Greenidge Increases Bitcoin Miner Count As Price Brakes Profit (NASDAQ: GREE)

Kosamtu / E + via Getty Images

A quick overview of the Greenidge generation

Greenidge Generation (NASDAQ: GREE) reported its first quarter financial results on May 16, 2022, after being announced in a merger with Support.com in September 2021.

The company operates a power plant and has related data center operations in New York and South Carolina.

Until we see Bitcoin’s price rise significantly, we will probably not see much improvement in operating revenues, so I am waiting for GREE until Bitcoin’s price action becomes bullish.

Greenidge Overview

Connecticut-based Greenidge was founded to develop a vertically integrated Bitcoin mining and power generation company.

The firm is headed by CEO Jeff Kirt, who joined the firm in March 2021 and was previously a Managing Partner at Fifth Lake Management and a partner at Pamplona Capital Management, both private equity firms.

The company seeks to use low or zero carbon energy sources to operate its Bitcoin mines.

GREE owns and operates a 106 megawatt power generation plant in Dresden, New York, which was originally a coal-fired plant and has since been converted into a natural gas-burning energy plant.

The facility provides energy to neighboring communities as well as to the company’s data center, which hosts Bitcoin mining.

Greenidge’s market and competition

The global market for Bitcoin mining is currently changing significantly, with the recent bans on mining in China prompting a large amount of the country’s hash power to leave the network while these operators look for more suitable locations.

Many mining companies have relocated to the United States due to its more predictable regulatory and legal environment and pro-business approaches in a number of states, although some states have been less than accommodating to the industry.

The market value of mining depends on the price of Bitcoin, since the majority of the value that goes to the miner is a function of the current Bitcoin reward rate of 6.25 Bitcoin per successfully recovered block.

At a cost of $ 25,000 per Bitcoin, the annual mining reward for the entire industry will be approximately $ 8.21 billion.

Important industry participants include:

