Crypto whales and key Bitcoin stakeholders aggressively accumulate BTC around $20,000: Quant Analyst

A closely followed quant analyst says two major Bitcoin stakeholders are accumulating BTC heavily at current levels despite uncertain market conditions.

Ki Young Ju, the head of research firm Crypto Quant, tells his 308,400 Twitter followers that investors with deep pockets are aggressively loading up BTC through top digital asset exchange Binance.

“Whale Accumulates BTC in Binance.

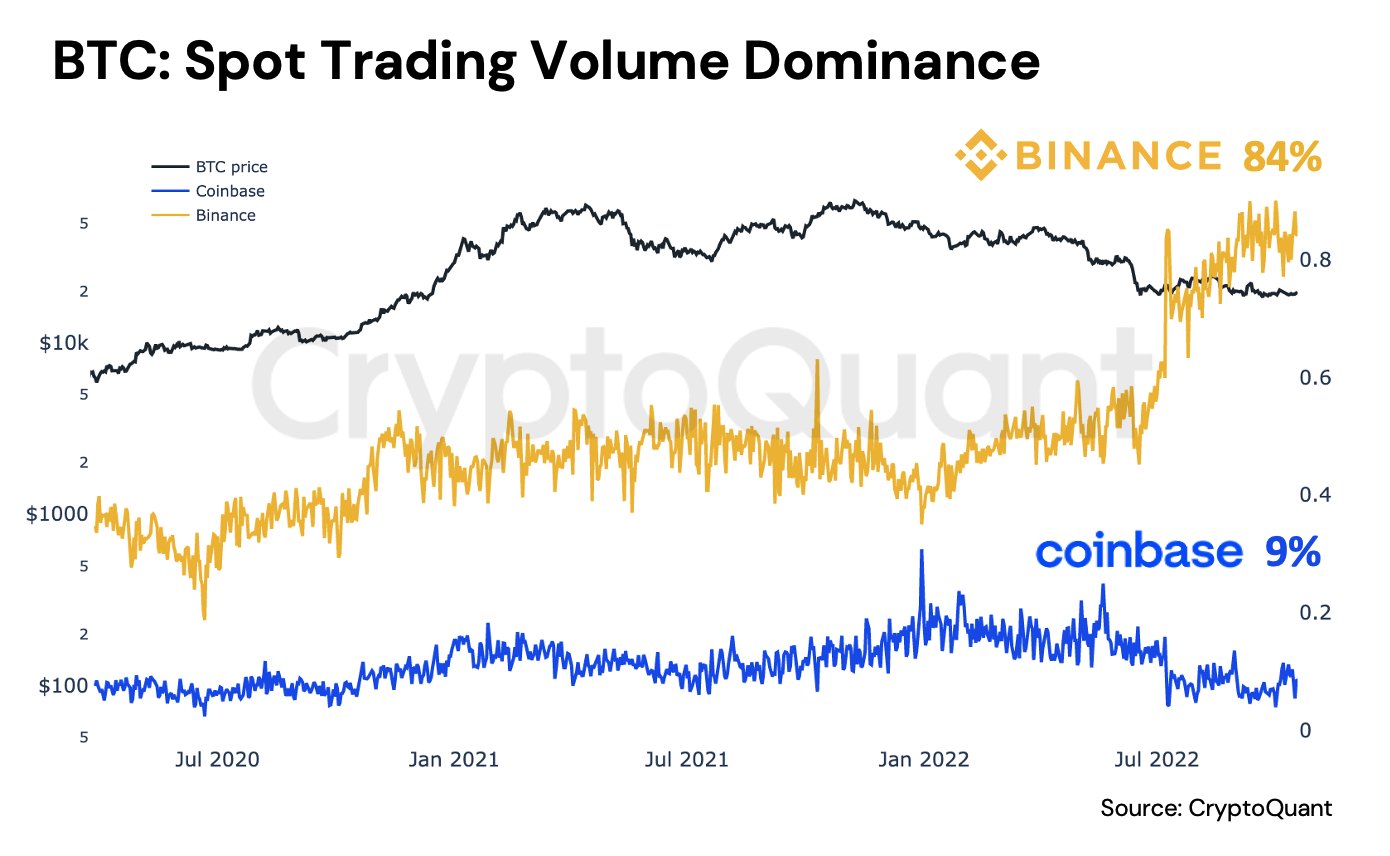

Since the Bitcoin price hit the $20,000 level, Binance’s spot trading volume dominance skyrocketed and it now stands at 84%. The second largest is Coinbase, 9%.

Not sure if these whales are institutions using prime brokers or crypto OGs (original gangsters) yet.”

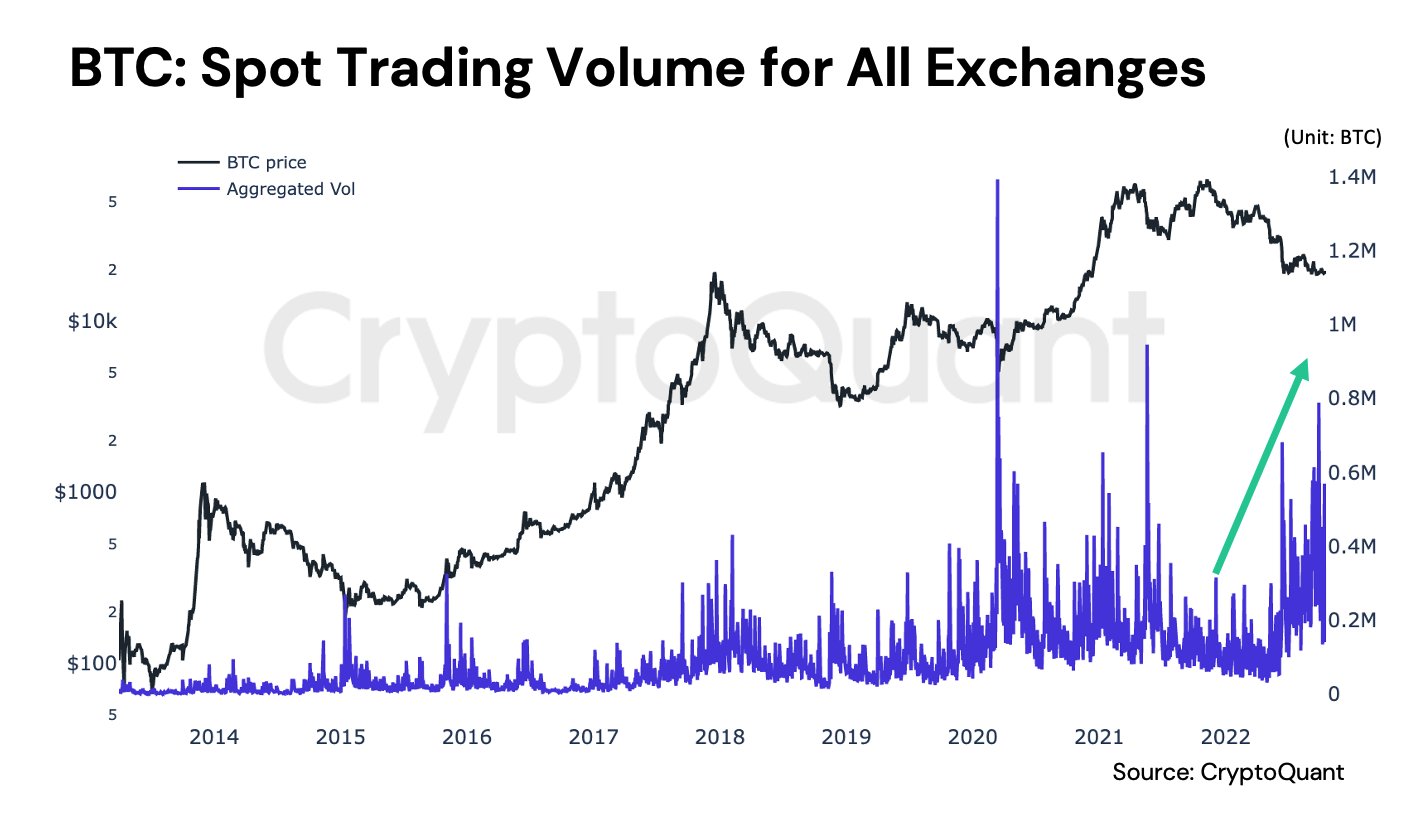

Ki Young Ju also highlights that Bitcoin’s spot trading volume has increased across all exchanges over the past six months, indicating that there is sufficient demand to absorb the intense selling pressure.

“BTC spot trading volume for all exchanges increased 20x in the last six months.

