Here are all the reasons why crypto prices are exploding right now

The crypto market just added $50 billion in a lightning-quick recovery from what some market watchers feared could be the start of the next leg down in a revisit to the year’s lows.

But what is behind this big price pump across the crypto complex?

A number of factors can be seen to have played together.

First, the deleveraging events seem to have run their course, and there may be no more dominoes to fall. After Terra, Voyager, Celsius and Three Arrows Capital, no more shoes have dropped yet.

Peak crypto prices flashed oversold, whales accumulate

Second, sellers may have exhausted themselves, with major coins such as bitcoin in oversold positions.

We can add a third and related factor, which is whales looking to take new positions in the belief that we are at or near the bottom for the crypto market.

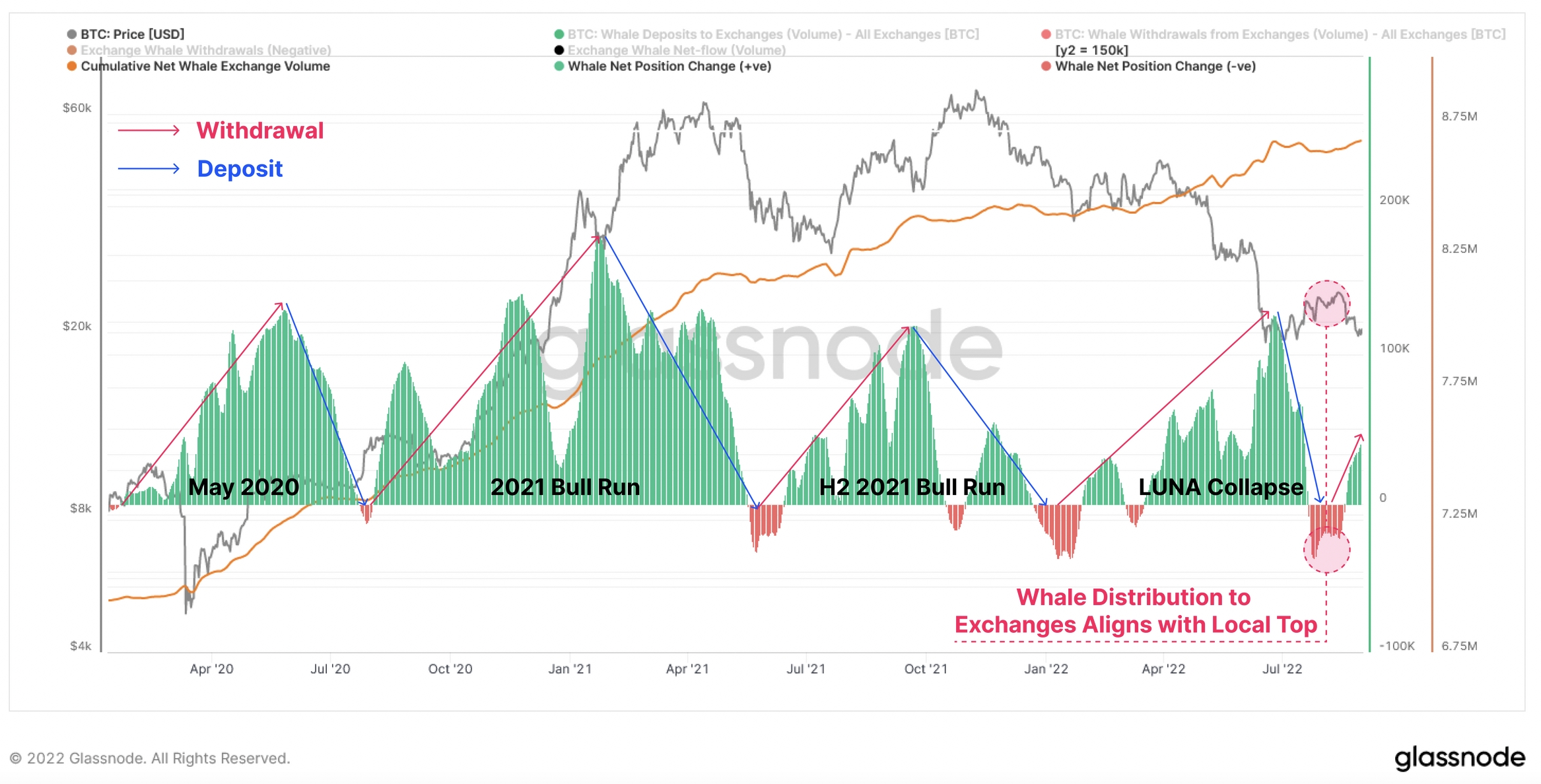

1,000 bitcoin whales have distributed to exchanges in the wake of the Luna collapse (more on Luna below) – the chart below from Glassnode shows how whale distribution lines up with local peaks.

Fourth, we need to take into account the situation with other asset classes and the macro environment, and this background music could be the trigger for today’s impressive recovery.

While there was no word from Fed Chairman Jay Powell that he would slow down on raising interest rates, there were indications elsewhere that the gloom was being exaggerated in equity markets.

In China, for example, producer price inflation came in better than expected, and hopes for further stimulus were raised.

In Europe, gas prices fell on hopes of a palliative emerging from European policymakers today.

That led to a fall in bond prices, even though oil was up and so was gold. But in general, good vibes in the stock market have passed through other risk assets – and crypto is the ultimate risk element.

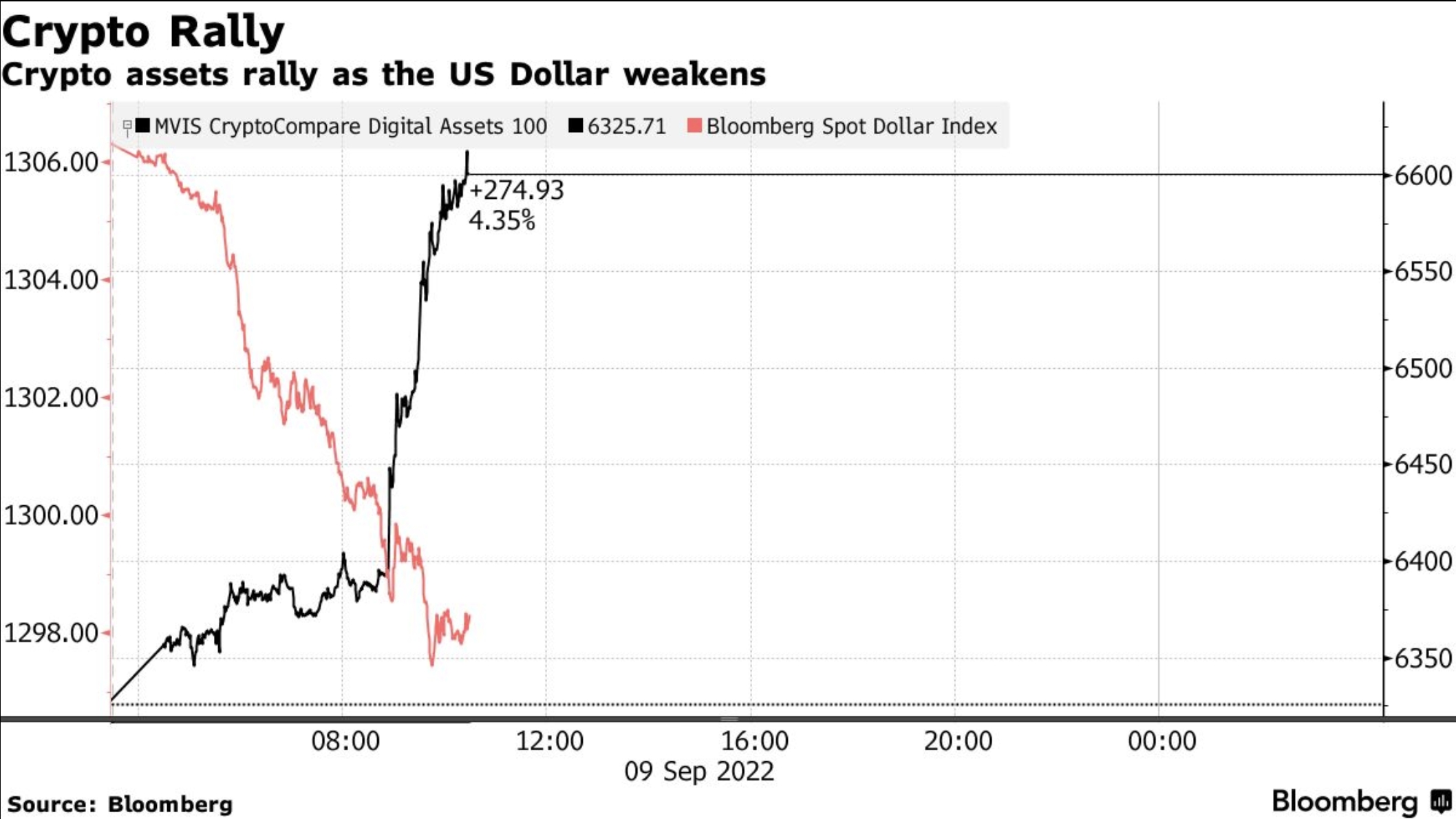

Dollar weakness brought out the risk asset bulls

But it was the drop in the dollar that may be the main catalyst for today’s bullish events. As the Bloomberg chart reproduced below shows, the negative correlation between crypto and the dollar is huge:

A fifth factor should be brought into the mix, and that is the views and actions of financial institutions. News emerged overnight that Franklin Templeton will provide its institutional clients with crypto accounts.

Earlier this week, Singapore’s biggest bank, DBS, said it would offer digital asset services and trading to its wealthiest 300,000 customers. The Whompoa Group followed a few days later.

And all this follows the massive news that the world’s largest asset manager, BlackRock, switched to crypto on behalf of its clients.

Why Ethereum Merge is a game changer for the crypto complex

A sixth and final positive to bring into the mix is the Ethereum Merge.

Ethereum can reasonably be considered the premier commercial network in the crypto-asset class. Indeed, it is starting to move towards an endpoint that will make it truly scalable and cost-effective for businesses to act on and run industrial-scale applications.

We can add to it a reinforcement of our fifth reason, institutional interest, because the Ethereum merger may lead to a departure of stake interests from investment banks and others

All of the above may have informed the reasoning of the likes of billionaire Sam Bankman-Fried, founder of the wildly successful FTX crypto exchange.

He told CNBC today that the worst is probably over. “The real pain, I think, came three to four months ago. We don’t necessarily anticipate more pain from here. Things have very much stabilized in the space,” says Bankman-Fried.

In case you missed it, here are some of the crypto prices that are buzzing