-

Bitfarmer

-

Argo Blockchain

-

DMG Blockchain

-

Hive Blockchain

-

Cabin 8 Mining

-

HashChain technology

-

DPW Holdings

-

Layer1 technologies

-

Riot Blockchain

-

Marathon Patent Group

-

Second

Greenidge’s recent financial results

-

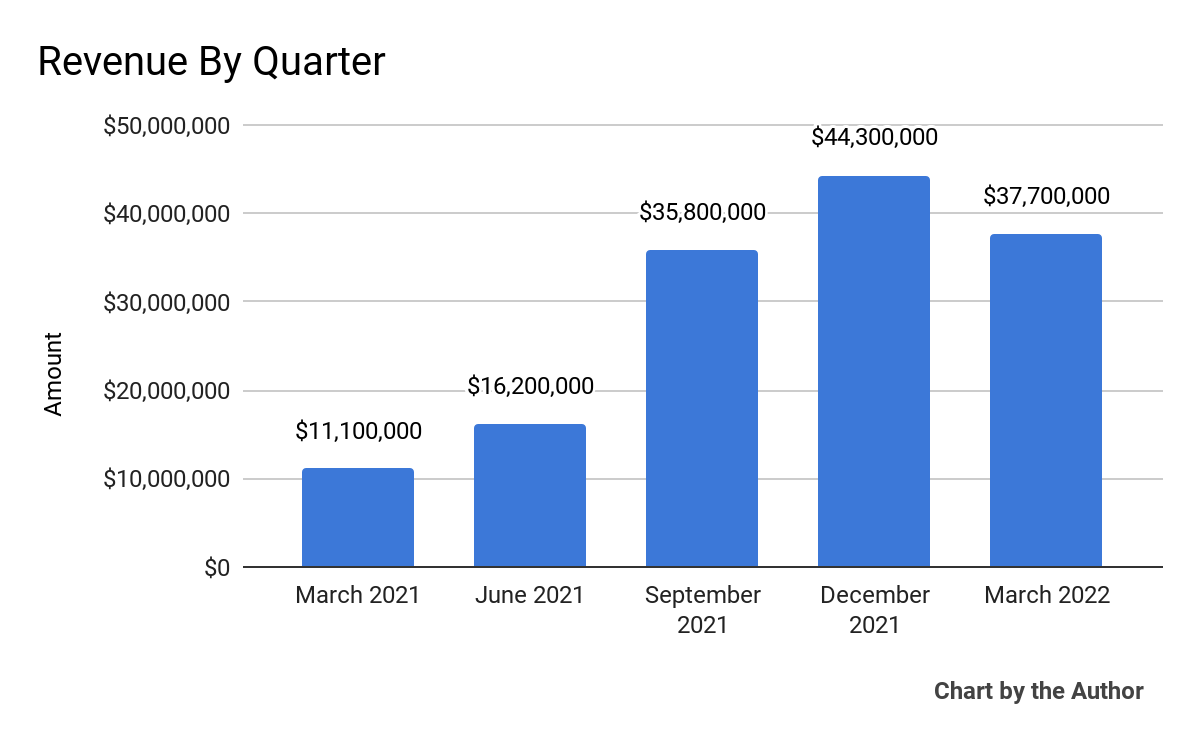

Total revenue per quarter (including Support.com data through September 2021) has increased significantly:

5 quarters total income (applying for alpha)

-

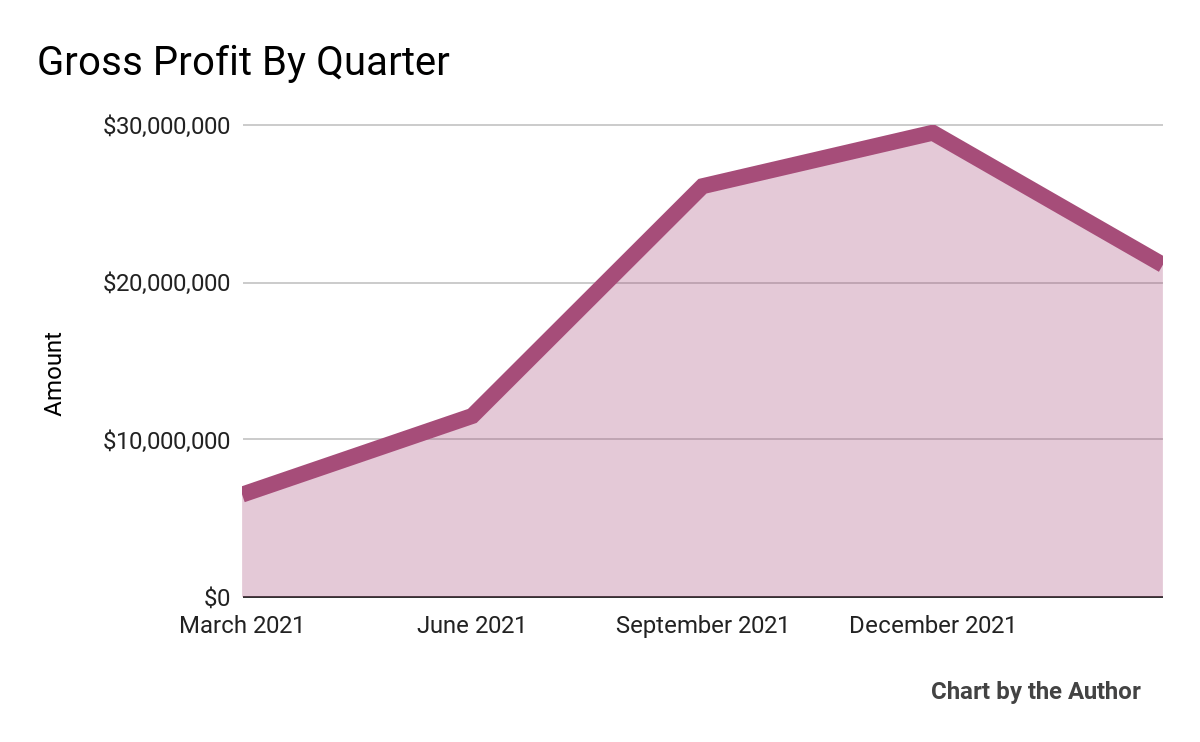

Gross earnings per quarter (including Support.com data up to and including September 2021) have also grown in the same direction as total revenue:

5 quarter gross profit (seeks alpha)

-

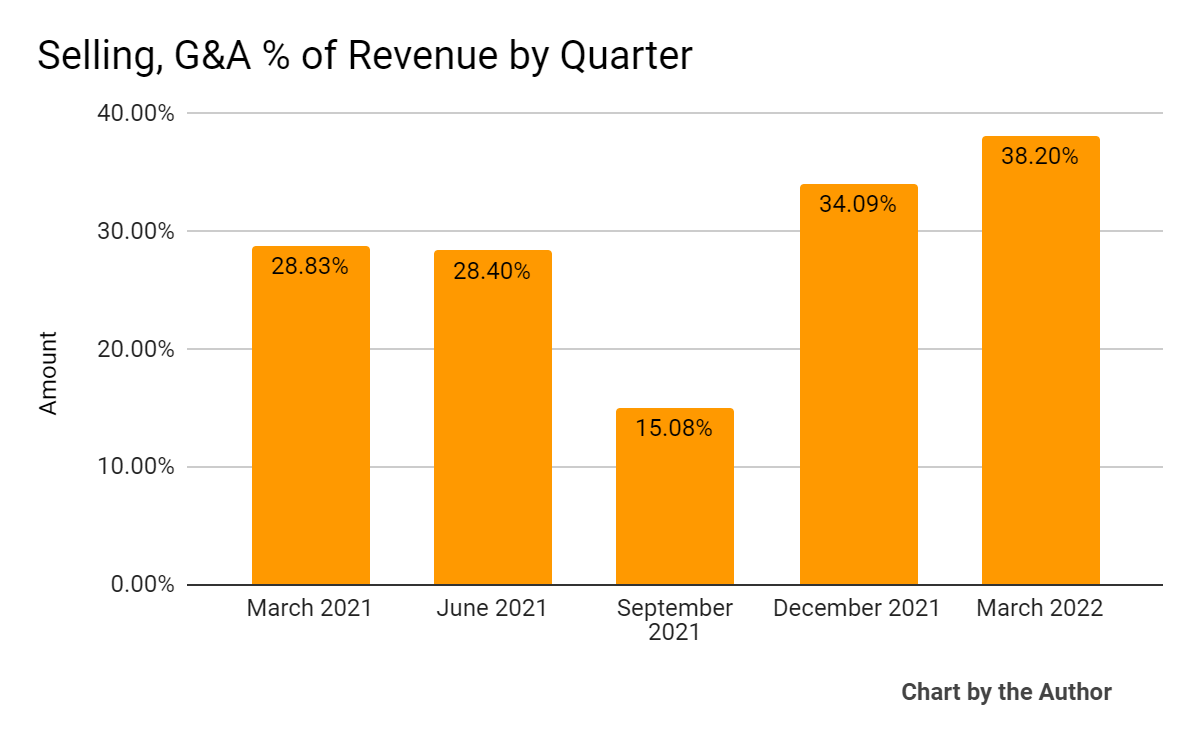

Sales, G&A expenses as a percentage of total revenue per quarter (including Support.com data through September 2021) have varied significantly in recent quarters:

5 quarter sales, G&A% of revenue (seeks alpha)

