Ethereum-based NFTs on OpenSea recorded highest monthly sales volume, here’s why

- Ethereum-based NFTs on OpenSea just saw their highest sales volume since May.

- However, monthly sales volume across OpenSea is at its lowest level this year.

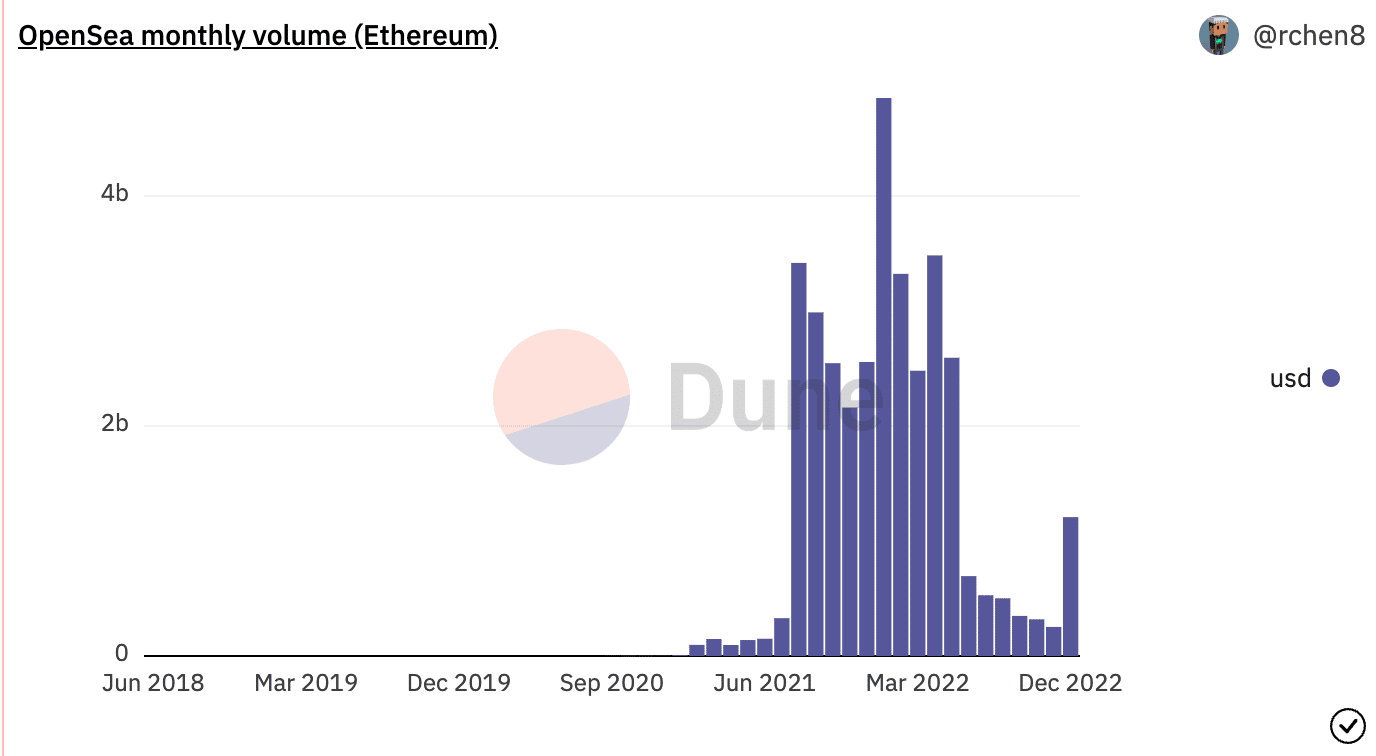

After suffering a sharp decline in interest, Ethereum-denominated NFTs on OpenSea managed the highest monthly sales volume since May, data from Dune Analytics knew.

With 696,908 Ethereum-based NFTs sold on OpenSea since the beginning of December, the monthly sales volume totaled $1.2 billion at press time. With seven days remaining until the end of 2022, this index represented a 74% increase from the $253 million recorded in sales volume in November.

