El Salvador marks first year of Bitcoin use as confidence wanes

Issued on: Changed:

El Zonte (El Salvador) (AFP) – A year ago, El Salvador began accepting Bitcoin as legal tender following a controversial and much-criticized decision by President Nayib Bukele.

Everything seemed rosy in the first few months as citizens enthusiastically embraced the new opportunity, but Bitcoin’s value has since fallen and some experts say the move has been a failure.

Maria Aguirre, 52, a shopkeeper in the seaside town of El Zonte which has been a major center for Bitcoin use, says things went well last year as Bitcoin’s value rose from $52,660 at the opening on September 7, 2021, to over $68,000 per couple. months later.

“But in the last five months, it just dropped,” said Aguirre, who continues to accept Bitcoin transactions.

Bitcoin has dipped below $20,000 for most of this September.

In El Zonte, about 60 kilometers southwest of the capital San Salvador, Bitcoin was already being used before Bukele’s move, which was designed to encourage a population where only 35 percent of people owned an account in a financial institution in 2021, according to the World Bank.

El Salvador became the first country to accept Bitcoin as legal tender, along with the US dollar which has been the official currency for two decades.

The government even created the Chivo electronic wallet and gave each user the equivalent of $30.

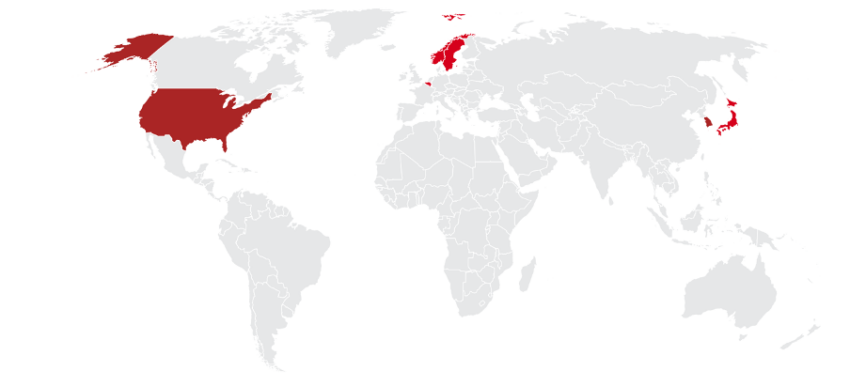

By January, the application had been downloaded four million times, according to Bukele – an impressive amount in a country of 6.6 million, but with a diaspora of three million living mainly in the United States.

#image1

Bukele’s idea was to ensure that remittances, which make up 28 percent of El Salvador’s GDP, are sent by Chivo, meaning less money lost in commissions to exchange agencies.

However, former central bank president Carlos Acevedo says the body’s records show that “less than two percent of money transfers come through digital wallets, which means this has not been an advantage either.”

University student Carmen Majia, 22, said she used Bitcoin at first, “but given the way things are going, now I don’t trust it and I uninstalled the application.”

Volatility

By the time Bukele’s plan was launched, Aguirre had already been using Bitcoin for eight months in the Pacific beach resort popular with surfers.

#image2

After Bitcoin skyrocketed in value between September and November 2021, Bukele announced a plan to build Bitcoin City – a cryptocurrency and blockchain technology tax haven in the Gulf of Fonseca that would be powered by geothermal energy from the Conchagua volcano.

To build it, Bukele was to issue $1 billion in Bitcoin bonds, but those plans were delayed by the volatile cryptocurrency market that saw some less robust currencies crash and Bitcoin take a big hit.

According to the credit rating company Moody’s, Bukele’s plan has cost El Salvador 375 million dollars.

#image3

Taking advantage of the drop in value, Bukele bought 80 Bitcoins at $19,000 each in July, taking El Salvador’s total holdings to 2,381 units of the cryptocurrency, all purchased within the past year.

In June, he told his countrymen to “stop looking at the graph” and insisted that Bitcoin is a safe investment that will bounce back.

“Patience is key,” he said.

Little enthusiasm

But Acevedo insists that using Bitcoin “really hasn’t worked” and that “so far it’s really been a failed effort.”

#image4

But not a total failure “because it could recover and get out of this crypto winter.”

Acevedo says that Bitcoin has not produced Bukele’s stated goal of “financial inclusion” and that its decline in value has “psychologically affected people who don’t look at it with enthusiasm.”

The adoption of Bitcoin has also complicated El Salvador’s efforts to secure a $1.3 billion loan from the International Monetary Fund, which had urged against the move.

Faced with a warning that the country could default on its public debt, which has exceeded 80 percent of GDP, Bukele announced in June a plan to buy back bonds maturing in 2023 and 2025.

He insists the country has the money to do so.

That reduced the country’s risk from 35 percent to 25 percent, but Acevedo says El Salvador won’t be able to return to debt markets until that figure comes down to “at least five percent.”

#image5

In El Zonte, Cheetara Hasbún, a hotel employee, still believes that Bitcoin is a “good payment method” and just “needs more time, which was given to the dollar.”

© 2022 AFP