Tags in this story

Bitcoin mining, Chandler Guo, Chandler Guo ETH, decentralized exchange, ETH Vitalik Buterin, Ethereum Hard Fork, ETHW, Joseph Lubin, Mining Pools, NFTs, US Securities and Exchange Commission

all about cryptop referances

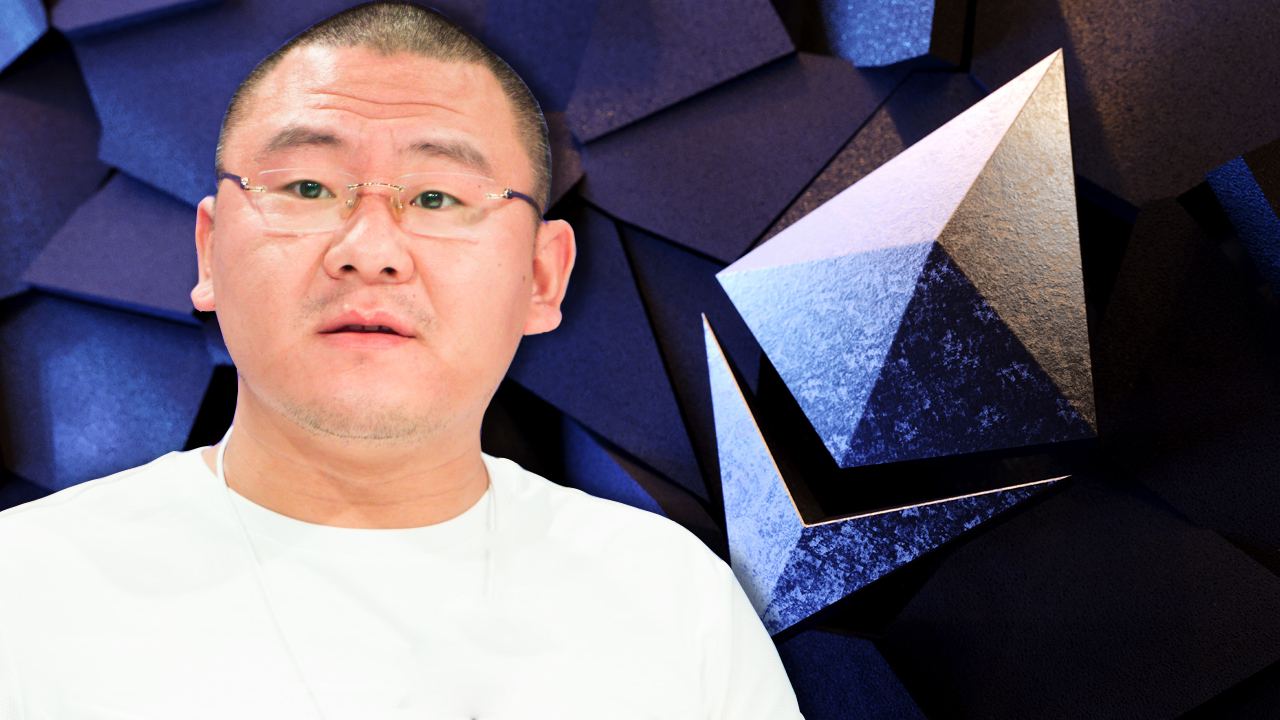

The US dollar value of the newly fired coin native to the forked Ethereum proof-of-work (PoW) blockchain will be on par with ether, Chandler Guo, the initiator of the latest Ethereum hard fork, has said. Guo added that he expects the value of the token, which is currently “very cheap”, to grow by 100 times in ten years.

According to Chandler Guo, the self-proclaimed organizer of the recent Ethereum hard fork, Ether (ETH) and the recently discontinued proof-of-work ETHW will have the same USD value in ten years. Guo claimed that the new token, which is currently trading at just a fraction of its September 15 high, still has the potential to grow by 100x.

In an interview with Bitcoin.com News, Guo claimed that the current price of the forked coin is “very cheap” and therefore the possibility exists for it to grow by 100 times. Guo, a former bitcoin and ethereum miner, nevertheless admits that the forked blockchain has a lot of catching up to do before this hundredfold growth is achieved. He explained:

Currently the ETH price is high because there are many developers and over 200 different projects running on top of Ethereum PoS [proof-of-stake] blockchain. On the other hand, there are less than 10 projects at ETHW.

Still, to prove that work to ensure that the fork chain eventually matches the PoS chain has begun, Guo revealed that within just four days of the merger, “the ETH proof-of-work chain already has two DEXs [decentralized exchanges]two bridges and two NFT [non-fungible token] exchanges already launched.”

He added: “Things are happening step by step and after one year I think there will be over 100 projects running on top of the PoW chain.”

Besides the launch of exchanges and bridges on the new chain, the protocol’s daily trading volume has increased since The Merge. While the data from Coinmarketcap on September 21, 2022 suggests that ETHW’s daily traded volume was just over $100 million, Guo however insists that the actual volume is closer to $1 billion.

“[Already] the trading volume of ETHW is huge. Today it is almost a billion dollars. [As of today] ETHW [is] supported by more than 20 mining pools and 2000 miners from around the world. More than 30 exchanges have listed ETHW,” claimed the former miner.

Just under a month before The Merge, Bitcoin.com News reported that a team led by Guo had confirmed that a new Ethereum chain split was coming. However, as soon as the migration to PoS ended, two alternative chains emerged: the ETHW blockchain and the Ethereumfair (ETF).

Commenting on the second coin’s prospects, Guo, who rose to prominence after playing a role in the Ethereum blockchain’s 2016 hard fork, said:

I know another team has ditched ETH, but no one is mining there, no one is showing their token. Only a few exchanges and mining pools. It [the success of a fork] it all depends on who forked ETH. I didn’t fork this so I could take advantage of this. But others fork for their own good or advantage. That’s why they get rich off of it – I don’t [do] that.

Meanwhile, before the Ethereum blockchain switched from a PoW to a PoS consensus mechanism, it was widely reported that this would cause the protocol’s energy usage to drop by more than 99%. As expected, climate change campaigners have applauded the September 15th merger, which some miners now fear will embolden opponents of the PoW consensus mechanism.

When asked to respond to the argument that bitcoin mining harms the environment, the former miner rejected this claim. He said that instead of buying electricity from power companies, bitcoin miners – especially from China – often prefer to use “abandoned energy” which is cheaper.

Abandoned energy could be natural gas or hydropower that is not currently being tapped, he said. According to Guo, in regions like Kazakhstan and Russia where miners harness such energy to mine bitcoin, local communities have benefited.

Meanwhile, regarding reports that the Ethereum merger may have given the US Securities and Exchange Commission (SEC) grounds to initiate or initiate some sort of case against the blockchain’s co-founders, Guo noted:

“I think Vitalik [Buterin] and the boss behind him is named Joseph Lubin. This guy knows how to fix this problem because he has connections to Wall Street. He knows how to handle the SEC.”

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons