Fintech Startup Aladdin Raises Capital Via Equity Crowdfunding

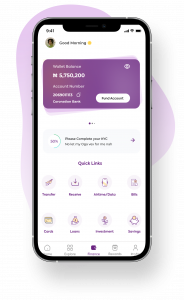

New digital banking ecosystem powering commerce and payments as it seeks to expand across Africa.

— co-founder and CEO Darlington Onyeagoro

LAGOS, NIGERIA , Dec. 23, 2022 /EINPresswire.com/ — Aladdin is pleased to announce that it is now seeking investors for its digital banking ecosystem for Nigerian entrepreneurs, individuals and small business owners.

For a minimum investment of $100, investors will support a digital bank that reported more than 80,000 monthly active users in July 2022 and helped facilitate the disbursement of more than $5 million in loans since its inception in September 2020. In addition, Aladdin reported more than 280 000 dollars in revenue through the third quarter of 2022, which exceeded the revenue from 2021 and made 2022 a record year for the company.

To facilitate the company’s growth, Aladdin has partnered with Purple Money Microfinance (PMM), which provides the banking infrastructure, including a lending facility the company uses to issue loans. PMM provides the core infrastructure for Aladdin’s savings and lending services by enabling customers to deposit money into dedicated savings accounts and receive short-term loans.

According to the International Monetary Fund, mobile money solutions in Africa have underpinned radical change in Africa, making it one of the global leaders in mobile money innovation, adoption and use, with 40 out of 45 sub-Saharan African nations uses technology. In particular, the e-payments market is projected to grow to around $40 billion in revenue by 2025, which is likely to “depend on infrastructure readiness, e-commerce penetration, mobile network penetration and regulation, among other factors, in each market.” according to a report from McKinsey.

“Aladdin seeks to address Africa’s growing needs for digital payments and lending infrastructure with its ecosystem of financial products and services,” said co-founder and CEO Darlington Onyeagoro. “By partnering with financial institutions that provide Aladdin with the digital infrastructure needed to meet customer needs, Aladdin aims to provide savings accounts, lending services, e-payment solutions and a marketplace for users to buy and sell any product.”

Onyeagoro is a seasoned product and strategy expert with more than ten years of experience across retail, banking and fintech in Africa. Before co-founding Aladdin, Onyeagoro founded Blacklistng, an alternative database for chronic debtors and fraudsters that aims to enable businesses to “blacklist” potential harmful customers.

To explore Aladdin’s investment opportunity, visit bit.ly/3HOwlWY.

Aladdin Corporate Website – https://aladdin.ng/

About Aladdin

Founded in 2020, Aladdin is a Fintech ecosystem of solutions designed to support the daily grind of small and medium enterprises (SMEs) and freelancers in Africa. Aladdin aims to empower Africans with financial tools to achieve their personal and professional goals through access to affordable banking products and services. With Aladdin, users can make payments, save, borrow, invest and sell their goods/services in a trusted, safe and secure ecosystem. Built for users starting a new business, freelancers who need extra capital or individuals who want to save money for the future, Aladdin’s goal is to be the best financial platform in all of Africa.

Howard Sherman

Crowdfund Buzz

+1 833-276-9377

send us an email here

![]()