EXCLUSIVE: FinTech Week London 2022: Are you talking finance?

Last week was Fintech Week London 2022, a five-day event where fintech executives gathered to discuss the “old age of the fintech industry”. For a sector that has been around for about two decades now, and is on the borderline between new and old, it is safe to say that fintech is in a constant flow of reinventions.

At a two-day conference, executives like Pietro Candela of AliPay, Ghela Boskovich of FemTechGlobal and Lori Lightfoot, the mayor of Chicago, sat down in conversation and discussed in depth the trends in financial technology, from ridiculing the big older banks to proclaiming embedded banks. finance the future.

The FF News team was spread throughout the event, from conducting interviews in a fake hair salon, to going junk from stand to stand on the network floor.

The cost of living and the coming cold winter will be a terrible blow to the economy. We are entering an era of brutalism, where customers can only afford what is absolutely necessary, except equipment. The two-day conference brought us back to life, and when I say that, I am not referring to post-pandemic relief, but to the fact that the economic world is in flames and solutions must be found now.

The Fintech agora was about banks. What is your job? Why do we need them? Did we do without?

FTW’s chairman Chris Skinner put together this framework in his keynote. He took a landscape picture of the current craze for crypto, proclaiming that “the modern world requires a decentralized digital currency.” From the beginning of globalization and Open Banking, a universal currency, which can be used across national borders and complies with a standardized distribution book à la SWIFT, seems like a natural conclusion to banking and payments.

