FLEETCOR Stock: This Fintech EV Combination Is Strong (NYSE:FLT)

THE PALMS

FLEETCOR (NYSE:FLT) is a business payments company specializing in fuel cards and automated business payments, for fleets of trucks and vans worldwide. The Fintech Expense management industry is predicted to grow an 11.2% compound annual growth rate and reach a value of $6.6 billion by 2028.

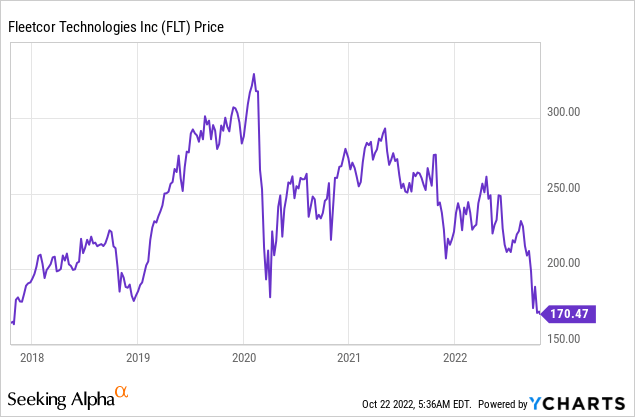

The company has recently announced the acquisition of EV charging point supplier Plugsurfing, which owns 300,000 charging points across Europe. According to the business press release, this is “almost 80% of all charging points in Europe”, which seems incredible at first glance. But even if the company means 80% coverage of Europe, this is still a strong value proposition, given the growth of the EV industry which I will share further details about later in this post. The company’s share price has fallen 48% from all-time highs in early 2020 and is trading lower than the pandemic’s low point. Therefore, in this post I will break down the company’s business model, finances and valuation, let’s dive in.

Fintech business model

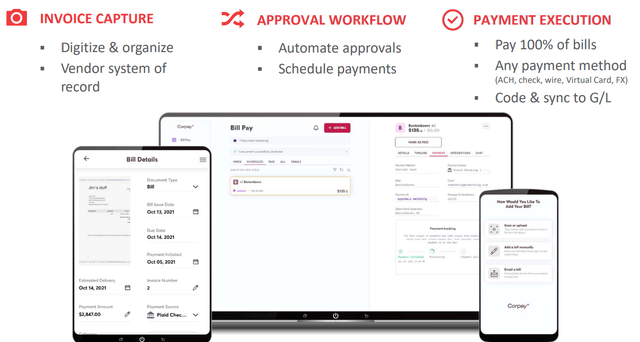

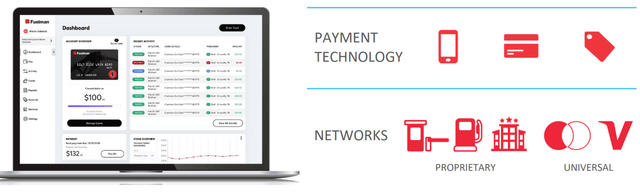

FLEETCOR was founded in the year 2000 and started as a fleet card supplier for company fleets. Fleet cards or “fuel cards” are payment cards used by businesses to manage fuel and maintenance costs for drivers while they are on the road. These cards enable accurate reporting of mileage expenses, fixed fuel prices that do not change by region and easy reporting. In 2010, FLEETCOR expanded its business to cover vendor payment programs and added additional expense categories for employees. Then in 2020, the company expanded further to become a comprehensive provider of payment solutions for businesses. This platform offers expense management, scheduled vendor payments, compliance and even integrates with popular accounting software.

FLEET COR (Investor presentation)

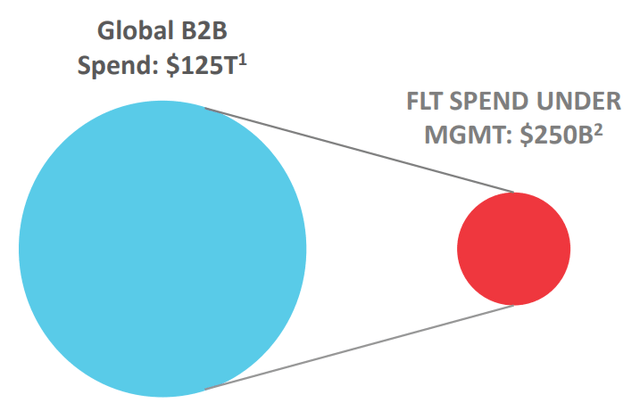

FLEETCOR estimates that they have leading market positions in the Fleet “Expense Management” and Supplier Payments categories. The business has approximately $250 billion in spend under management versus the $125 trillion global B2B spend.

FLEETCOR TAME (Investor presentation)

Despite being founded over 20 years ago, the company is continuously innovating both with its platform and digital advertising. For example, the company created a character called “Fuel Card Barb” as part of a humor-driven social media campaign that has proven highly successful.

