Hive Blockchains are efficient and strategic on point, with a catch

Imagesrouges / iStock via Getty Images

Introduction

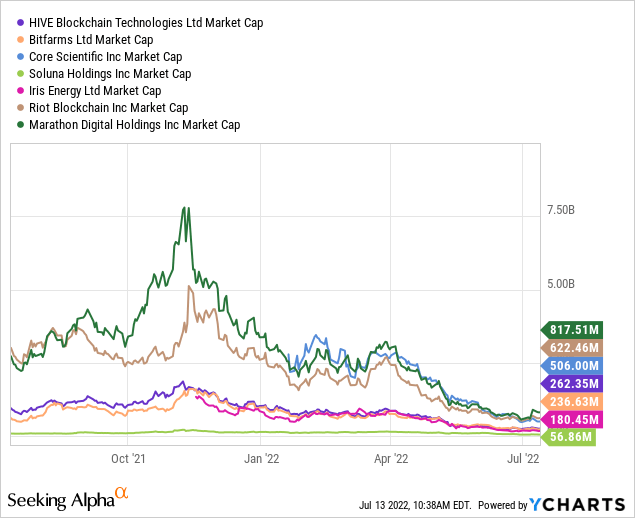

We have been in the market and searched for crypto mining companies that can offer alpha. We have covered such as Riot Blockchain (RIOT), Marathon Digital (MARA), Iris Energy (IREN), Soluna Holdings (SLNH), Core Scientific (CORZ) and Bitfarms (BITF).

Our prerequisites for a crypto mining company to be investable, it is to be 100% powered by renewable energy. By this standard, only IREN and SLNH managed the cut. IREN’s investment proposal is centered around being priced close to the value of its total hard assets (cash, land and grid-connected power plants). The problem with IREN is that its total mining cost is not as efficient as other miners. On the other hand, not only are SLNH’s mining costs inefficient, it is limited to the availability of limited renewable energy. Since we expect the limited renewable energy to shrink over time, SLNH’s business prospects will also be limited.

BITF’s mining operations are much more efficient than IREN and SLNH. Unfortunately, BITF’s Bitcoin mining operation in Argentina is powered by natural gas. Therefore, it is disqualified from being 100% powered by renewable energy. The same applies to RIOT and MARA for being only carbon neutral and not 100% powered by renewable energy yet.

What we want to find out in this article is about HIVE Blockchain (NASDAQ: HIVE) can fill the gap and offer sufficient safety margin at IREN level with leading mining efficiency.

HIVE is strategically in place

The first thing investors can see on HIVE’s website is the following statement:

… The company uses 100% green energy to extract both Bitcoin and Ethereum, with a committed ESG strategy since day one. HIVE strives to create long-term shareholder value with its unique HODL strategy…

This statement has 2 very big implications for us. This confirms that HIVE is in line with our view of what makes a crypto-mining company investable.

First, the first statement confirms that the company is aware of ESG risks from day one. The ESG risk is significant. Core Scientific acknowledges this in its official fills:

Increasing scrutiny and changing expectations from investors, lenders, customers, government regulators and other market participants regarding our environmental, social and governance guidelines (“ESG”) may incur additional costs or expose us to additional risk.

As far as we know, one way to be ESG compliant is to be carbon neutral. For crypto miners to be carbon neutral means to absorb the same amount of carbon emitted through mining. If the carbon cannot be absorbed locally, it can be compensated in another region through methods such as afforestation (eg buying plots to plant trees).

The problem with carbon offsets is the method of measuring how much carbon is absorbed. Any changes in the measurement technique may risk the company’s ESG compliance.

That is why HIVE’s 100% green energy strategy is in place.

Second, crypto-mining companies act as agents for the underlying asset being extracted. Crypto mining companies should maximize asset storage. The more crypto mining companies keep their assets in reserve, the more valuable they are. In fact, it is one of the key calculations in our valuation framework.

Based on these two aspects, HIVE is actually strategically on point for us. HIVE met our prerequisites and reasoned with us.