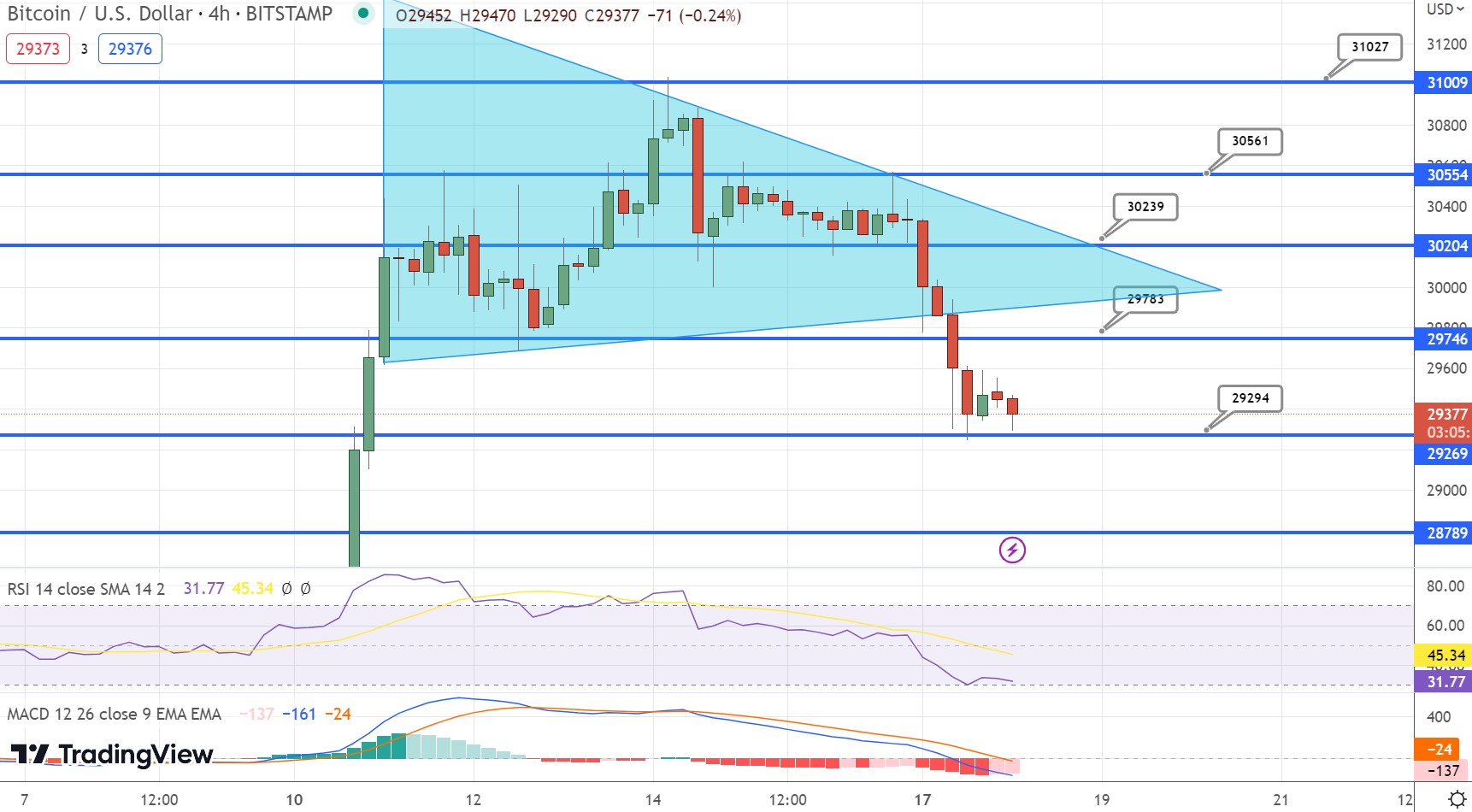

Still, we are nowhere near that goalpost. There are several factors for this, a borrower from the saying that Rome was not built in a day. Changes, especially in the banking and finance sector, take years before they are realized. Automation in insurance has existed since the 70s, and we are still experimenting with the use cases. The cryptocurrency market just crashed, and Bitcoin fell from the highest level of $ 49,000 in November 2021 to a hell of $ 15,000. Like any cycle, we will eventually return to a period of prosperity, but we can not plan for the future when today’s structures are not yet cemented. .

This had to happen. Bitcoin will most likely stabilize in the coming months and people will get some of their money back. What this crash shows is that crypto is still very much in its experimental stages. It will take years to come to a decentralized digital currency, and it will come with its trials and tribulations.

A common theme was implanted in Skinner’s keynote. No matter what innovations come and go, time and implementation will always be the most important factor to consider.

This filtered into today’s first large panel at Big Tech and Big Banks, of which big banks and fintech executives Ronit Ghose from Citi, Rita Martins from HSBC and Mark Hartley from Bankifi gathered. There was friction around the topic of banks and their relationship with technology companies. Martins sincerely approached the idea that banks should become technology companies, and offer more on the customer-facing part of rewards and personal experience.

This, Ghose replied as unsteady, banks will always be financial services first, because banking is where their primary interests lie. Starling and Halifax would not invest so much in pastoral pleasures if customer loyalty and return were not guaranteed. Financial services are the name of the game, and technology is what we use to win.

By far the most enlightening argument came from Hartley, CEO of Bankifi, an Open Banking provider that specifically focused on the often underserved demographics of SMEs.

It is this naive idea that customers do not care about the inside and outside of financial services, and that they only care that the experience of the introduction process should be simple. The latter is true to the extent that the simple means are inclusive and lack corporate jargon.

I caught up with Hartley during the conference, where we discussed a myriad of peeves from the industry, most of whom accumulated to whether fintech did anything to improve the lives and finances of the end user, real people. For Mark, things are still speculative, the fintech companies that will stand the test of time will be the ones who have a distinct model with something to solve, aimed at the problems people face here and now.

The next panel broadened the horizons for alternative payments around the world, with Pietro from AliPay and James Winterson from Thunes merging what makes the age of digital wallets and super apps so tempting for India and Asia, which operate in space. age level.

I talked more with Winterson about this idea of personalized offers from banks and why it means more than ever to customers. “Those with less pay the most,” Winterson said. We traded anecdotes about what matters to us when it comes to our banking experience. We agreed that rewards and incentives were important in convincing a customer to use a service or product. A 1% cash bank on all transactions and a £ 20 discount at a weekly shop would make a huge difference to half the population of this country, which is plunging deeper into economic uncertainty.

The latest panel discussion gave the entire industry a whirlwind, tearing the pedantic trends of crypto and metaverse to shreds.

Entitled “The Good, the Bad, and the Ugly”, the group boasted of an exciting collection of speakers; Ghela Boskovich, the founder of FemTechGlobal, Andrew Vorster from Banking Scene, Theodora Lau from Unconventional Ventures, Chris Skinner and Dr Leda Glyptis from 10x Future Technologies. In this latest turn, the group dissected all current issues and trends affecting the fintech industry, from ESG to attracting new talent.

“The calculations for ESG are for vanity or low industry standards,” Glyptis said, discussing greenwashing and how standards set by companies themselves to achieve zero carbon emissions are not enough.

“The industry is good and bad, but we do not accept responsibility since there is no real punishment,” said Ghela Boskovich. We are approaching necessities such as equality at arm’s length, without real action when it comes to finding perpetrators. The reason for this, the group explained, is because we are linked to legacy thinking, what we are comfortable with, banks invest in a six-year period, disregard the seventh period. It is uncomfortable to push for a change in thinking.

The injection of ambiguity is a retroflex of time. It takes time to implement and perfect new technologies, blockchain, built-in finance and open support, we are still on the surface of understanding how to use them. When new shiny ideas emerge, it is to keep the motivation alive and push towards developing initial ideas, as Boskovich describes “the metaverse is just a distraction.”

One last thought resonated with me, and it concerns the reason we were gathered this week in London.

“These events are instructive […] we have a duty to educate beginners about what is bothering the industry, we must do the job to see progress. ” and constant learning of new technologies and businesses can be overwhelming. My preoccupation subsided as I spoke to the leaders and disruptors of our industry, so open to talking about how fintech affected all people. It became very clear that we were all heading for the same storm, but in different boats – and trying to find answers to very human problems.