Ethereum Merger One of the few positives for the cryptocurrency and blockchain sector—Q3 2022 Crypto Market Recap

Cryptocurrency markets are in deep bearish territory, as more than half of the coins in the cryptocurrency top 100 are down more than 65% from their all-time highs. Undoubtedly, a significant part of the 2022 crypto market crash can be explained as part of a standard crypto market cycle, similar to what we saw in 2017/2018.

In 2021, the market was dominated by abundance and optimism. Cryptocurrency companies spent tens, if not hundreds of millions of dollars on mainstream marketing campaigns, big celebrities endorsed NFT projects and crypto exchanges, and social media hype led to skyrocketing price increases for meme coin projects like Dogecoin and Shiba Inu despite their dubious fundamentals. Venture capitalists poured record amounts of capital into the sector, leading to an unprecedented amount of unicorns emerging from the crypto and blockchain industry.

With all of this in mind, it’s pretty clear that the crypto markets needed a reality check as valuations became completely disconnected from the real world utility or use of the technology.

However, there is another extremely important aspect of the current downturn in the crypto market. From a global perspective, the macroeconomic outlook and geopolitical instability are at their worst since Bitcoin was launched back in 2009. The biggest source of global uncertainty at the moment is of course the ongoing Russian invasion of Ukraine. With the help of weapons supplied by the West, Ukraine has seen remarkable success in reclaiming some of its occupied territory, but the chances of the conflict ending in the short term appear slim at best.

Q3 2022 Crypto Market Summary

With this context in mind, let’s take a look at the key news events and trends that shaped the cryptocurrency and blockchain sector in Q3 2022. Let’s first take a look at the performance shown by the top digital assets by market capitalization, Bitcoin and Ethereum .

Bitcoin’s quarterly performance was virtually flat

While there were ups and downs along the way, Bitcoin started and ended Q3 at almost exactly the same price. BTC traded just below $19,500 on July 1, ending the quarter at around $19,350. The total cryptocurrency market capitalization increased from $906 billion to $958 billion (+5.7%) in the same time period.

The quarterly peak for BTC came in mid-August, when the Bitcoin price reached just above the $25,100 level. The quarterly low was set on September 22, when the BTC price came perilously close to falling below $18,000.

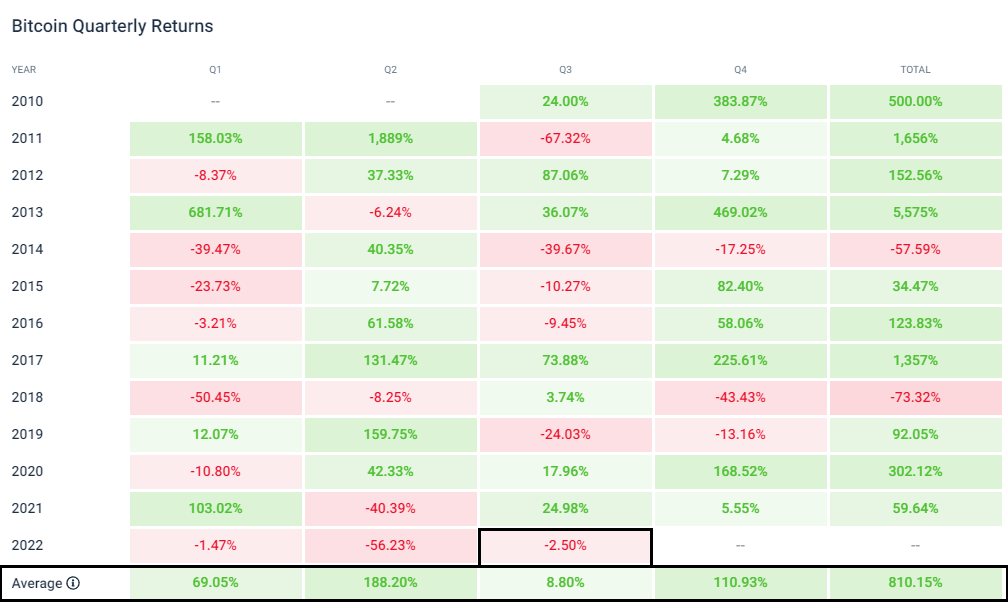

While Bitcoin’s Q3 performance was certainly not exciting, it did provide some relief after the catastrophic -56% price crash in Q2. It’s also worth keeping in mind that Q3 is historically the weakest quarter for Bitcoin by a significant margin.

