Crypto Moves – Bitcoin, Ether fall; G20 watchdog to propose global crypto rules; Blockchain.com faces a loss of $ 270 million

The balance between Saudi bank deposits and loans will be negative for the first time since at least 2013

CAIRO AND MOSCOW: Growth in Saudi Arabia’s total credit to the private and public sectors fell to 14.1 percent in May year-on-year, down from 14.7 percent in April, the latest data from the Saudi central bank revealed.

With regard to banks’ deposits, annual growth also slowed to 8.9 per cent in May, compared with 9.4 per cent in April. In absolute terms, the difference between deposits and credit was negative for the first time at least since 2013, according to data collected by Arab News.

Figures are not available for before this date.

In May 2022, the balance of total bank credit exceeded the balance of total bank deposits by SR14.5 billion ($ 3.9 billion). This compared to a deficit of SR5.4 billion in April.

In absolute terms, total bank credit increased by SR16.3 billion to SR2.19 trillion in May from SR2.18 trillion in April, while total deposits decreased by SR3.6 billion in the same period.

On an annual basis, growth in deposits, which is an important source of bank loan financing, slowed to a much lower rate of 8.9 per cent in May from 9.4 per cent in April, according to data compiled by Arab News.

The annual growth in credit and deposits has slowed markedly from the peak figures observed in June last year – 16.8 per cent and 10.2 per cent, respectively. Looking at net changes in the same period, however, the balance of total credit grew by SR 240.1 billion, while for total deposits it increased by much less SR 148.3 billion.

As a result, the lending-to-deposit ratio exceeded 100.7 percent in May compared to 99.8 percent in April 2022 and 96.2 percent in June 2021, data collected by Arab News showed.

“The pressure on banks’ liquidity stems from deposit growth, which has remained lower than lending expansion in recent years,” S&P Global Ratings said in a research note issued in late June.

«In the last couple of years, an average of 60 per cent of lending growth has been financed by the increase in customer deposits. In 2021, the remaining lending growth was financed by an increase in foreign debt and a fall in cash and cash equivalents, the memo states.

Following the central bank’s injection of SR 50 billion in bank liquidity reported earlier this year, Saudi banks are facing less short-term liquidity, and the chances of the system having to slow down lending growth have diminished, the S&P note concluded.

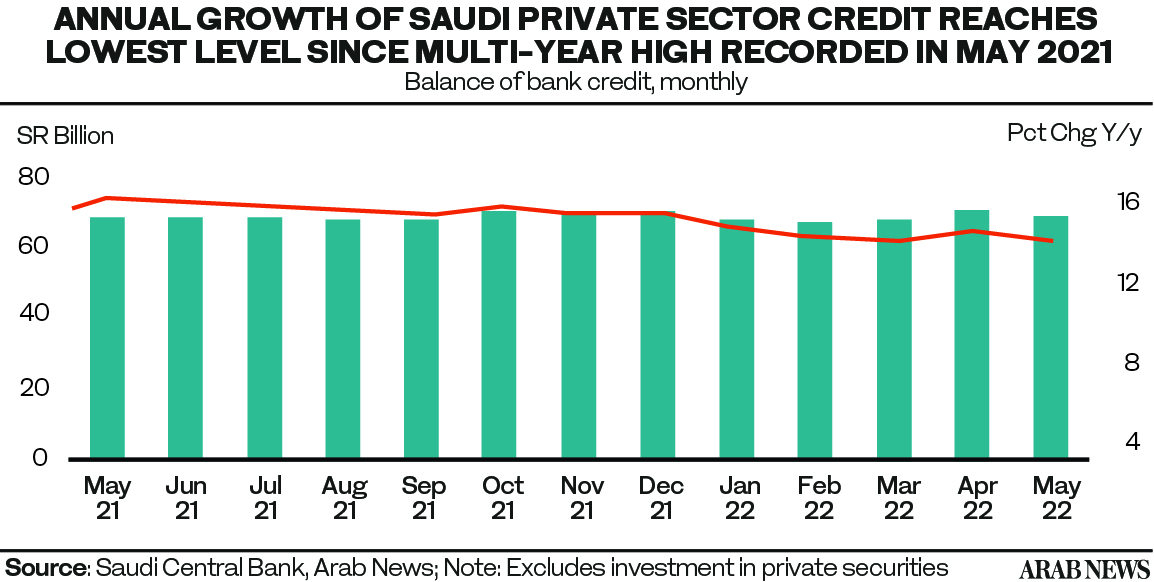

If you look at the distribution of lending by sector, the picture looks relatively similar. Year-on-year growth in credit to the private sector in 2022 reached a low of 14 percent in May since peaking at 16 percent in May 2021, according to a statistical bulletin published by the Saudi central bank.

Saudi banks’ credit to the private sector, which consists mainly of loans, advances and overdrafts, but excludes investments in private securities, increased by SR 18 billion in May, as SAMA stated in their report.

The total balance of such credit at the end of May was SR2.098 trillion, with a year-on-year increase of SR257.1 billion, which corresponds to an annual growth rate of 14 per cent.

Bank credit to the private sector grew by 16 per cent from year to year in May 2021, when the annual interest rate rose to its second highest level since October 2014.

On a monthly basis, the balance increased by 0.87 per cent in May, the lowest rate in the kingdom in the last four months.

In 2022, month-on-month bank credit to the private sector began to increase. The first three months recorded an increase of 0.91 percent, 1.67 percent and 2.22 percent.

Furthermore, the monthly rate of change began to decline in April and May to 0.98 per cent and 0.87 per cent, respectively.