance line of the channel is at $19.32. It also coincides with the 0.618 Fib retracement resistance level. As a result, the price will likely be rejected when it gets there.

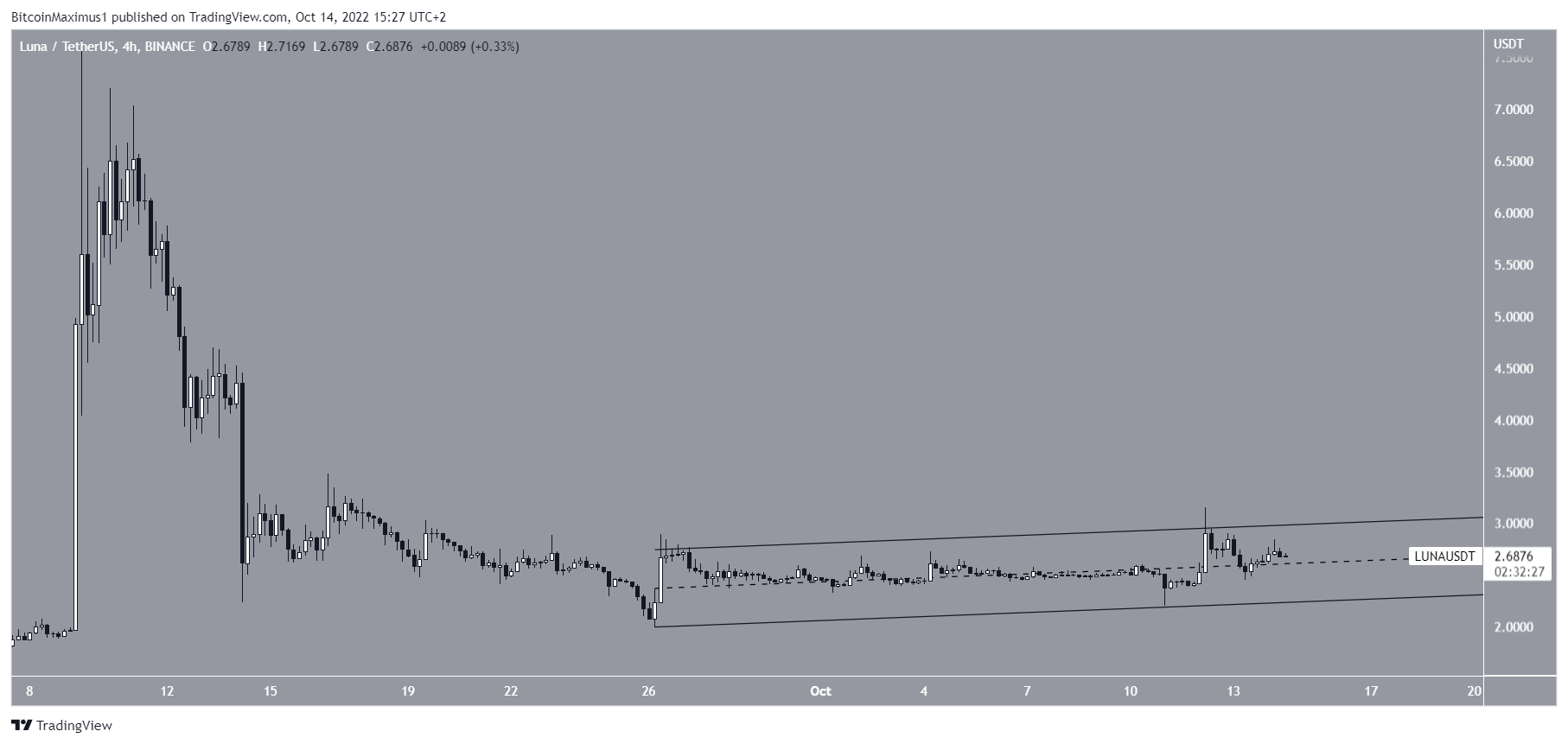

The Terra LUNA price may soon collapse

Like the OKB price, the LUNA price has been trading in a rising parallel channel since September 27. It made an attempt to erupt from October 12, but was unsuccessful. Now the Terra LUNA price is about to fall below the middle of the channel. As a result, an eventual breakdown is likely.

Terra LUNA Price overview. Source: TradingView

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.