All the major coins are higher. Bitcoin is up 9% to just over $21k, a sharp increase from this week’s low of $18,660.

Ethereum, which was expected to continue its good form on the back of the Merge upgrade, took off, but it too has rediscovered its mojo. The leading smart contract platform is trading 5% higher at $1,724.

Apart from the top coins, there has been surprising progress in other quarters as well.

LUNA pumps – what is happening and will it last?

Crypto traders have been cheering the rise of Terra Classic which has improved 64% this week alone and almost 400% in the last 30 days.

That run has reversed a bit today as LUNC is down 12% to $0.000445. Surprisingly, it is Terra 2.0 (LUNA), the reshaped version of the collapsed Terra Luna – which some deride as Do Kwon’s fraud – who now carries the torch.

Terra rallied more than 200%, as we reported earlier today, in a move that has stunned seasoned market watchers and novices alike.

As always with such violent price movements, accusations of manipulation are in the air.

Twitter crypto influencer Fat Man thinks a dump is coming, so buyers getting in now could be caught out:

There is also strong bullish action in BTC’s perpetual futures market, as Kaiko analyst Riyad Carey has brought to our attention:

Crypto price action suggests reasons to be cheerful

All things considered, there are plenty of reasons to be happy about the crypto sector at the moment – now that’s something that might not have been said at the beginning of the week.

Nevertheless, volatile times are of course de rigueur for crypto, so investors may want to accumulate on a consistent and regular basis rather than drop in a significant lump sum.

In other words, the market may be bottoming out, but it may not be at the bottom yet.

But if you want to hold for months instead of days, fishing around or below current price levels can prove profitable. Dollar cost averaging is your friend.