Filecoin the latest crypto to increase in Market Bounce

Important takeaways

- Filecoin has risen over the past week. It is up 19.4% on the day.

- The increase comes after a shift in sentiment in the crypto market despite rising macroeconomic tensions.

- Traders are still divided on whether the market bottom is in.

Share this article

Filecoin’s FIL is up 19.4% today.

Filecoin Jumps on Market Rally

Filecoin is outperforming the rest of the cryptocurrency market.

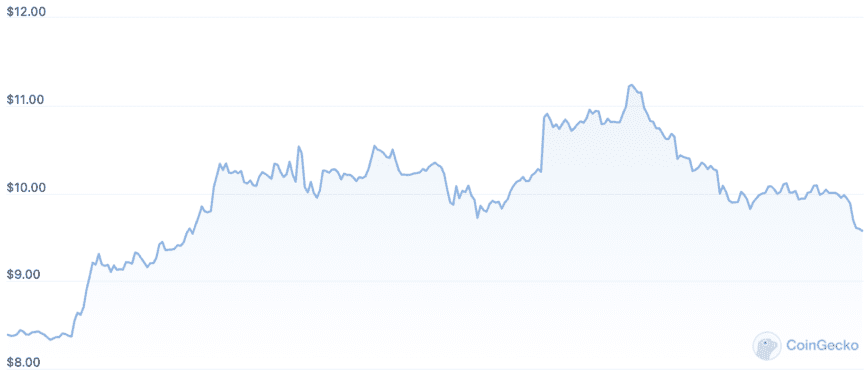

The decentralized storage network’s FIL token has jumped 19.4% today, outperforming most major crypto assets like Bitcoin and Ethereum. Several other tokens, including Polkadot’s DOT and Kusama’s KSM, have also rallied, though Filecoin is today’s strongest performer on the crypto top 100 leaderboard. Per CoinGecko data, it is currently trading at $9.90, up 75% in the past week.

The rise comes during a volatile period in the crypto market. Prices have been falling for months due to macroeconomic tensions, market fatigue and the collapse of giants such as Terra and Three Arrows Capital, but the market began to show signs of recovery in July. Last week, the Federal Reserve raised interest rates by another 75 basis points, while the Bureau of Economic Analysis revealed that the US economy had contracted for the second consecutive quarter, signaling the start of a “technical recession.” While such a development would typically be seen as negative for risk assets, the crypto market rallied last week, suggesting that the market may have actually priced in macro uncertainty.

The crypto market is making a comeback

Bitcoin closed July in the green after a brutal May and June, with its best monthly performance since October 2021. Meanwhile, Ethereum has led the market in recent weeks amid growing anticipation for the milestone “Merge” event, which is currently scheduled to go live in mid-September. When Bitcoin and Ethereum rise, liquidity tends to flow to other cryptoassets with lower market caps, which is partly what has allowed the likes of Filecoin to rise as confidence returns.

Interestingly, some of the strongest performers have been those linked to Ethereum’s so-called “Merge trade”. Ethereum Classics ETC, for example, has jumped 44.4% in the past week, likely because the narrative around the Proof-of-Work consensus mechanism has strengthened (the Ethereum fork will continue to use Proof-of-Work after its more famous sibling changes on Proof-of-Stake), causing Ethereum’s soon-to-be redundant miners to flock to the network. LDO, the management symbol for the liquid intervention protocol Lido, is up 31.3% in the same period.

With many cryptoassets showing bullish strength, some market participants have raised questions about whether “the bottom,” a term crypto enthusiasts use to refer to the lowest price point in the bear cycle, may be in, but traders remain divided. While some of Crypto Twitter’s top traders claim that the bottom is in, second say they are bearish due to the macroeconomic environment and the nature of previous bear markets (if Bitcoin and the rest of the market rallied for the rest of the year, the recent decline would be the shortest bear market in crypto history).

The global cryptocurrency market capitalization is currently around $1.1 trillion, about 63.3% less than its November 2021 peak.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AUYL2CT5IVLKNLWD5QNEB734BM.jpg)