Q4 is historically the strongest quarter for Bitcoin, which may provide some hope for the bulls.

Ethereum showed promise, but ETH markets disappointed after the merger

The action in the Ethereum market was much more compelling in Q3 than what we saw from Bitcoin. Ethereum started the quarter strong, with the ETH price climbing from $1,060 on July 1st to a quarterly high of $2,040 on August 14th. ETH’s quarterly low came on July 13, when the bulls managed to prevent the Ethereum price from falling below it psychologically. significant price level of 1000 dollars.

Ethereum’s big rally in the first half of Q3 was likely driven by anticipation of the Merger, a technical upgrade that transitioned the Ethereum blockchain from a Proof-of-Work consensus mechanism to a Proof-of-Stake consensus mechanism. The upgrade, which was in the works for several years, was successfully completed on 15 September without significant difficulties.

As is often the case in the crypto markets, the merger turned out to be a “buy the rumor, sell the news” event. The ETH price hit a local peak one month before the upgrade went live, and saw an accelerated decline after the merge actually happened.

LUNC was the top performer in the crypto top 100

The best performer in Q3 in the cryptocurrency top 100 was LUNC, the original token of Terra Classic. The token, which still has a hugely inflated supply due to the collapse of the UST stablecoin in May, rallied sharply in early September and has retained a significant portion of its gains despite a price correction.

Enthusiasm for the coin was largely fueled by social media hype. The controversial history of the Terra ecosystem combined with the opportunity to “revive” a once important blockchain platform has resulted in a fervent online community of LUNC supporters. LUNC now shares many similarities with “meme coins”, including the low price per unit that can make a cryptocurrency appear “cheap” to less sophisticated investors regardless of its actual market value.

Other strong performers in Q3 include GMX, Lido DAO Token, Quant and Chiliz. All of these tokens more than doubled in price, showing that the crypto markets still held plenty of opportunity despite the uninspiring performances shown by Bitcoin and Ethereum.

The worst performer in the crypto top 100 was HNT

The worst performer in the top 100 was Helium’s HNT token, which recorded a 43% price drop in Q3. The project received negative press for allegedly misrepresenting the nature of some of the partnerships. However, Helium fans have a lot to look forward to, as the project plans to transition to the Solana blockchain and a Helium-powered mobile operator called Helium Mobile is set to go live in early 2023.

Green Metaverse Token, The Sandbox, Basic Attention Token and Loopring were also among the worst performers in the quarter.

The biggest crypto news events of Q3 2022

The most notable crypto news events of the quarter were the Ethereum merger, as well as the collapse of several prominent companies in the crypto and blockchain industry.

The Ethereum merger finally happened

Ethereum successfully completed its long-awaited Merge upgrade on September 15th. As a result, Ethereum no longer uses the energy-intensive Proof-of-Work consensus model to validate transactions, as the network is now maintained by validators who stake their ETH coins. The transition to Proof-of-Stake has reduced Ethereum’s energy consumption by more than 99%, which could make the network more attractive to a wider audience.

In addition, the merger has resulted in a significant reduction in the amount of ETH issued. According to estimates by the Ethereum Foundation, around 13,000 ETH were issued per day to reward miners under the Proof-of-Work system. Now the network only needs to issue about 1600 ETH per day to reward validators. This will drastically slow the inflation of the ETH supply. Depending on how much ETH is burned through EIP-1559, we may even see ETH become a deflationary cryptocurrency in the future.

The next step for the Ethereum project is the Shanghai upgrade, which will enable stakers to withdraw ETH.

