Has the market recovery brought any relief to miners?

The 2022 crash sent shock waves through the crypto industry. As a sector, mining took one of the biggest hits. Mining companies sold more product than usual to stay afloat. Also, many individual miners had to pack up and sell their equipment to overcome the financial burden. Both Bitcoin (BTC) and Ethereum (ETH) lost almost 70% of their value. Therefore, mining became unprofitable for the first time in a long time.

Still, when July arrived, the markets breathed a sigh of relief. Many major crypto projects showed some signs of recovery. Ethereum was the leader of the pack this time. In anticipation of the merger, investors began flocking to the second-largest cryptocurrency by market capitalization. In August, markets are only on the rise and so are Bitcoin mining companies.

Bitcoin Miners Pulling Out of Recession?

According to the data from Yahoo Finance, shares of crypto mining companies are outperforming Bitcoin and Ethereum. Marathon Digital Holdings (124.12%), Core Scientific (110.39%), Hut 8 (98.95%) and Riot Blockchain (96.69%) have seen breakthrough numbers during the 30-day time frame. On the other hand, Bitcoin is up 24.3% and ETH is up 82.8% during the same time frame.

Core Scientific published its Q2 filing on August 11. The company reported a 118% increase in revenue compared to Q1 2022. Furthermore, the company reported a 1,769% increase in Bitcoin self-mining production compared to Q2 2021.

Hut 8 Mining Corp. reported a 14.6% increase in Bitcoin holdings. The company’s year-on-year revenue also increased by 30.7%.

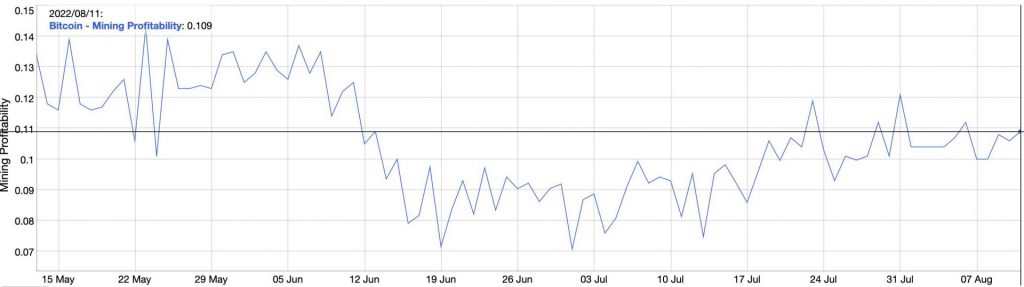

As for individual miners, there seems to be some relief there as well. After many left the scene due to unprofitability, miner earnings and profitability are showing signs of improvement. After plunging to record lows in July, the numbers are slightly positive this month.

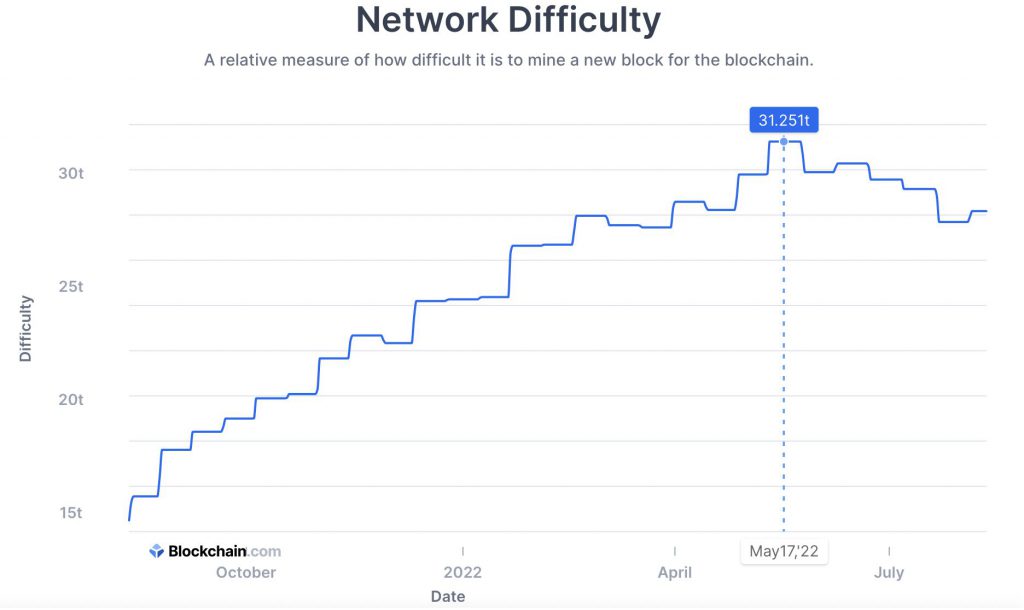

On the other hand, network difficulties have fallen steadily after peaking in May. This is probably due to some miners leaving the site. Nevertheless, it makes it easier for miners to make money. However, this comes at the expense of less rigid network security.

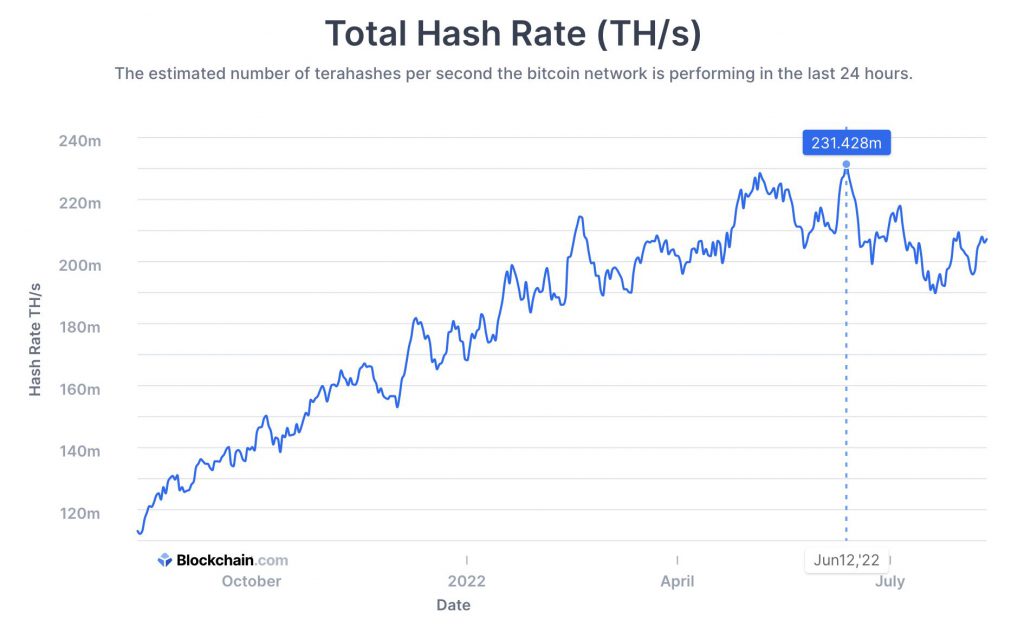

In addition, the hash rate has had a steady decline since the peak in June. As of today, the hash rate stands at 207,241m TH/s. The lower hash rate is attributed to older machines that are not profitable, and the heat wave that swept America and caused energy shortages.

At press time, Bitcoin (BTC) was trading at $24,037.88, down 1.3% in the last 24 hours. On the other hand, Ethereum (ETH) was trading at $1,902.45, up 0.9% in the last 24 hours.