Source: Dune Analytics

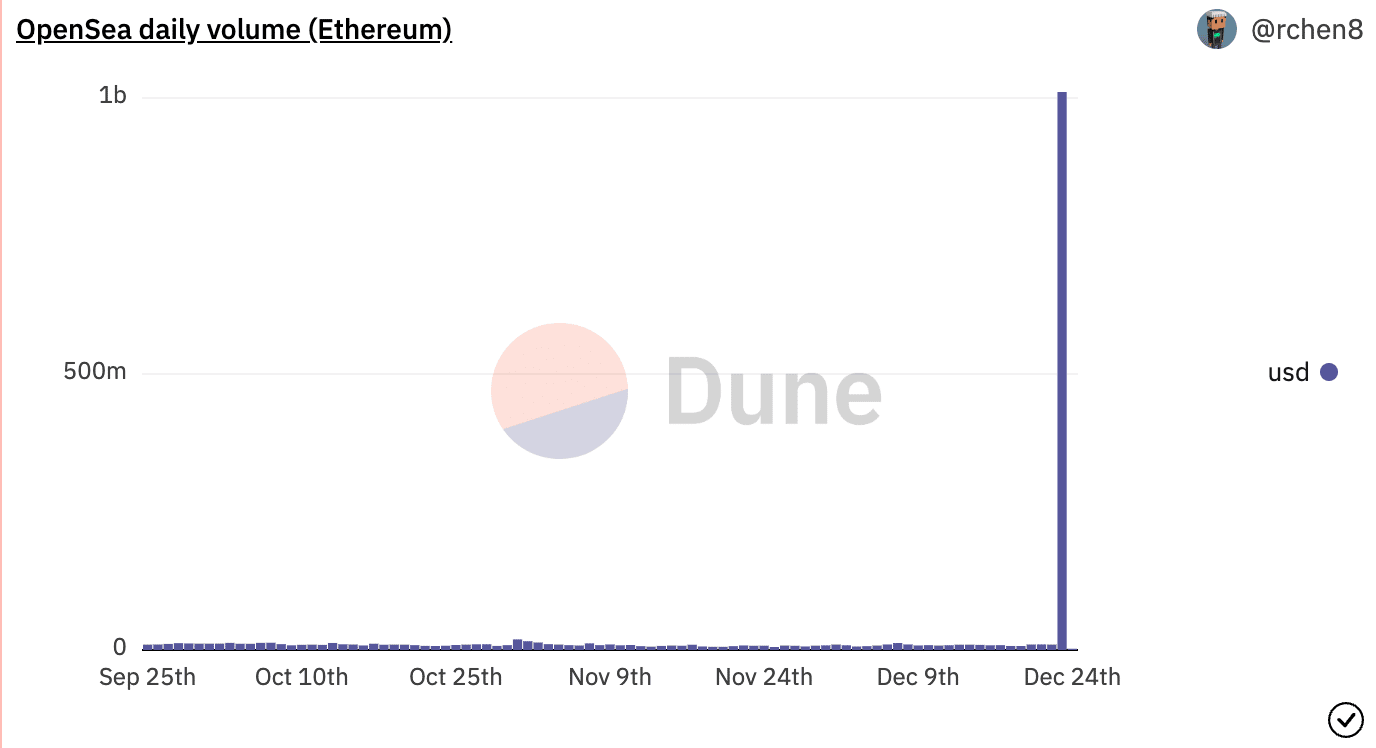

Interestingly, of the $1.2 billion recorded in monthly sales for Ethereum-denominated NFTs on OpenSea so far this month, the $1.01 billion daily sales volume recorded on December 24 accounted for 84% of the total sales.

In fact, for several months, the sales volume of Ethereum-denominated NFTs sold on OpenSea had been less than $20 million.

