Fintechs Accounted for Over 30% of Tracked Kenyan Tech Startups in 2022 – Study – Fintech Bitcoin News

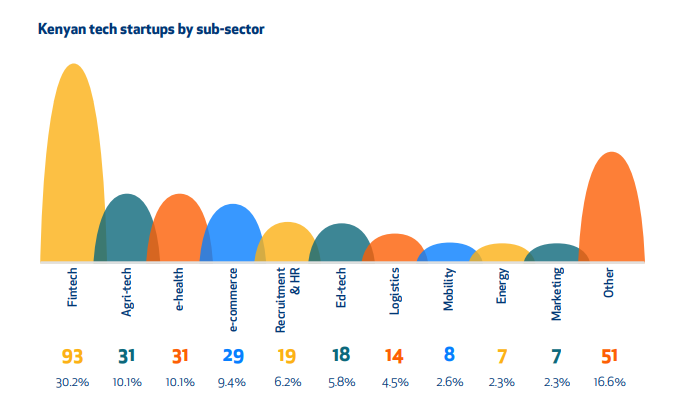

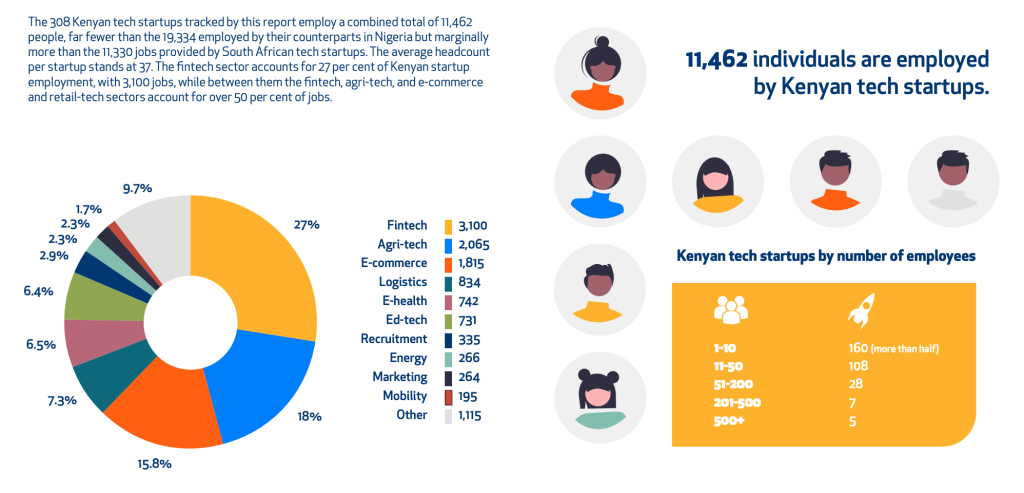

As of November 2022, Kenyan fintechs accounted for 30.2% or 93 of the 308 tracked tech startups, a recent Disrupt Africa study found. In addition, the study findings show that the fintech sub-sector alone accounted for 3,100 or 27% of the 11,462 people employed in tech startups in the same period.

Fintechs that solve fundamental problems

According to the findings of a study on Kenya’s startup space, fintech ventures alone accounted for just over 30% or 93 of the 308 startups tracked. This figure is almost three times higher than that of the closest contenders, namely agri-tech and e-health, which both accounted for 10.1% of Kenya’s technology startups tracked between January and November 2022.

As explained in Disrupt Africa’s study report on the Kenyan startup ecosystem, the dominance of fintech is not unusual.

“Fintech occupies the top position in most African countries as it solves fundamental problems for the population, is an area where new technological solutions tend to be well received and quickly adopted, as well as offering attractive returns for investors,” it said that in the report.

Remittances and loans Several popular categories

In addition to accounting for the largest share of technology startups, fintechs also employed more workers (3,100) than other subsectors. Agritech and e-commerce are the only other tech subsectors that employed more than a thousand workers.

Meanwhile, as shown by the study’s breakdown of fintech focus areas, money transfers (24%), as well as lending and financing (21%) appear to be the most popular categories. According to the report, part of the reason for this is that “these areas cover many of the most basic financial services that are still lacking for large sections of the population.” The report added that such categories have been “the starting point for fintech ecosystems across the continent.”

When it comes to technology startups’ use of blockchain, the study found that 12 of the 30 blockchain-based ventures are fintechs. E-health (6) and agri-tech (5) are number two and third respectively.

Register your email here to get a weekly update on African news delivered to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.