Decode Bitcoin’s Next Move With IMF Officials, Rally To $60,000 Coming?

- Bitcoin’s correlation with Asian stock markets has increased, according to IMF officials.

- Asian markets, India, Vietnam and Thailand have embraced cryptocurrencies and Bitcoin adoption continued to grow.

- Bitcoin price is poised to target the $60,000 level, analysts identify three bullish signals in the BTC chart.

The Bitcoin price and the performance of Asian stock markets are correlated, IMF officials claimed. Several countries in Asia have adopted Bitcoin, Ethereum and cryptocurrencies, despite regulatory concerns. The increasing risk of Bitcoin use making it a sensitive environment for crypto in Asia.

Also read: Bitcoin at $300,000 or $10,000? The JP Morgan chief warns of something worse than recession

Bitcoin’s correlation with Asian stock markets increased

Colin Wua Chinese journalist, it reported International Monetary Fund (IMF) officials observed that the correlation between the performance of Asian stock markets and digital assets such as Bitcoin has increased significantly.

Wu explains it Asian countries such as India, Vietnam and Thailand have adopted and embraced Bitcoin and cryptocurrencies. It is a increase in individual and institutional use of Bitcoin despite regulatory concerns.

Despite the fact that governments and law enforcement agencies in Asian countries are aware of the growing risk posed by Bitcoin and remain sensitive to it, Bitcoin’s correlation with Asian stocks is real, and IMF officials acknowledged as much.

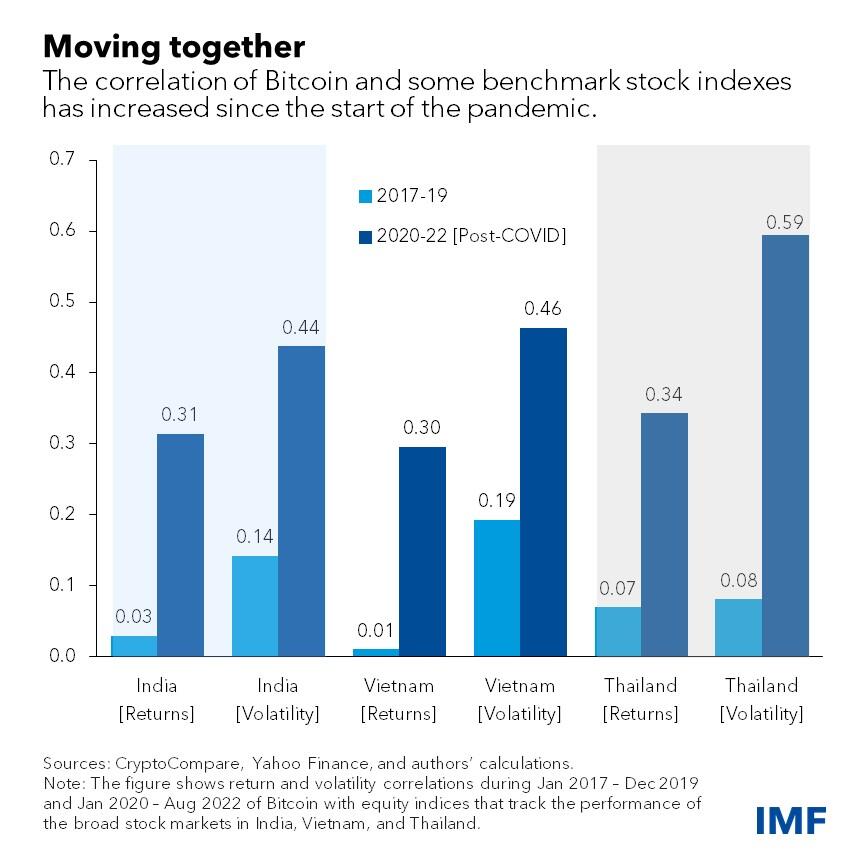

The IMF thinks so Bitcoin’s rapid adoption in Asian countries raises concerns about financial stability. Before the covid-19 pandemic, cryptocurrencies seemed isolated from the financial system, and Bitcoin showed no signs of correlation with Asian stock markets. However, this scenario changed after the pandemic.