Source: Dune Analytics

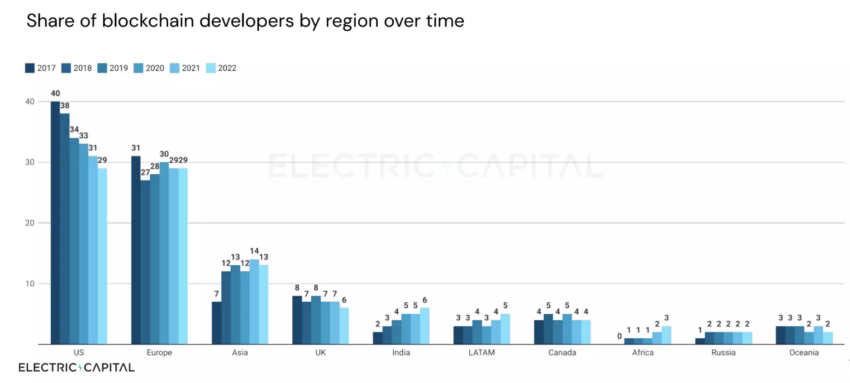

While data from DappRadar revealed a 4% increase in sales volume across OpenSea in the past week, an assessment of monthly sales volume across the leading marketplace showed a decline.

According to data from Dune Analyticssince April, monthly sales volume in the OpenSea market has fallen by 95% and could end the year at the lowest level since June 2021.

Source: Dune Analytics

2022 in a nutshell

As tightening conditions in the broader financial markets led to a slowdown in the overall cryptocurrency market, profile picture (PFP) NFTs saw a significant decline in investor interest.

The drop in interest showed through a significant drop in sales volume, number of NFTs sold, etc. across leading NFT marketplaces.

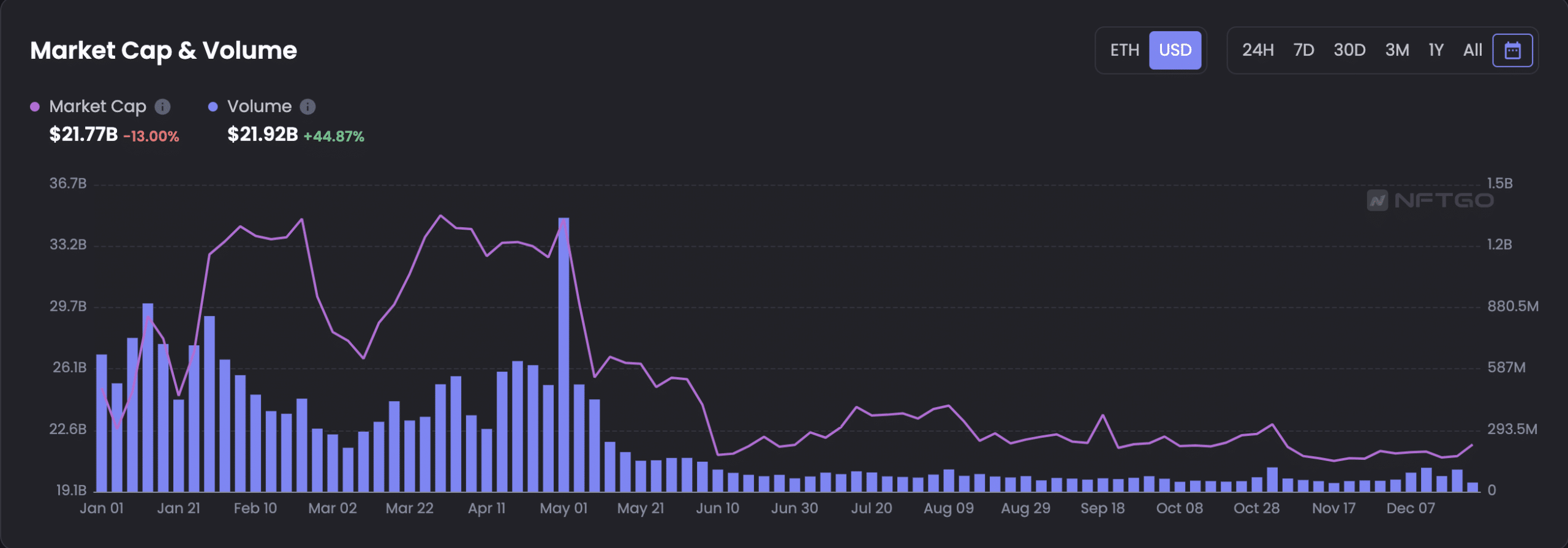

According to data from NFT analysis platform NFTGo, the market capitalization of the NFT ecosystem fell by 13%. As of December 24, this amounted to $21.77 billion.