The company has also announced a new accounts payable brand called “Corpay”. This is a platform that helps companies automate accounts payable and make cost-effective cross-border transactions while reducing the risk of fraud. The brand has positioned itself as “more flexible than banks”, but also “safer than Fintechs”, which is a strong position that I believe will resonate with businesses.

FLEETCOR Tech (Investor presentation)

EV strategy

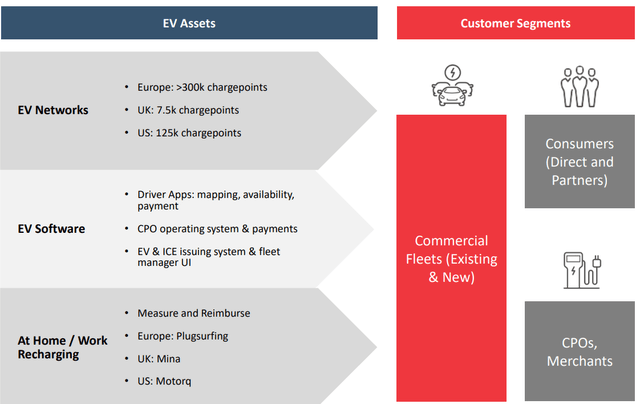

Climate change, consumer preferences and government incentives are predicted to cause a surge in the use of electric vehicles. In fact, a study indicates that the EV market was worth $163 billion in 2020 and is projected to grow at a rapid 18.2% CAGR to reach $824 billion by the end of the period. FLEETCOR’s management believes that despite the wave of growth, electric vehicles will only make up an estimated 50% of vehicles on UK roads by 2030 and 20% of vehicles in the US. The company believes that companies will face a new challenge in managing “mixed fleets”, and this is where they see a market opportunity. The company already has experience in this industry and has helped traditional fleet customers to switch to electric cars. In fact, the business processed approximately 3 million electric vehicle transactions in Europe in 2020. Management plans to further attack this market with a three-pronged strategy. The first part of this is to build out “connectivity” to EV charging stations. A key part of making this possible was the recent acquisition of Plugsurfing. This company has over 300,000 charging points, which is 80% of all electric car charging stations in Europe, according to the company.

EV assets (FLEETCOR)

The technology also includes a Plugsurfing app that provides tariff information and offers easy payment that is facilitated. The company also plans to integrate with private charging points and even partner with utility providers. An example of a customer is Virgin Media O2, which is one of the largest telecommunications companies in Great Britain. This company has integrated with All Star EV (which is a subsidiary of FLEETCOR) to be able to offer EV charging points at drivers’ homes for their 4,300 vans by 2030. Initially the deal was only for 300 vans, but this is still a great start and prove the concept.

Growing economy

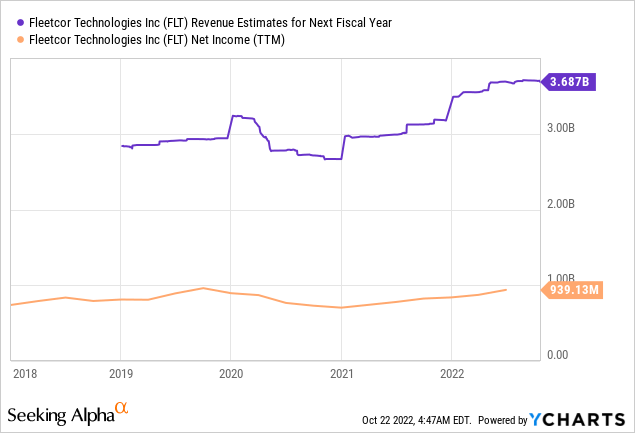

FLEETCOR generated solid financial results for the second quarter of 2022. Revenue was $861.3 million, which was up a brisk 29% year-over-year and beat analyst estimates by $40.3 million. On an organic basis, the business grew its revenue by 17% year-on-year, driven by strong results in corporate payments and lodging. In October 2022, the company announced the acquisition of Roomex, a European workforce accommodation business that has 600 corporate customers, who have stayed in approximately 50,000 hotels. This acquisition complements FLEETCOR’s existing accommodation business and looks to be a great acquisition overall, although the price paid is unknown.

Net income rose by a rapid 34% to $262.2 million, up from $196.2 million in the corresponding quarter last year. Earnings per share also rose to $3.35, which beat analysts’ expectations by $0.35. In the second quarter, fuel giant BP North America expanded its relationship, and the company won one of the largest global grocery chains as a customer for its gift card program. Delta Airlines also selected the company’s new “emergency passenger” mobile app to automate hotel bookings for passengers in the event of a canceled flight. This is a game changer as it means there is no need to wait at the airport, you just get a notification for the hotel booking. FLEETCOR has a super high retention rate of 92%, which means that customers are extremely “sticky” and thus consistent cash flow is expected.

