Funding Circle co-founder unveils new Super Payments fintech venture with $27M investment – TechCrunch

Funding Circle co-founder Samir Desai has unveiled a new fintech startup in the UK called Super Payments, a venture he founded back in February, but which very little was known about until now.

Reports surfaced a few months back that Desai had raised around $30 million for this new company, and today this has been confirmed. Super has raised £22.5 million (about $27 million as of today) in a funding round led by Accel, with participation from Union Square Ventures, LocalGlobe and a number of angel investors.

Although Super won’t open for business until later this year, the company has now launched a waiting list for consumers and businesses who want to be first in line when things officially get underway – this will include an early access programme.

So what does Super actually do? Well, on the consumer side, shoppers are promised cashback on purchases they make through the app, from clothing and electronics to flights.

Super payments in action

On the brand side, meanwhile, Super partners with companies with the promise of increasing their sales, and those brands pay Super a commission, part of which is shared back to the customer.

So in effect, Super promises to help its customers (businesses) cut out the financial “middleman” payment processors, who often charge up to 5% on top of each transaction.

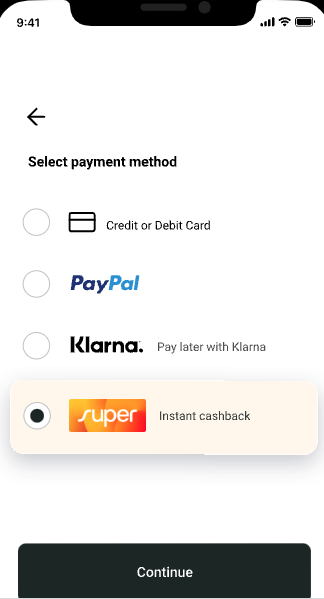

It is worth noting that Super offers its own payment solution as an option that apparently has no fees, and if a brand decides to support this, Super gives cashback to the customer immediately. If the brand does not offer Super as a payment option, or if the customer chooses not to pay with Super, the customer may have to wait up to two weeks.

Presumably, cashback and commission fees vary depending on which payment method the customer uses.

Super payments: Payment options

On top of that, Super also promises to help brands avoid costly customer acquisition and advertising fees – they don’t pay to feature their products in the app, they just pay a commission for every sale that Super generates.

Desai co-founded small business lending platform Funding Circle back in 2009, and remained CEO until he stepped down last September with the company’s shares at more than half their IPO value. While he remains a non-executive director of Funding Circle, Desai said he now wants to focus on helping businesses and shoppers avoid exorbitant e-commerce costs – particularly relevant at a time when Britain teeters on the brink of recession .

“For far too long, businesses and shoppers have been saddled with huge fees on the internet, in many cases without even knowing it,” Desai said in a statement. “We believe that the simple Super app can save customers and businesses billions a year. At a time of high inflation and increases in the cost of living, redistributing the huge profits from payment and digital advertising companies back to customers will significantly improve people’s lives.”

_id_b32fb481-53b2-43f3-b9be-7ec7ef356fd6_size900.jpg)