Interestingly, with a plethora of NFT projects launched during the year, the sales volume increased by 44.87% this year. At the time of writing, NFT’s sales volume across all marketplaces was $21.92 billion.

Source: NFTGo

Furthermore, in a recently published research, Blockwork research found that in the web3 ecosystem it was the NFT/Gaming vertical sectors that attracted the most funding. According to the research platform, both sectors raised $8.3 billion, which represented a 51% growth from the funds raised in 2021.

[4/17]

Funding trends:

🏆 NFT/Gaming vertical attracted the most funding this year.

📈 The vertical raised $8.3 billion in 2022, up 51% year-over-year.

➡️ Half of these investments were in VR/metaverse, blockchain-based games and game studios. pic.twitter.com/QpgBCzzAQf— The Block Research (@TheBlockRes) 21 December 2022

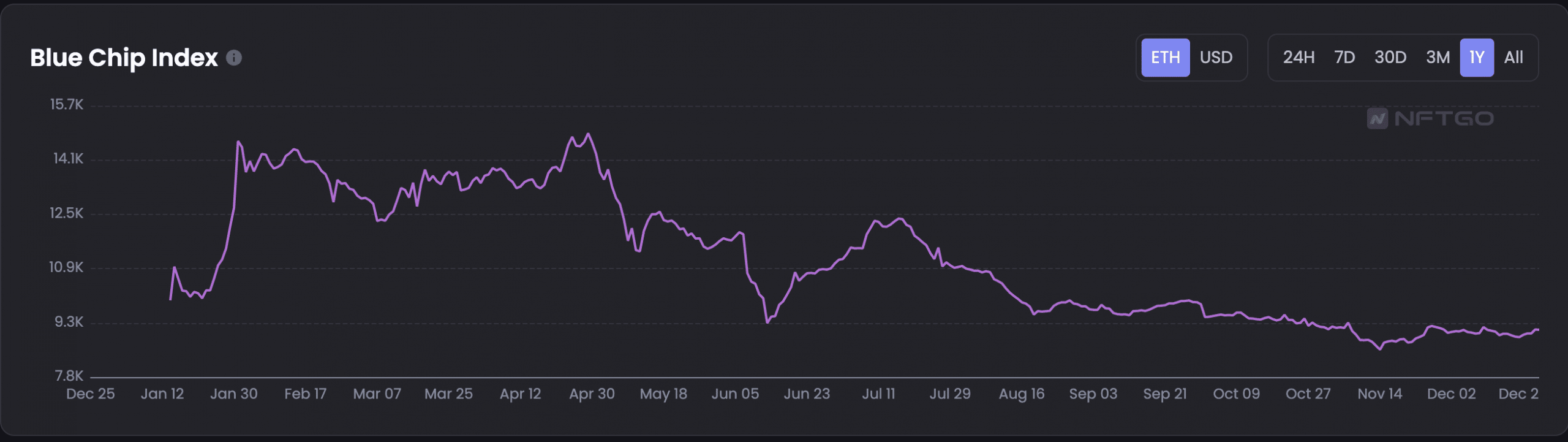

As for Blue Chip NFTs, they saw a decline in value in 2022. The NFT collections that make up the Blue Chip NFT category include but are not limited to Bored Ape Yacht Club, Cool Cats, CryptoPunks, Art Blocks, and CloneX.

According to NFTGo, the Blue Chip Index is calculated by weighting the market capitalization of Blue Chip NFT pools to determine their performance. At 9138 ETH as of December 24th, this has fallen by over 30% in the past 12 months.

Source: NFTGo