-

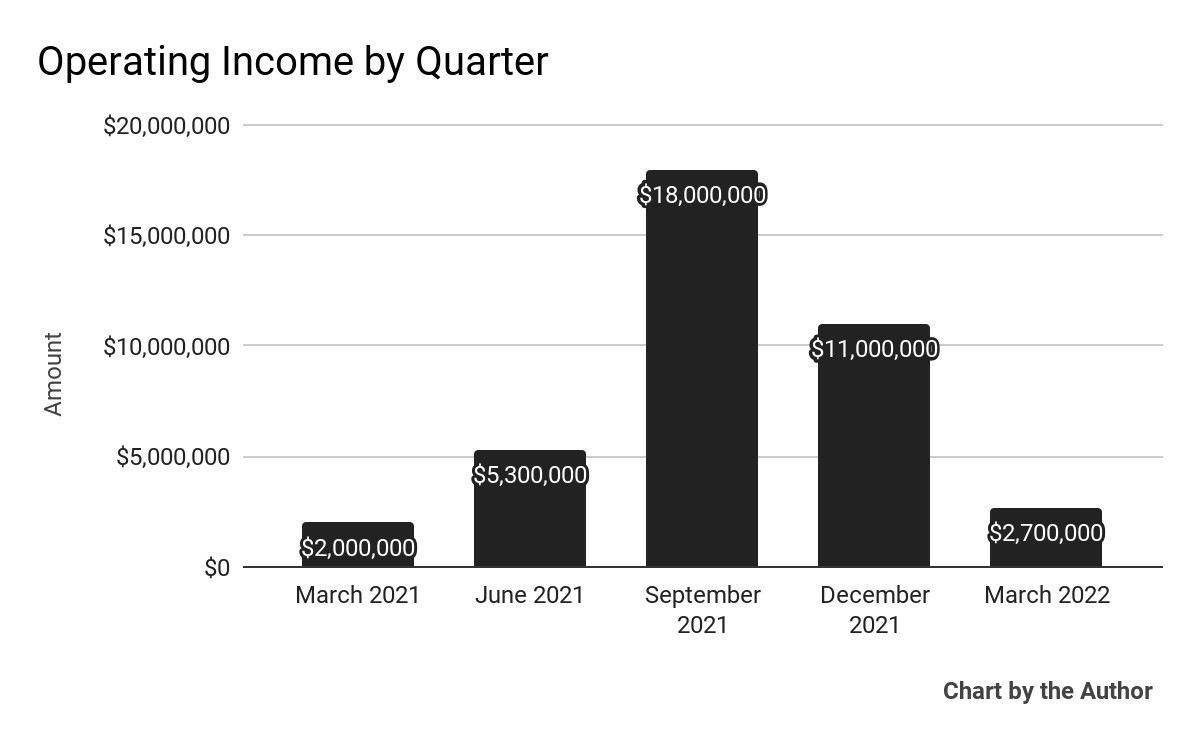

Operating revenues per quarter (including Support.com data up to and including September 2021) have varied significantly in recent reporting periods:

5 quarter operating income (applying for alpha)

-

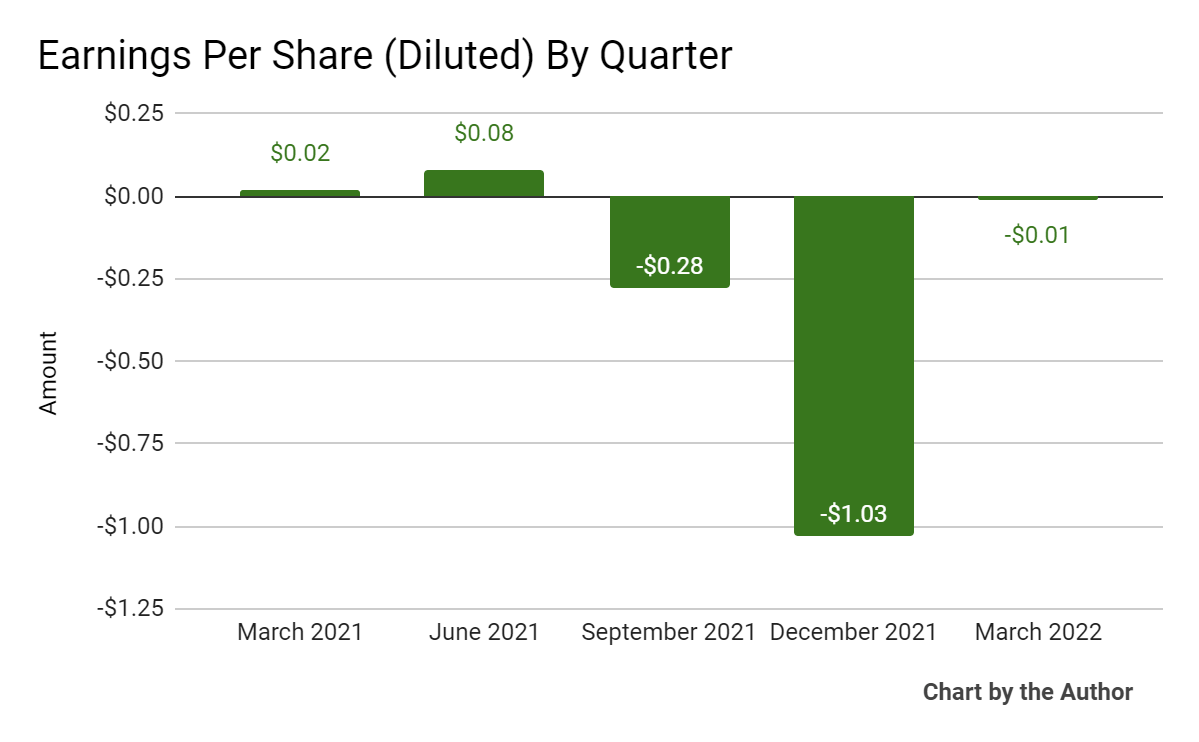

Earnings per share (diluted – includes Support.com data up to and including September 2021) have varied, although the very negative figure in the fourth quarter of 2021 was due to a non-cash goodwill amortization of the Support.com business:

5 quarter earnings per share (applying for alpha)

