Data indicates purchases on Coinbase behind the Bitcoin pump

Data show that the Bitcoin Coinbase premium gap has increased to positive values, suggesting that purchases from investors on the stock exchange may be behind the pump to $ 22k.

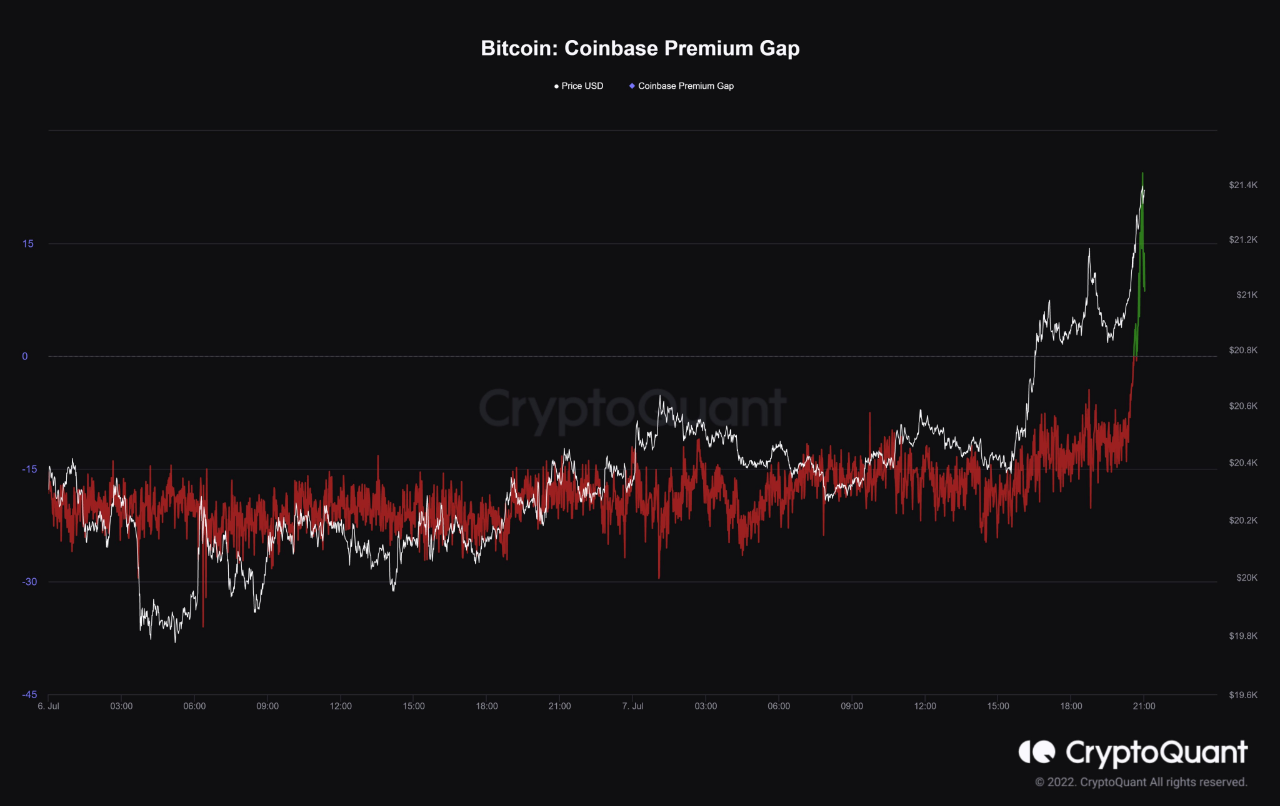

Bitcoin Coinbase Premium Gap observes sharp rise to positive values

As pointed out by an analyst in a CryptoQuant post, after many months of negative values, the Coinbase premium gap is now above zero.

“Coinbase premium gap” is an indicator that measures the difference between the Bitcoin price of Coinbase Pro (USD pair) and the value of Binance (USDT pair).

Since Coinbase is popularly used by US investors (especially institutional investors), while Binance is used more in other parts of the world, the difference in BTC prices between exchanges may indicate where the buying / selling pressure may come from.

When the value of the premium gap is greater than zero, it means that the value of the crypto listed on Coinbase is currently higher than on Binance. This suggests that US investors have recently bought more compared to the rest of the world.

Related reading | Bitcoin miners have dumped, but the price has remained so far

On the other hand, negative values of the metric suggest that US investors may be using more sales pressure / less buying pressure in the market at the moment.

Now, here’s a chart showing the trend in the Bitcoin Coinbase premium gap over the last few days:

The value of the indicator seems to have spiked up over the past day| Source: CryptoQuant

As you can see in the graph above, it appears that the Bitcoin Coinbase premium gap has observed an increase in the last 24 hours.

The indicator previously had a red value for many months, but now it seems that the metric has returned to a positive value.

Related reading | Rumors of Mt. Gox effect on Bitcoin Resurface, victims of receiving 150K BTC?

It is also clear from the chart that the last pump in the price of the crypto seems to have happened at the same time as this peak in the premium gap.

This may indicate that buying pressure from investors in the US may be behind Bitcoin catching some new momentum.

BTC price

At the time of writing, Bitcoin’s price is floating around $ 21.6k, up 12% over the last seven days. Over the past month, the crypto has lost 31% in value.

The chart below shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has surged up during the last couple of days | Source: BTCUSD on TradingView

Earlier in the day, Bitcoin broke past $ 22k for the first time since mid-June. Since then, it seems that the crypto has gone back a bit.

Featured image from Mariia Shalabaieva on Unsplash.com, charts from TradingView.com, CryptoQuant.com