How BaaS opens up great opportunities for the banking sector

As banking-as-a-service (BaaS) approaches mainstream adoption, there is a significant opportunity for banks to join the BaaS ecosystem, develop new relationships with fintech firms and create new revenue streams for themselves at the same time.

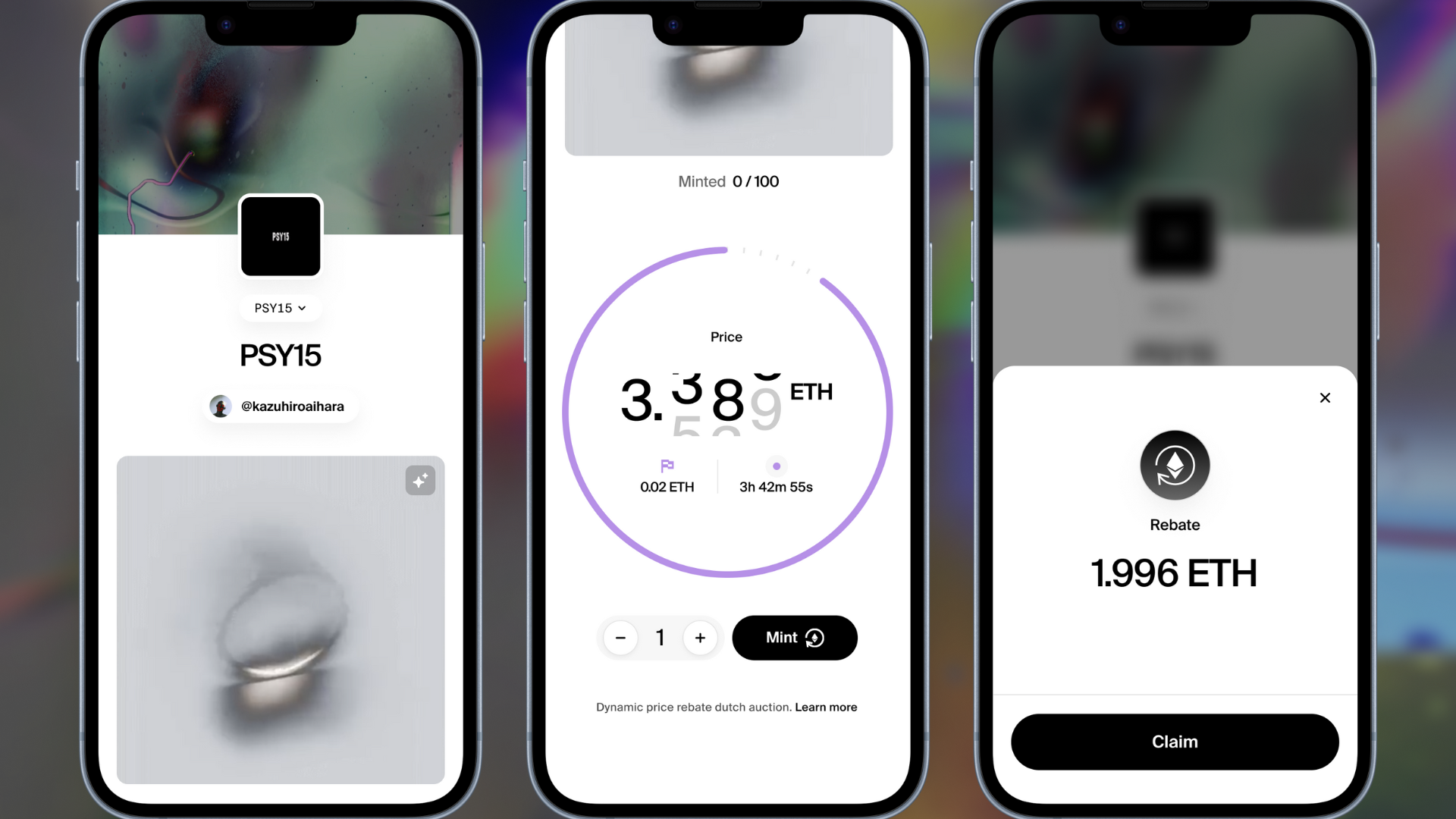

The mobile industry is one sector where we will see BaaS flourish and be readily adopted by mobile providers, fintech firms and banks. Smartphones (of which there are around 6.6 billion globally) have given people access to instant communication, and the financial services industry is beginning to understand that. By offering smartphone users BaaS, they can ease their daily lives and help families and businesses with financial planning for everything from long-term goals to unexpected emergencies.

