French pensioners can buy Bitcoin to secure their future

Bitcoin could stabilize the value of pension schemes in France after President Emmanuel Macron revealed a plan in January 2023 to raise the retirement age for French pensioners from 62 to 64.

Protesters today invaded the Paris branch of BlackRock, the world’s biggest asset manager, in the latest blow to President Macron’s sweeping reforms that some say only benefit rich companies.

France’s president polarises workers as government seeks to recoup funds

The French government forced approval of the new arrangement on 16 March 2023, without a vote.

In addition to changing the retirement age, the new law brings together all 42 schemes into a single points-based scheme. This revised plan will reportedly simplify job transitions and interruptions. However, it will harm employees whose scheme provides better money and a lower retirement age.

Knowing that the new reform would likely result in winners and losers, Macron sought to reshape public opinion through a lengthy national consultation. He said the plan would start in 2025 and go completely over 15 years.

The French Pension Advisory Council estimates that the reform will bring in $19.3 billion for the French government by 2030. Compensatory measures to smooth the transition to a higher retirement age and longer contribution period could exceed $4.9 billion.

While some fund managers, including Vanguard, argue that Bitcoin’s long-term value proposition is weak, others have seen it as a safe haven that protects against currency devaluation that retiring employees are likely to face.

How Bitcoin could benefit future French pensioners

US pension funds have generally erred on the side of caution when recommending crypto allocations, using them to boost returns without incurring significant losses.

Last year, Boston-based Fidelity announced that it would include Bitcoin in its 401(k) plans by the end of 2023. That would allow up to 20% of an employee’s retirement fund to be allocated to crypto. Fidelity manages pensions for around 23,000 companies.

Cryptocurrency advocates see France’s pension reform as an opportunity to spread Bitcoin adoption and follow in the footsteps of Fidelity Investments and ForUsAll, two prominent US pension managers.

Crypto Founder Share Crxpto wrote that moving pension funds to Bitcoin over the next five years could mean that investors could retire at the original age of 62. Some argue that currency devaluation is reason enough to allocate part of the funds to crypto.

Currently, pensioners stand to earn 1,400 euros per month after tax. Based on an inflation rate of 3% per year, pensioners will need around 1,721 euros monthly to maintain the same standard by 2030 and 3,109 euros by 2050. This prediction is based on raw data from the European Commission and the European Central Bank.

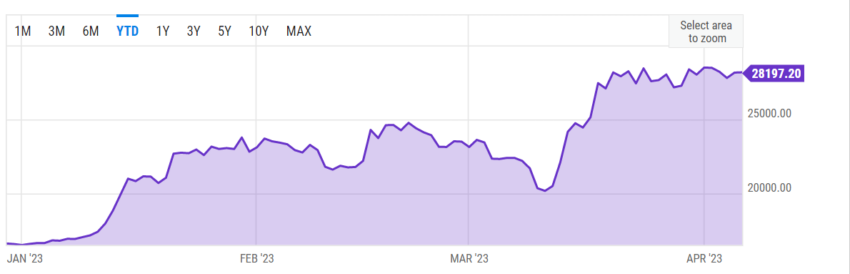

On the other hand, Bitcoin is up over 70% compared to its January 1, 2023 price of $16,600. It is currently trading at just under $28,200.

Bitcoin maxi Michael Saylor remains bullish on Bitcoin’s pedigree as a safe haven. MicroStrategy, the company on whose board he serves as executive chairman, recently bought another 1,045 BTC.

The latest purchase takes the stock to over 140,000. MicroStrategy was one of the first US firms to offer employees crypto allocations in their retirement portfolios.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.