Three Arrows Capital collapsed as part of an industry-wide rout

At the beginning of the year, the hedge fund Three Arrows Capital was considered one of the most recognized crypto-native investors. The hedge fund managed an estimated $10 billion in assets as of March.

Three Arrows Capital had significant exposure to the Terra ecosystem, which saw a complete collapse in May. In total, around $60 billion was wiped out as both the LUNA token and the UST stablecoin crashed to zero.

The fund’s founders Su Zhu and Kyle Davies said the Terra collapse resulted in a loss of about $200 million for the company. However, the collapse of Terra had a domino effect on the entire cryptocurrency market, causing further losses for Three Arrows Capital. The company was unable to pay off the debt and filed for bankruptcy in July.

Three Arrows Capital was far from the only victim of the collapse of Terra and the subsequent crypto market crash. Here are examples of companies that have frozen withdrawals of customer funds. Some of the companies on the list have filed for bankruptcy.

- Celsius – Freezes withdrawals in June, filed for bankruptcy in July

- Voyager – Frozen withdrawal in July, filed for bankruptcy shortly after (the company’s assets have been acquired by FTX)

- CoinFLEX – Freeze withdrawals in June (they were reactivated in July in a very limited capacity)

- Vauld – Frozen withdrawals in July, is currently in discussions with Nexo about a possible acquisition

- Babel Finance – Frozen withdrawal in June, currently seeking restructuring

Other notable crypto events and trends

Beyond the two biggest stories, there were also a number of other important news and trends for the crypto and blockchain space in Q3 2022.

US CPI numbers and Fed rate hikes continued to have a big impact on the crypto markets

Macroeconomic factors continued to have a major impact on cryptocurrency markets. Rising interest rates tend to reduce demand for riskier assets such as cryptocurrencies and tech stocks, which is why the crypto market has been closely watching inflation numbers and monetary policy updates, especially in the US. Monthly releases of consumer price index (CPI) statistics and the US Federal Reserve’s interest rate decisions drove short-term volatility in the crypto market.

Several crypto bosses resigned from their positions

An interesting trend from Q3 2022 is that CEOs of many prominent crypto and blockchain industry companies have stepped down from their roles. Some of the most notable CEO departures include:

- Michael Saylor (MicroStrategy)

- Jesse Powell (The Kraken)

- Michael Moro (Genesis)

- Sam Trabucco (Alameda Research)

- Robert Gutmann (NICE)

- Alex Mashinsky (Celsius)

Another notable departure is Brett Harrison, who has stepped down from the role of president of FTX US.

While many of the former CEOs on the list plan to remain involved with their respective companies in various roles, the trend of top crypto executives is still definitely something to keep an eye on.

The US Treasury Department sanctioned the Ethereum-based protocol Tornado Cash

In August, the US Treasury Department imposed sanctions on Tornado Cash, an Ethereum-based protocol that allows users to obscure the origin of their cryptocurrency. The Office of Foreign Assets Control (OFAC) claims that the protocol has been used to launder more than $7 billion in cryptocurrency. As a result of the sanctions, it is now illegal for US citizens to use the Tornado Cash protocol.

While the Tornado Cash protocol is certainly used by hackers and other criminals to hide the origin of illicit funds, the protocol also provides a valuable service for everyday Ethereum users who simply want to protect their privacy. For example, a buyer of a highly publicized NFT may not want to disclose their entire history of transactions on the Ethereum blockchain. The Ethereum blockchain has no built-in privacy functionality and has a fully transparent ledger similar to Bitcoin.

The sanctions have raised concerns about the censorship resistance of the Ethereum blockchain, especially in light of the recent move to Proof-of-Stake. Centralized entities such as Coinbase, Binance, and Kraken, which may be pressured by government agencies to censor some types of Ethereum transactions, control a significant portion of all active ETH validators.

![What next after Bitcoin Cash [BCH] taking back $110 from riding BTC’s coattails What next after Bitcoin Cash [BCH] taking back $110 from riding BTC’s coattails](https://www.cryptoproductivity.org/wp-content/uploads/2023/03/alexander-grey-8lnbXtxFGZw-unsplash-1-1000x600-120x120.jpg)