Crypto miners hit hard during the downturn in digital assets

Crypto miners are coming under heavy pressure from this year’s digital asset slump as high energy costs and the flat price of coins push several names close to the financial cliff edge.

Nasdaq-listed Core Scientific warned last week that it could file for bankruptcy protection as its cash resources would be exhausted by the end of the year. On Monday, London-listed Argo Blockchain reiterated the gloomy outlook, saying it may be forced to suspend operations after a critical fundraising fell through.

Those warnings came just weeks after US-based Computer North, which ran data center services for miners, filed for bankruptcy, owing up to $500 million and blaming tough market conditions.

Their dire financial situations show how cryptomining – the process by which coins are generated and transactions verified – is next in line to feel the impact of the crash in the price of popular cryptocurrencies such as bitcoin over the past 12 months.

What is Crypto Mining?

The act of using a large network of computers to work together to solve cryptographic calculations that confirm cryptocurrency transactions. Typically, one party will solve the puzzle, known as a hash, which creates the next block in the chain. The others will confirm that. In return for maintaining the blockchain, miners are rewarded with new tokens for being the first to solve the cryptographic proof. They also collect transaction fees.

Read more in the FT password list.

The downturn has already claimed a number of once-prominent crypto firms such as lending platform Celsius Network and hedge fund Three Arrows Capital.

“The crypto winter has negative consequences for the overall ecosystem, including the miners. It’s a chain reaction as this long cold crypto winter continues,” said Dan Ives, CEO of Wedbush Securities.

Industry analysts and executives have questioned the sustainability of mining, especially after the prices of leading tokens have been capped since June. Bitcoin has rarely risen above $21,000 after hitting a high of nearly $70,000 late last year.

Miners play a crucial role in the operation of so-called “proof of work” tokens such as bitcoin. They verify new blocks on blockchains, effectively taking on the role of guarantor that agreements are reliable in a system that bypasses third parties such as banks and exchanges. In return for mining, they are rewarded with new tokens. Ether, the world’s second largest crypto token, recently moved away from the type of system that requires miners.

Many miners were lured by ever-increasing coin prices. When the price of bitcoin crashed in 2021, companies poured money into buying mining equipment, including fast computers that soak up large amounts of electricity. Hut 8, a mining company, added 9,592 machines for mining in the first quarter of 2022, increasing capacity by almost a third.

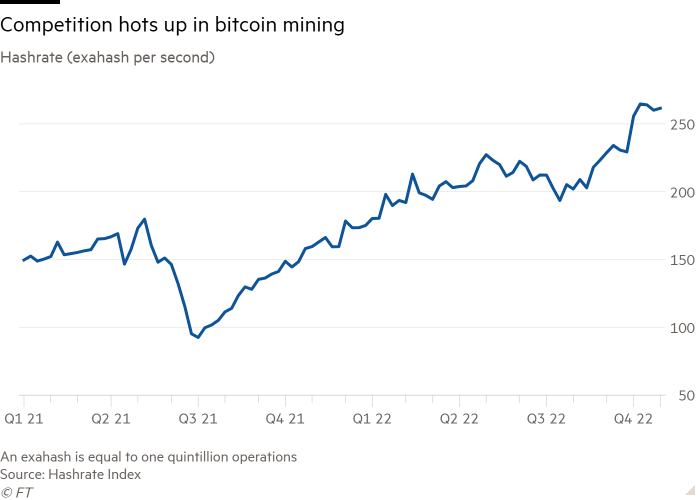

The extra mining capacity has hit the market just as the price has fallen, meaning miners are racing harder to win the token. Bitcoin’s total hashrate, the computing power used for mining, has increased by 57 percent in the past year to a record 260 exahashes — or quintillion — operations per second, according to the Hashrate Index.

The high energy costs have also trapped many and punctured the miners’ ambitions. Miners race against each other to solve complex mathematical puzzles and earn bitcoin. They use large amounts of energy regardless of whether they claim bitcoin before the competition or not. Argo admitted that energy costs for the Texas plant were nearly three times the average price for August.

This has been exacerbated by the threat of blackouts in the US. In July, Argo, Core Scientific and Riot Blockchain scaled back their Texas operations as demand for energy threatened to overwhelm the power grid.

“The bottom line is that competition has increased recently, even though electricity costs are high and the bitcoin price is pretty stable . . . I think they’re still profitable, but the profit spreads are shrinking,” said Chris Brendler, senior analyst at DA Davidson, an investment bank. He remains bullish on some miners, including Stronghold Digital Mining, which has lost more than 95 percent of its value in the past year.

Conditions may not improve in the short term. Since the Ethereum “Merge” in September effectively rendered Ethereum mining obsolete by switching to a different system for transaction verification, companies such as Hive and Hut 8 said they planned to fill their capacity with bitcoin mining.

Also, in less than two years, the rewards for mining bitcoin are expected to halve, in a four-year event that is preset in bitcoin’s code.

“The only way for miners to increase their bitcoin production through the upcoming halving is to increase capacity much faster than the competition,” said Jaran Mellerud, an independent cryptomining analyst.

Click here to go to the Digital Assets dashboard