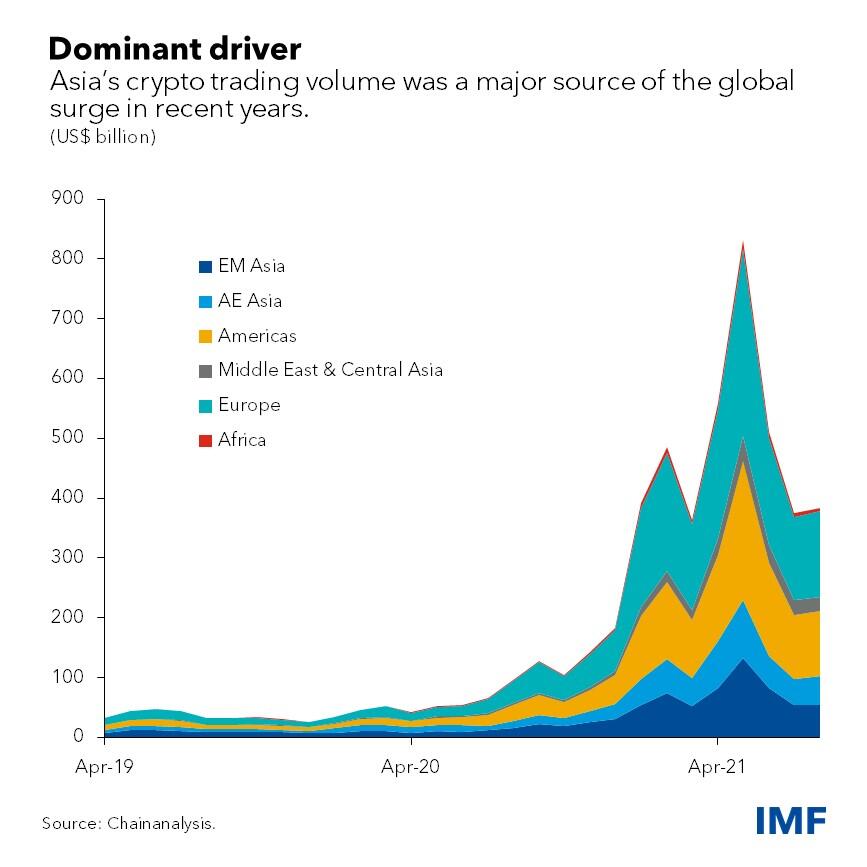

Asia’s crypto trading volume is driving the global market

Asian investors piled into crypto during the pandemic and this has increased the correlation between the performance of the region’s stock markets and Bitcoin. The Return and volatility correlation between Bitcoin and Asian stock markets has increased significantly since 2020.

Correlation between Bitcoin and Asian stock markets

IMF officials identified three key drivers of Bitcoin’s Asian connection: increasing acceptance of crypto-related platforms, stock market and OTC investment vehicles that have higher crypto adoption, and acceptance by private and institutional investors.

As the IMF makes a strong case for Asian equity markets fueling Bitcoin’s next move, analysts present a bullish view on the asset.