Volume renewed to a yearly high last month, but not much change in the daily close, indicating that someone is buying all the liquidity on the sell side.”

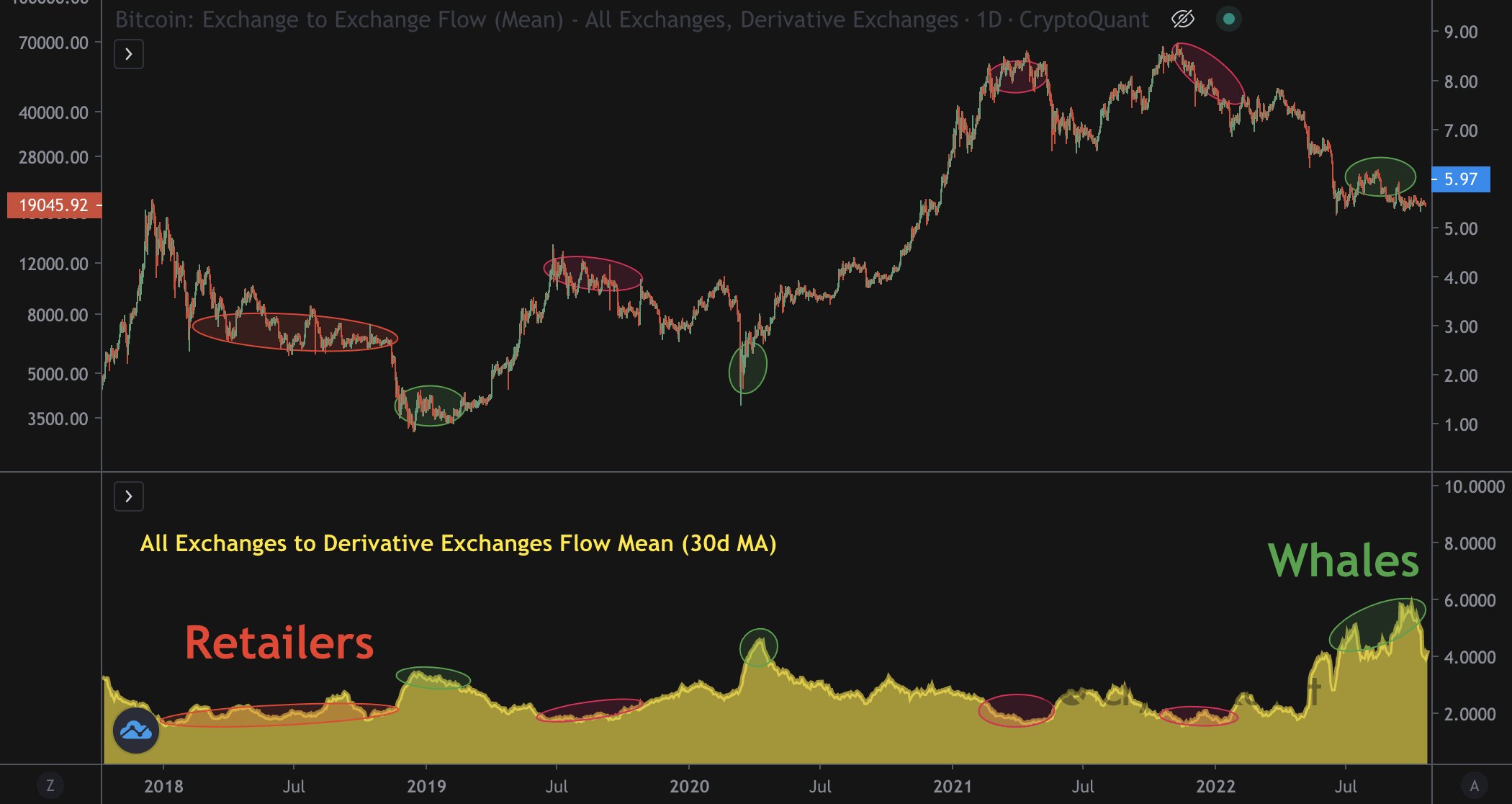

The Crypto Quant boss also notes that whales have taken over the BTC futures markets.

“BTC futures traders are now mostly whales.

The average amount of Bitcoin deposits into derivatives exchanges from other exchanges is relatively large, at a five-year high.”

Based on the quant analyst’s chart, it appears that Bitcoin tends to bottom out when whales dominate the futures markets.