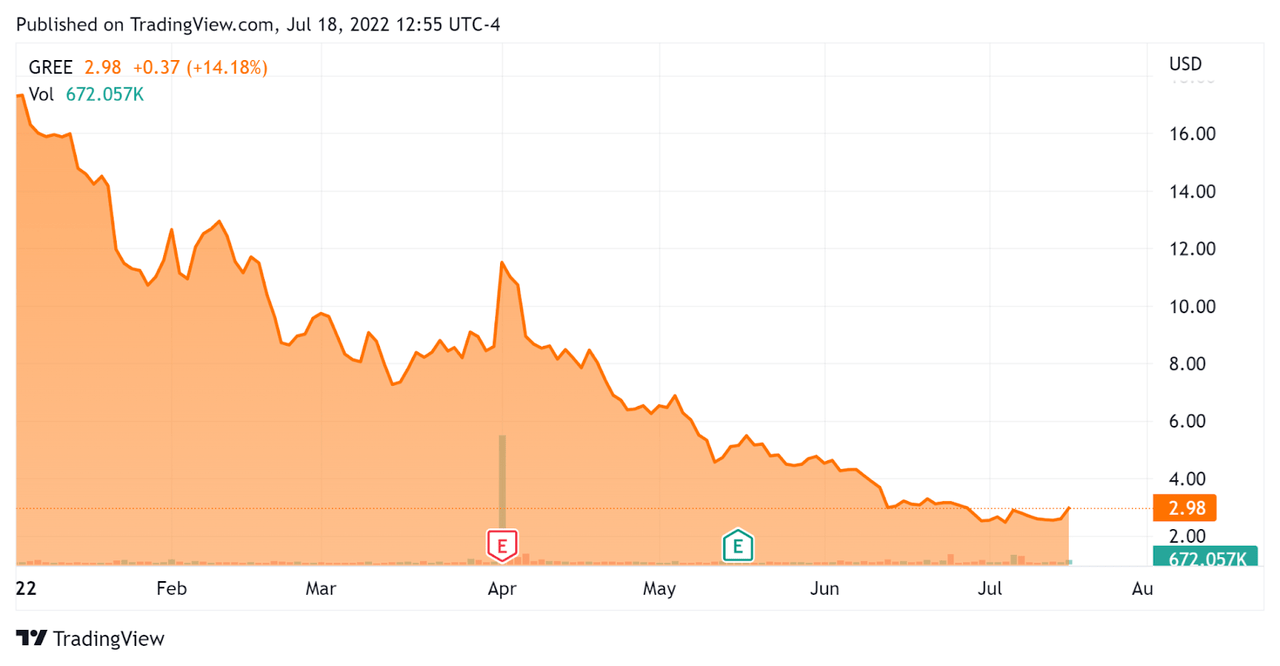

Since the beginning of 2022, the GREE’s share price has fallen 83 percent against the fall of the US S&P 500 index of around 18.9 percent, as the chart below indicates:

Stock price so far this year (Seeking Alpha)

Valuation calculations for Greenidge

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Corporate value |

$ 182 130,000 |

|

Market value |

$ 107,960,000 |

|

Enterprise Value / Sales (TTM) |

1.36 |

|

Price / sale (TTM) |

0.69 |

|

Revenue growth (TTM) |

377.51% |

|

Operating cash flow (TTM) |

$ 43,920,000 |

|

Earnings per share (fully diluted) |

– $ 1.24 |

(Source – Seking Alpha)

Comment on Greenidge

In its latest quarterly report (Source – Seeking Alpha), which covers the results for the first quarter of 2022, management highlighted growth in capacity growth at the data center facility in South Carolina, which contributed 22% of the company’s hash power.

The company also ended the quarter with approximately 19,600 miners in operation and orders for an additional $ 135 million of equipment from Bitcoin mining provider Bitmain.

As of the operational update on June 30, 2022, the company had 27,500 miners in operation, with 24% of the hash rate from the plant in South Carolina.

In terms of financial results, total revenues continued to grow strongly as the company brought more miners online.

However, GAAP operating profit has been highly volatile due to volatile Bitcoin pricing conditions.

For the balance sheet, the firm ended the quarter with $ 98 million in cash and cryptocurrencies, $ 28 million in drawn financing. The company completed two debt financing operations during the quarter for a total of $ 108 million in financing, of which the company had received $ 81 million.

In addition, Greenidge completed secured equipment financing of $ 81 million maturing in April 2024, of which $ 54 million was financed at the end of the quarter.

Looking ahead, the share price of the company will be strongly affected by the price of Bitcoin, which has recently fallen significantly from all-time highs reached in 2021.

Some analysts assume that the price of Bitcoin has fallen due to a rising interest rate environment combined with traders’ view of Bitcoin as a “risk asset” similar to technology stocks.

Whatever the reason, GREE’s future potential economic results are linked to its ability to cheaply produce power, acquire reasonably priced mining equipment and operate its facilities efficiently.

The primary risk to the company’s prospects is a continued downward pressure on Bitcoin, which slows revenue growth and potentially delays expansion plans.

Regulatory concerns are also a potential problem, as the company’s recent application for a title V air permit was rejected for the New York power plant.

The management said that the refusal ‘has no effect on our current business in Dresden’ and seems to be preparing to challenge the refusal of permission in court.

New York State has made headlines in the Bitcoin industry because of its apparent hostility to the mining of data center facilities and other industry participants, so I do not envy GREE’s potential struggle in an unfavorable regulatory environment.

Until we see Bitcoin’s price rise significantly, we will probably not see much improvement in operating revenues, so I am waiting for GREE until Bitcoin’s price action becomes bullish.