FLEETCOR has a solid balance sheet with $1.4 billion in cash and short-term investments. The company has a large amount of long-term debt ~$4.7 billion, but only $508 million in debt, thus this is manageable.

Advanced valuation

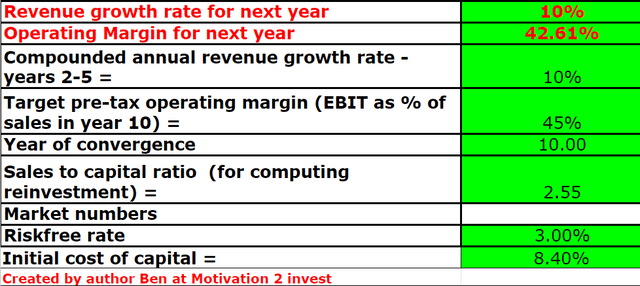

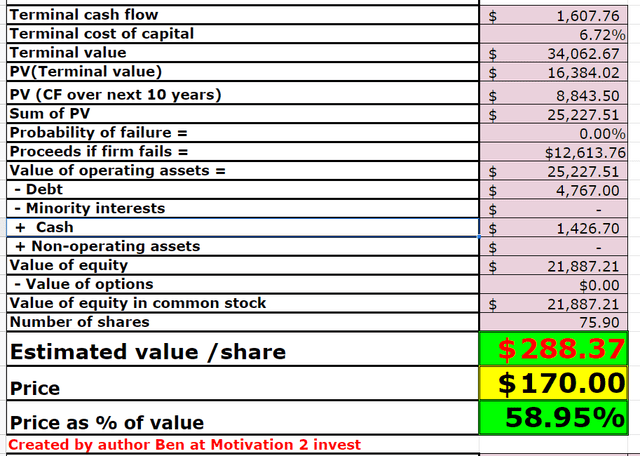

To value FLEETCOR I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecast a conservative 10% revenue growth for next year and 10% over the next 2 to 5 years.

FLEETCOR share rating (created by author Ben at Motivation 2 Invest)

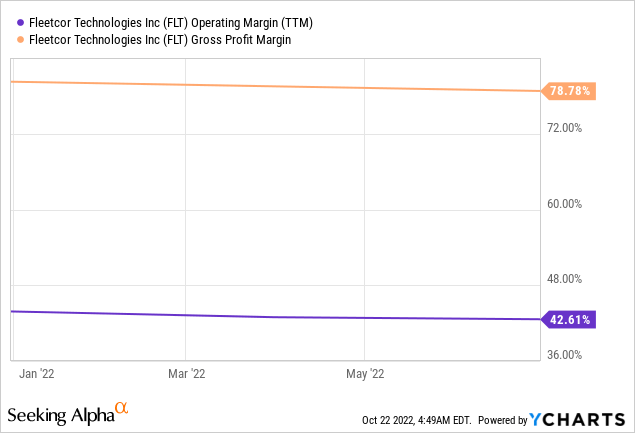

I have predicted that the business will increase its margin slightly to 45% over the next 10 years as the company benefits from additional EL charging revenues.

FLEETCOR stock rating (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $288 per share, the stock trades at $170 per share at the time of writing and is thus over 40% undervalued.

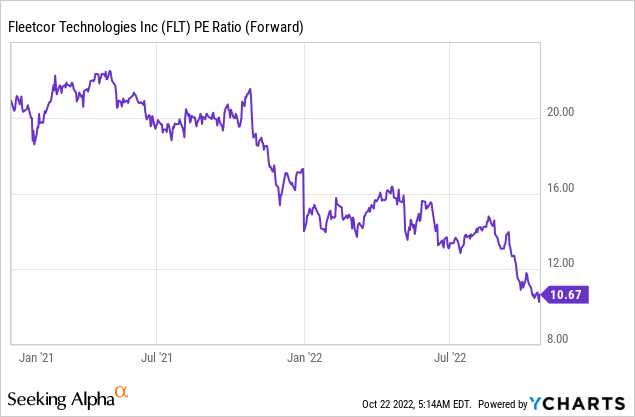

As an additional data point, FLEETCOR trades at a PE ratio = 10.67, which is 47% cheaper than its 5-year average.

Risks

Competition

There is plenty of competition when it comes to business expenses and automated payments. These companies include SAP Concur software, Sage Intacct, Payoneer, Bill.com, Tradeshift and many more. In the fuel card area, we have companies such as FuelGenie and various direct fuel operator cards via Shell and BP. This means that the company doesn’t really have a “graveyard” around the business that could be a problem.

Recession

The environment of high inflation and rising interest rates is predicted to cause a recession and cause lower economic demand. This is not good for any business and may lead to the demand for FLEETCOR’s customer services also being reduced.

Final thoughts

FLEETCOR is a very exciting company that continuously innovates and acquires businesses across its industry. The business offers a unique play on the fintech and electric charging industry. At the time of writing, the business itself is undervalued, and thus it appears to be a good long-term investment.