Most mobile operators around the world only offer the ability to make payments via phones, but they do not offer people access to banking services – that is, about 1.2 billion people worldwide who want access to savings accounts and insurance, for example both as BaaS can enable.

If those who do not currently have a bank account were to open one, they would be more likely to use other financial services such as credit and insurance. They may even start or expand their business, invest in education and health, or manage risks and manage financial shocks – all of which are likely to improve their overall quality of life. So if a bank offers BaaS services to mobile phone operators, it will encourage financial inclusion, which according to the World Bank Group has been identified as an enabler for reducing extreme poverty, increasing shared prosperity and achieving seven of the 17 Sustainable Development Goals.

HM Queen Maxima of the Netherlands, UN Special Advocate for Financial Inclusion Worldwide, attended SIBOS 2022 to emphasize its importance to the world, explaining that “the rapid growth in mobile phone usage and new customer data tracks offer exciting new ways to deliver financial products by exploit big data and AI – especially in emerging markets”, where many people are unbanked or underbanked. BaaS, while in its early stages of development, is quickly becoming a part of our daily lives. As consumers, we’re used to using apps like Uber to pay for things, and once our payment methods are established, the process is frictionless. We moved relatively easily from cash to cards and now to digital payments, and our expenses have probably increased as a result. Overall, all the players in the BaaS system will benefit from it – the BaaS provider (the bank), the technology company with a banking license and the charter or fintech in the middle as well as the end consumer.

Long-term benefits of BaaS outweigh the challenges

Banking is moving out of the exclusive realm of banks and into a comprehensive ecosystem to bring personalized, customer-centric offerings to market faster. This is what BaaS can achieve if banks are willing to embrace it, and it can enable them to reach many more customers, gain economies of scale and reduce costs. Accessing the data captured via BaaS leads to more personalized services and better management and retention of customer relationships.

As BaaS becomes more mainstream, regulators have taken notice. Neobanks and fintech firms provide a seamless digital banking experience and they need a bank to offer cards, loans, money transfers and other banking services. Fintech firms also have limited experience with compliance processes. A BaaS model therefore becomes critical in a highly regulated and competitive market. Banks have responded by enabling fintech firms and neobanks to have a bank’s resources and infrastructure to expand their offerings while reducing operating costs.

Another challenge with offering banking services through APIs is that it increases the risk of cyber attacks and security breaches if not handled carefully. Technical and operational constraints, such as legacy infrastructure, can delay implementations and may require costly manual processes to overcome the constraints. In addition, the banks must maintain the work of adding new fintech partners to the portfolio. Banks can further align their business models and reduce risk by partnering with an experienced fintech provider that offers a secure digital layer that can integrate seamlessly with multiple systems and offer end-to-end connectivity of business data.

Despite some challenges, BaaS still brings many benefits to the financial sector, and it is the customer who is rightfully the biggest beneficiary of these advances. With BaaS, they have more choices and are able to enjoy the full experience of, for example, buying their own house, rather than just getting a mortgage from a bank. Overall, there are benefits for the entire ecosystem because there is more value creation that happens via BaaS.

BaaS is developing globally

BaaS is in its infancy, but adoption is growing. In the US, many BaaS providers are emerging because it is so much more difficult to get a banking license there than it is in Europe. The UK has issued the maximum number of licenses in the world for the last 10 years, but if you can’t get a license and want to use banking services, such as making payments or securing loans, you have to rely on someone who has a permit. That company can “squeeze the juice” completely out of the charter and take full advantage of it.

In Asia, very interesting cases are emerging, for example in Indonesia. A business software provider that provides software to manage gyms must allow for management of membership, heavy machinery or equipment and payment processing. The fitness chain together with a bank (with a license) becomes a BaaS provider.

Without a doubt, customer expectations have changed. They want contextual, hyper-personalised, integrated banking experiences and on-demand access to banking services. They want to access banking products and services when they need them, so BaaS presents a new opportunity for financial institutions to acquire customers at lower costs, reach new customer demographics, increase revenue and deliver customer satisfaction.

About the Author: Amit Dua is president of SunTec, a pricing and billing company that creates value for businesses through its cloud-based products. More than 150 customers in over 45 countries rely on SunTec to provide hyper-customized products, offers, pricing, loyalty programs and billing for over 400 million end customers.