Crypto prices will “nuke” if 100 bps rate announced at FOMC meeting

Two crypto experts shared their crypto price predictions heading into Wednesday’s FOMC meeting at 2pm ET and Jerome Powell’s speech.

FOMC Crypto Price Predictions

With crypto prices falling over the past 24 hours – Bitcoin and Ethereum are down 3 to 4% – many traders are wondering, waiting on the sidelines and searching for crypto expert analysis online:

Crypto Chase

Crypto Chase (@Crypto_Chaseformerly @Chase_NL) has approximately 100,000 followers across Twitter and YouTube and correctly sold BTC at over $56k and ETH at over $4k.

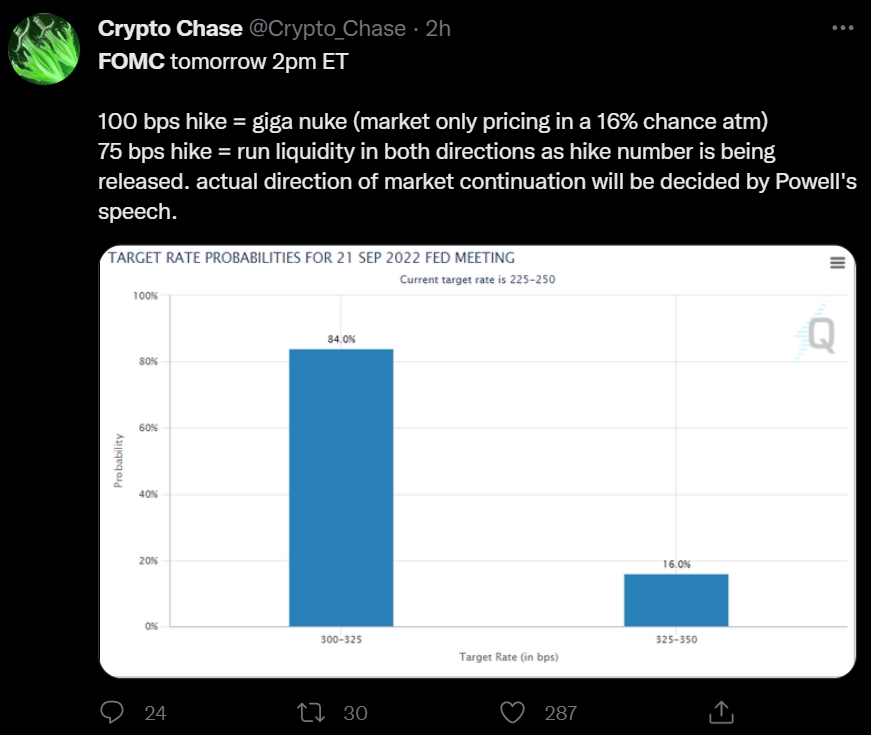

His FOMC prediction is that crypto prices will crash in a “giga nuke” if a 100 bps rate hike is the result – which the market predicts has a 16% chance of happening.

If a 75 basis point increase is announced, he expects liquidity to be driven in both directions – choppy price action and the usual ‘Darth Maul candle’ to stop longs and shorts – before the long-term cryptocurrency movement is determined by Fed Chair Powell’s comments.

Trade tank

Trading Tank (@TheTradingTank) posted a longer forecast for crypto prices to his 7,700 followers over an eight-tweet thread.

His analysis was that since core CPI and PPI data “came in hot” and inflation was higher than expected, equity and crypto markets may have sold off in reaction to the price of a 75bps rate hike.

Like Chase Crypto, he expects further selling if a 100 bps increase is announced, potentially testing the lows (for the Bitcoin price, the $17,600 level in June) or crashing further.

‘100 bps will most likely create a sell-off and we can expect risk assets to test recent lows or perhaps even break through. The actual financial impact of rate hikes doesn’t fully show until 6+ months later, but investors act as if they are immediate.’

However, he also notes that a 75bps rise could improve sentiment and lead to a crypto price rally in the medium term – feeling like a “victory lap” if it’s actually already priced in.

Following the FOMC meeting, US GDP data and PCE inflation data will be released next week which Trading Tank claims are “equally important”.

Earlier this week CryptoNews reported on a third cryptoanalyst’s price prediction, Ted Talks Macro. He also predicted that the markets have priced in a 100 bps rate and risk assets like Bitcoin will rise if 75 bps is announced.

FOMC meeting schedule

The next FOMC meeting after Wednesday is scheduled for 1 – 2 November.

Find the full FOMC meeting calendar at federalreserve.org.