Does Fintech Select’s (CVE:FTEC) Earnings Warrant Your Attention?

Investors are often driven by the idea of discovering “the next big thing,” even if that means buying “story stocks” with no revenue, let alone profit. But as Peter Lynch said in One up on Wall Street, ‘Long shots almost never pay off.’ Loss-making companies can act as a sponge for capital – so investors should be careful not to throw good money after bad.

Despite being in the age of blue-sky tech stocks, many investors still adopt a more traditional strategy; buy shares in profitable companies that Fintech Select (CVE:FTEC). Now, this does not mean that the company presents the best investment opportunity out there, but profitability is a key component of business success.

See our latest analysis for Fintech Select

How quickly does Fintech Select increase earnings per share?

Strong earnings per share (EPS) is an indicator of a company making solid profits, which investors view positively, and therefore the share price tends to reflect good EPS performance. So a growing EPS generally brings attention to a company in the eyes of potential investors. Impressively, Fintech Select’s EPS went from CA$0.0035 to CA$0.023 in just one year. When you see earnings growing so quickly, it often means good things ahead for the company.

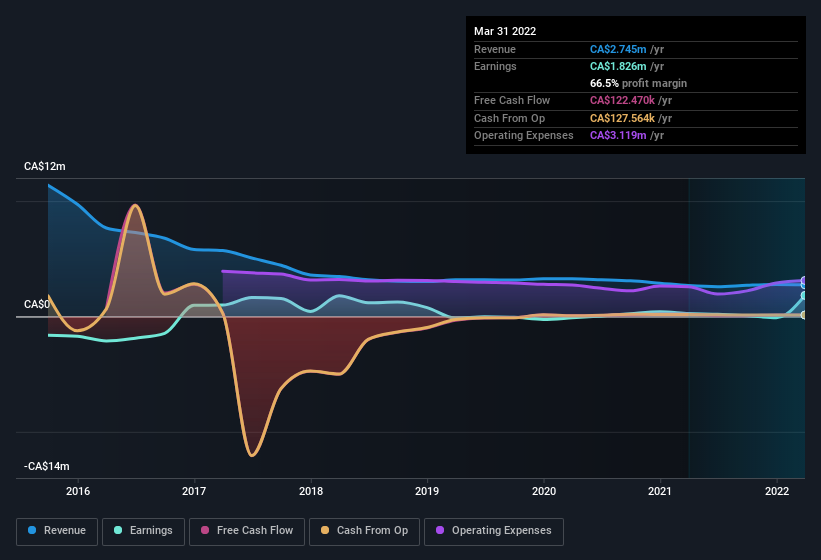

It is often useful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get a fresh perspective on the quality of the company’s growth. On the revenue front, Fintech Select has done well over the past year, growing revenue by 2.7% to CA$2.7 million, but its EBIT margin numbers were less good, seeing a decline over the past 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The diagram below shows how the company’s bottom and top lines have developed over time. For finer details, click on the image.

Fintech Select is not a large company, given its market cap of CA$2.8 million. That makes it extra important to check the balance strength.

Are Fintech Select insiders aligned with all shareholders?

Insider interest in a company always arouses a bit of intrigue, and many investors are on the lookout for companies where insiders put their money where their mouth is. This is because insider buying often indicates that those closest to the company have confidence that the share price will do well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Fintech Select top brass are absolutely in sync, and haven’t sold any shares in the past year. But the biggest deal is that the director, Naveed Ul-Hassan, paid CA$84,000 to buy shares at an average price of CA$0.04. Purchases like this give us an indication of the faith the management has in the future of the business.

Does Fintech Select deserve a spot on your watchlist?

Fintech Select’s earnings have taken off quite impressively. Most growth-seeking investors will find it hard to ignore that kind of explosive EPS growth. And in fact, it may well signal a fundamental shift in business economics. If this is the case, it may be in your best interest to keep an eye on Fintech Select. However, be aware that Fintech Select is displayed 8 warning signs in our investment analysis and 4 of them make us uncomfortable…

There are many other companies that have insiders who buy up shares. So if you like the sound of Fintech Select, you’ll probably love this one free list of growing companies that insiders buy.

Please note that the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while helping us build better investment tools for individual investors like yourself. sign up here