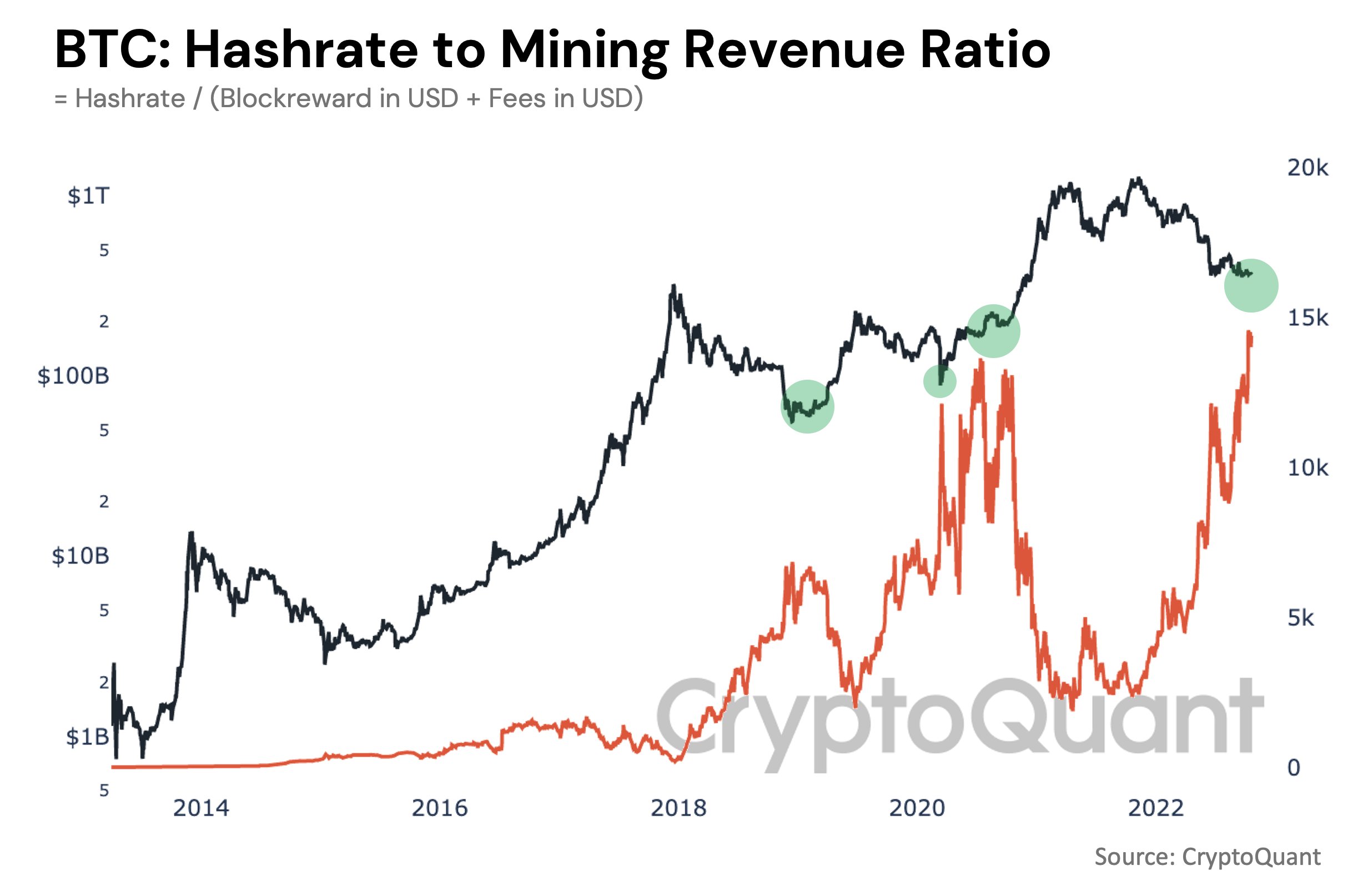

Looking at another key Bitcoin stakeholder, Ki Young Ju says that BTC miners are “extremely bullish now” on the largest crypto by market cap.

“Hashrate to mining revenue ratio reached an all-time high, which means they continue to invest in infrastructure despite very little BTC mining revenue.

Historically, miners were under water in the short term but never failed in the long term.”

At the time of writing, Bitcoin is exchanging hands for $19,209, fixed on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/studiostoks