Bitcoin price is poised for rally to $60,000

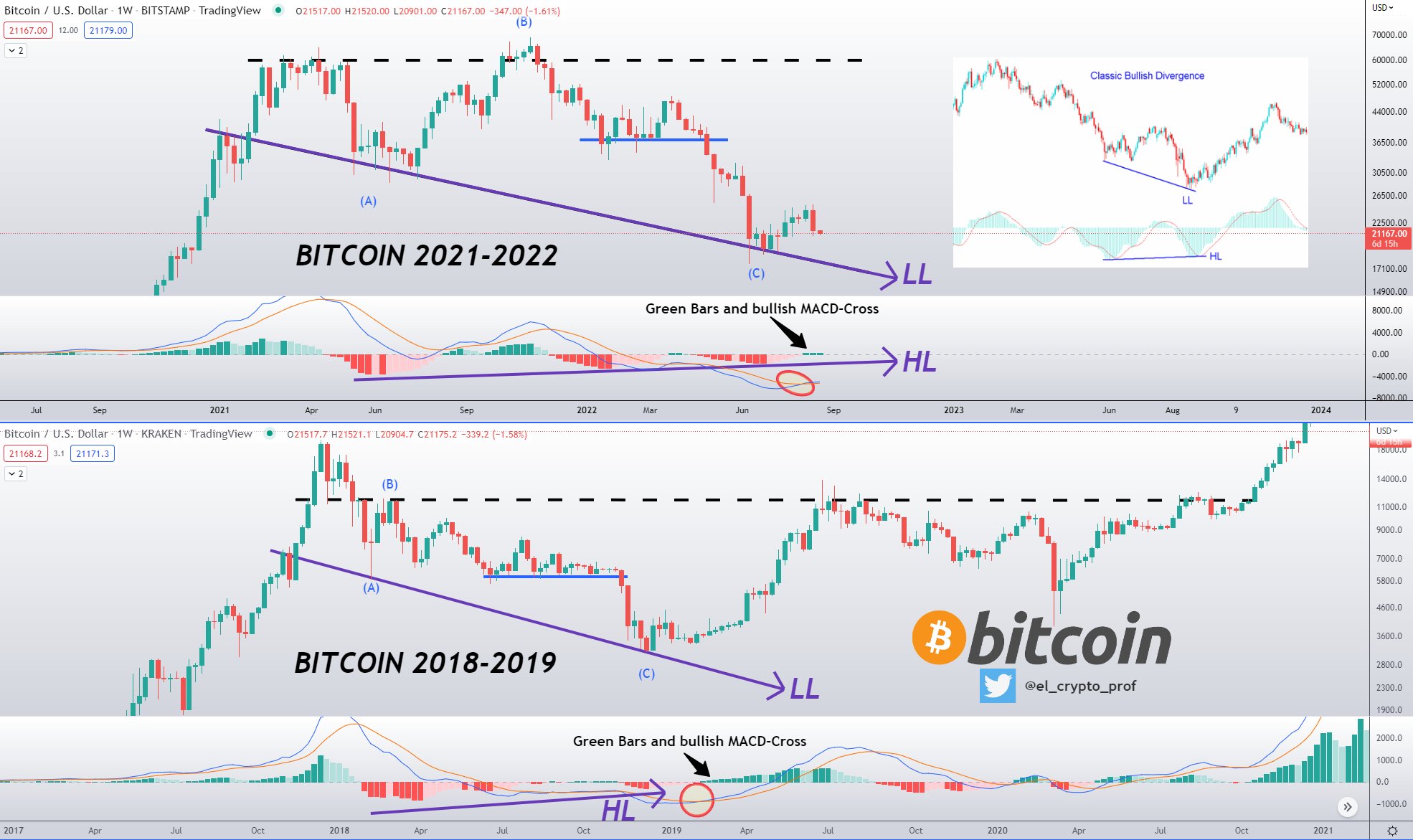

El Crypto Prof, a pseudonymous cryptoanalyst, is bullish on Bitcoin. The analyst has identified three bullish signals in Bitcoin price chart similar to 2018-19. MACD, the trend-following momentum indicator reveals classic divergence.

Bitcoin price chart comparison with 2018-19

The analyst identified a ABC correction in the Bitcoin price chart. An ABC correction is a measured chart pattern of moving down that is nested inside a measured moving up. This matches Bitcoin’s 2018-19 setup. The analyst expects one Bitcoin price rises to $60,000.

FXStreet analysts are on the same page and claim that sellers have taken a step back. Bitcoin bulls have entered and the asset’s price is poised to recover from the decline. For price targets and more information, check out the video below: