How banks plan to use AI to boost Web3 adoption

[gpt3]rewrite

The investment bank Goldman Sachs and Microsoft want to increase the uptake of Web3 on the Canton blockchain through artificial intelligence (AI).

The duo joins traditional finance giants (TradFi) Deloitte, S&P Global, Moody’s, BNP Paribas and Cboe Global Markets in building infrastructure during the crypto bear market.

AI can improve the Web3 user experience

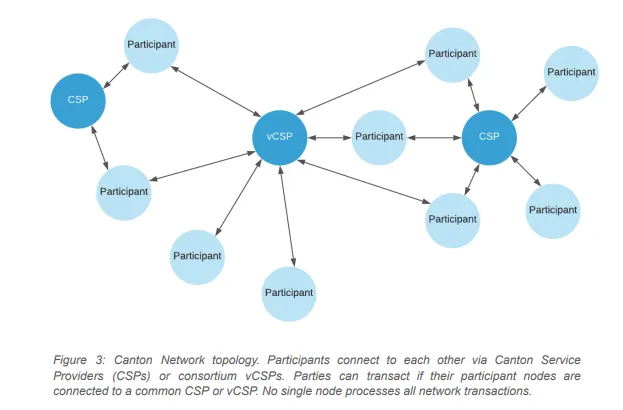

The recently released Canton Network connects the trading platforms of Goldman and Deutsche Börse, whose nominal volumes exceed the trading activity of many cryptoassets.

The network is built on Microsoft’s Azure cloud. The consortium hopes to attract developers with the new digital asset smart contract language.

Microsoft said last month that it wants to augment Web3 users with artificial intelligence at Canton. The firm said yesterday that it added Bing to OpenAI’s ChatGPT Plus premium service.

AI can analyze app usage patterns to help Web3 companies elevate user experiences. First, it can assess a product’s weak points and help users easily pick up where they left off.

In addition, the technology can also streamline complex tasks such as decentralized governance and token management. AI can also improve network management through automated data collection, decision making, monitoring for malicious activity and streamlining transaction processing.

Google, also a notable cloud and AI player, became a Solana validator last year. After that, it merged with Tezos Foundation in February for similar reasons.

Google’s deal with Polygon last month provides tools and infrastructure that empower zero-knowledge projects. The Silicon Valley giant recently opened up the preview of its PaLM 2 library to enable coders to add AI to their applications.

Canton Network can streamline trade, Cboe says

TradFi firms envision real-world asset tokenization as their next target, as banks can benefit from faster transfers of assets on blockchains. According to Cathy Clay of Cboe, Canton can help “create new market infrastructure and drive efficiencies in the trade of products worldwide.”

Early efforts have tokenized valuable assets such as real estate, vehicles, or fiat for rapid transfer across blockchains. BlackRock CEO Larry Fink told shareholders the bank would tokenize stocks and bonds this year.

Previously, JPMorgan Chase exchanged tokenized Japanese yen and US dollars using an Aave permissioned pool whose access was controlled by credentials in smart contracts.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

According to the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.

[gpt3]