Cryptoanalysts try to explain Bitcoin’s pause near $25K

Join the most important conversation in crypto and web3! Secure your place today

Bitcoin’s (BTC) rally has stalled at a price level that proved a tough nut to crack last year.

The leading cryptocurrency made a strong bid at the start of the year and has gained nearly 50% since then, outperforming major traditional risk assets. However, the bullish momentum has stalled since February 16, with the cryptocurrency failing several times to secure a foothold above the $25,000 mark. The aforementioned level provided stiff resistance in August last year, after which the cryptocurrency retraced lows around $18,000.

According to Laurent Kssis, a crypto trading advisor at CEC Capital, a breakout above $25,000 depends on the performance of tech companies.

“Tech firms performed terribly last year and it’s all down to how well they recover in the first quarter. That’s why BTC isn’t pushing forward,” Kssis told CoinDesk. Technology shares will announce results for the first quarter after March.

Bitcoin tends to move in step with Wall Street’s tech-heavy Nasdaq index. Recently, the 90-day correlation coefficient between the two strengthened to 0.75. The Nasdaq fell 2.4% last week, ending a four-week winning streak that sent positive signals to high-risk assets such as bitcoin.

Kssis added that crypto traders are currently parking money in the world’s largest dollar-pegged stablecoin tether (USDT), and the bitcoin rally will resume once this trend ends.

“The market is patiently waiting for realized profits parked in USDT right now to pile back into bitcoin and ether. This is why we ran out of breath to break $25,000,” Kssis said. “As BTC rallies, USDT dominance tends to thin out.”

Data from charting platform TradingView shows that tether’s dominance, or stablecoin’s share of the total crypto market valuation, has stabilized around 6.5% since the end of January, a sign that traders are rotating money into the stablecoin, as Kssis said. USDT’s dominance fell from nearly 9% to 6.5% in January as bitcoin rallied.

According to Paris-based crypto data provider Kaiko, heightened regulatory risks have dampened market sentiment and “volatility is unlikely to dissipate.”

Last week, the US regulatory agencies specifically called out Paxos for its BUSD product and not the Pax Dollar, hinting at an indirect action against Binance, the world’s largest cryptocurrency exchange by trading volume. BUSD is a Binance-branded dollar-pegged stablecoin issued by Paxos.

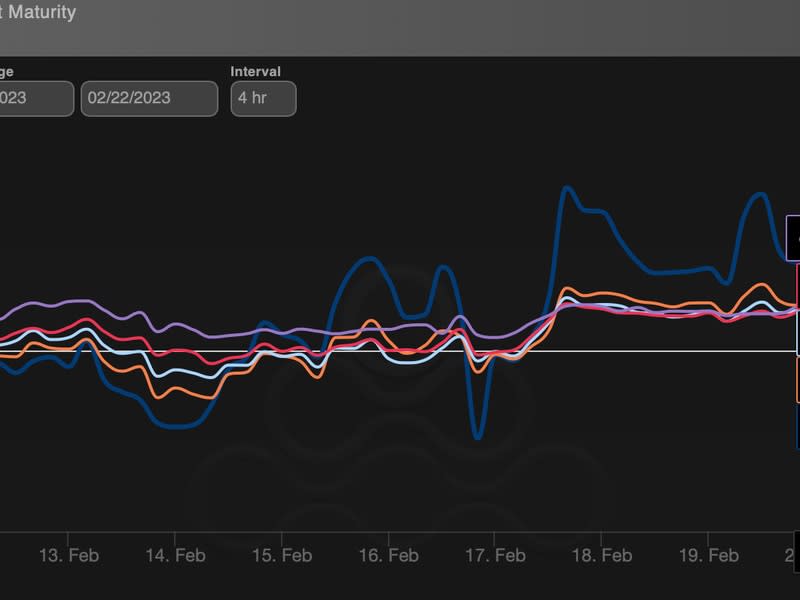

Since then, long-term and short-term call-put biases have retreated to zero, indicating a neutral sentiment in the options market. Call-put biases measure the cost of bullish call options relative to bearish put options and are widely tracked to gauge sentiment among sophisticated institutional players and retail investors.

“The options market had shown a bullish inclination, but now has a neutral view of the market,” analysts at crypto exchange Bitfinex said in a report shared with CoinDesk. “Investors now place roughly equal value on put and call options.”

Also, there is evidence that investors are pulling money out of crypto funds. Per data tracked by CoinShares, digital asset investment products had outflows totaling $32 million last week, the largest since the end of December 2022. Bitcoin funds alone lost nearly $25 million, while short bitcoin funds saw inflows of $3.7 million dollars.

Griffin Blofin, a volatility trader at crypto-asset management firm Blofin, said concerns about sticky inflation have resurfaced since last week, halting the rally in risk assets.

“The expectation of an inflation pick-up has emerged in many markets. Both the US Jan CPI and the latest UK PMI data point to a relatively strong economy, raising the possibility of a resurgence of overheating. The above means that the Federal Reserve and the European Central Bank must maintain a hawkish policy and even return to the pace of every 50 basis point rate hike,” Ardern told CoinDesk.

At press time, Fed Funds futures show a 15% chance that the central bank will raise interest rates by 50 basis points next month, while in Europe an increase of a similar size in March is practically priced in.

Meanwhile, bitcoin changed hands at $24,650. Some market participants expect a potential breakout above the $25,000 technical resistance to bring a strong rally.

“We have tested the 25k resistance multiple times over the past week and failed. After hearing the view from our clients that we can gap higher if we meaningfully break the range,” Paradigm said in a Telegram broadcast late Monday.