Good safety margin and best-in-class efficiency

According to HIVE’s latest quarterly report (CY2021Q4), HIVE managed to extract 1220 equivalent Bitcoins (697 Bitcoins and 7,126 Ethereum). HIVE’s total business expenses, which consist of operation and maintenance, depreciation, general and administrative expenses, split based compensation and financial expenses amounted to $ 27.4 million. This means that HIVE’s total total cost per BTC equivalent extracted is only $ 22,500 (Table 1). If non-cash expenses (depreciation and share-based compensation) are excluded, HIVE’s total cash cost per BTC equivalent is only $ 8,900.

To put this in perspective, HIVE’s all-in cost is still the lowest compared to the 7 other crypto mining companies we have covered so far (Table 1). HIVE’s total business expense per BTC equivalent is also consistently low over the last 2 other quarters (CY2021Q3 and CY2021Q2) of $ 17,842 and $ 23,468, respectively (Table 2). The same applies to HIVE’s total cash cost per BTC equivalent in CY2021Q3 and CY2021Q2 of $ 8,856 and $ 11,475, respectively.

We rarely consider the cost of a crypto-mining business to be low. This is the lowest we have seen.

Table 1. All-in Business Cost per BTC equivalent extracted

Source: Author, HIVE

* Excluding hosting, range depending on how shared costs are proportional between hosting and self-recovery (proprietary)

Table 2. HIVE’s mining operating costs

| QR (CY) | BTC equivalent recovered | Total mining costs ($ miles) | Operation and maintenance ($ miles) | Depreciation ($ miles) | General and Admin ($ mil) | Action-based values ($ mil) | Economy ($ miles) |

| 2021Q4 | 1220 | 27.4 | 6,526 | 15 | 2,862 | 1,672 | 1,338 |

| 3rd quarter 2021 | 1233 | 22 | 7.6 | 9.6 | 2.63 | 1.48 | 0.305 |

| 2021Q2 | 767 | 18 | 6.2 | 6.9 | 2.3 | 2.3 | 0.3 |

Source: Author, HIVE

In terms of safety margin, HIVE has $ 63mil cash and $ 203mill worth of deposits and equipment. HIVE’s reserve also has 3,239 BTC and 7,667 ETH according to the June 2022 update and is worth $ 70.5 million at the time of writing. Therefore, these assets are worth around $ 330 million. These assets beyond the total liability ($ 55.1mil) are worth $ 280mill.

HIVE’s market value at the time of writing is $ 260 million, which is approximately 10% lower than HIVE’s assets (cash + reserves + deposits + equipment) in excess of total debt. In comparison, BITF is traded at around a similar metric while IREN is traded at around 55% lower than the corresponding metric.

Therefore, IREN’s safety margin is still the best. That said, HIVE’s margin is good and acceptable.

The catch

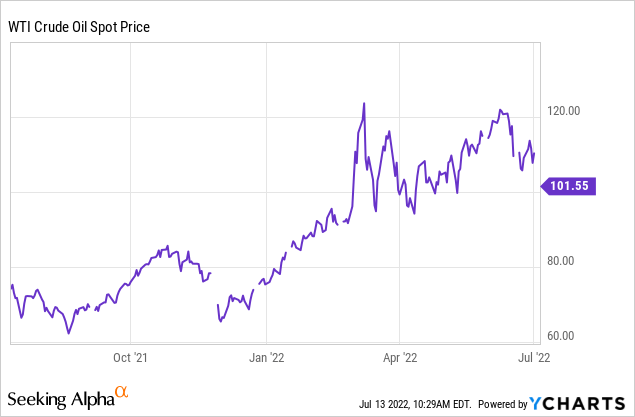

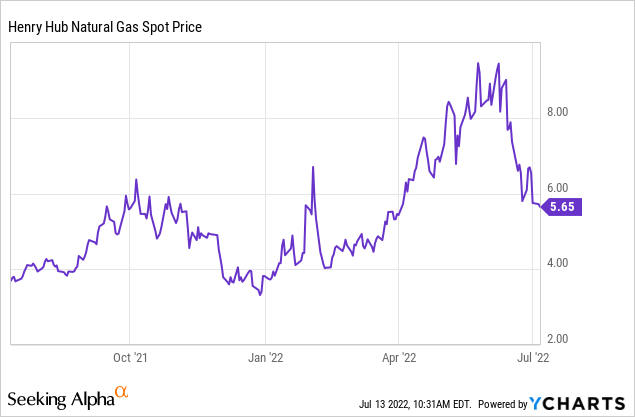

The catch mentioned in the title of this article is the date. HIVE’s data are based on 2021Q4 while the other miners mentioned in Table 1 are based on 2022Q1. This catch is significant because the price of crude oil jumped from around $ 77 to almost $ 130 per barrel while the price of natural gas increased from $ 4 to almost $ 6 in 2022Q1.

However, we have reason to believe that this cost will be maintained. By referring to Table 2, we can see that the only cost that increased significantly is depreciation, while all other costs such as operation and maintenance, general and administrative, share-based compensation and finances remain relatively consistent. Furthermore, HIVE is 100% renewable energy.

Therefore, we do not expect HIVE to incur significantly higher costs in 2022Q1 and 2022Q2.

Valuation

HIVE is priced relatively closer to BITF and IREN. So let’s use BITF and IREN as comp.

HIVE’s expected capacity in the near future is approximately 38% to 60% lower than IREN’s (depending on early or late 2023), but is priced 40% higher. This premium can be contributed from HIVE’s 3 times higher capacity (which means less execution risk), and 50% lower total cost per BTC. Only time will tell whether IREN’s costs can reach economies of scale. Contrary to many people’s beliefs, we explained why crypto mining companies may not achieve economies of scale in our previous coverage of BITF.

Nevertheless, we believe that IREN provides investors with better upside opportunities if investors are willing to take more risk. As far as we know, IREN has not proven its ability to keep its Bitcoins mined as IREN does not have Bitcoin reserves yet while HIVE has a good track record to prove its ability. In addition, we showed that a crypto mining company’s capacity growth is somewhat similar across the sector of 8.5% or 0.4 EH / s -1 EH / s per quarter. With this standard, IREN may be able to achieve its target capacity of 10 EH / s from the current 1 EH / s. Hence the risk.

On the other hand, HIVE is priced approx. 10% higher than BITF despite the fact that it has a similarly built capacity and expected capacity of 6 EH / s in 2023. Given that HIVE is 100% powered by renewable energy and HIVE’s all-in-business cost is 35% lower than BITF, this premium of 10% is well justified. Just remember that the catch mentioned in the previous section.

Furthermore, HIVE shareholders suffered less dilution than BITF shareholders despite HIVE’s $ 100mil ATM Equity Program. HIVE shareholders received only 11% dilution in 2021, while BITF shareholders suffered 33%. When it comes to potentially diluting securities, HIVE has only 6% potential dilution while BITF has more than 15% (from outstanding stock options and warrants). In comparison, CORZ has 66% potential dilution from potentially diluting securities. This further justifies HIVE’s 10% premium over BITF.

Table 3. Built and expected close to future capacity for mining companies

| Company | Built-up capacity | Near future expected capacity |

| Hive Blockchain (HIVE) | 3.2 * | 6 |

| Bitfarms (BITF) | 3.3 | 8 |

| Nuclear Science (CORZ) | 8.3 | ~ 16 |

| Soluna Holdings (SLNH) | 1 | 4 |

| Iris Energy (IREN) | 1.1 | 10 |

| Riot Blockchain (RIOT) | 4.3 | 12.8 |

| Digital Marathon (MARA) | 3.9 | 23.3 |

Source: Author

* Including BTC equivalent capacity for Ethereum

Verdict

Apart from the recent announcement of shortages from NASDAQ, we have only good things to say about HIVE. HIVE has less ESG compliance risk (driven by 100% renewable energy), increasing Bitcoin reserves, acceptable safety margin when it comes to the price of hard assets exceeding the total liability ratio, and significantly lower total cost per BTC by sector standards.

Although HIVE’s expected capacity in the near future is not a wow factor as IREN’s, HIVE’s expectation is closer to the realistic historical growth in the sector.

That said, we believe it’s still early to enter HIVE as Bitcoin is expected to fall further to $ 10,000 by the end of 2022. This has been our position since May 2021 and is evident from Bitcoin’s decade – long halving cycle, as well as the current financial basics.

When Bitcoin shows signs of improvement within that time, we expect HIVE to be our current most important crypto mining company to invest in.