Crypto market volatile after drop in US Consumer Confidence Index (CCI)

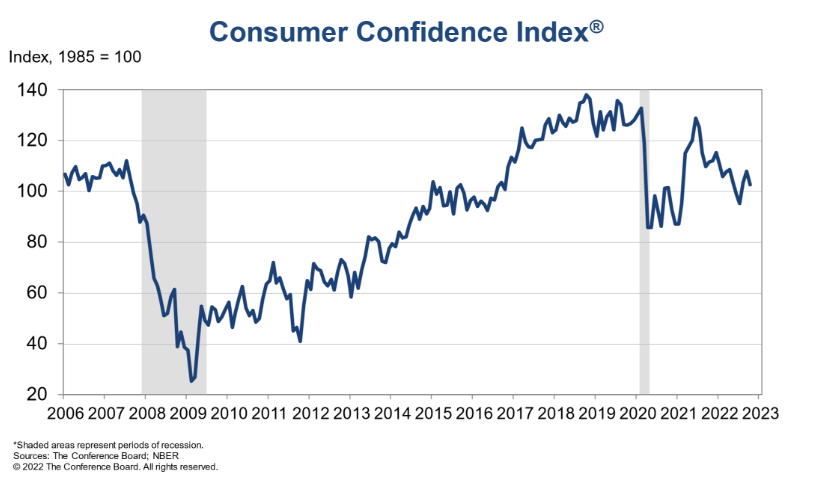

Crypto markets turned bullish after a lower US Consumer Confidence Index (CCI) of 102.5 was announced for October 2022, following two months of straight gains.

The index, which tracks sentiment about how households view their future financial situation, is down from 107.8 in September 2022.

Households are still optimistic despite lower figures

The Conference Board, a 501 (c) (3) nonprofit think tank, publishes CCI on the last Tuesday of each month at 14:00 UTC. Toluna, a market research firm, conducts the CCI survey.

After the CCI numbers fell, Bitcoin rose from $19,427.90 to $19,505.23, price data from Coingecko shows. Ethereum is up around 0.5% to $1,385.08 since the announcement and is up 4% in the last 24 hours. The total crypto market cap is also up 1.3% today, breaking through $980 million.

According to Lynn Franco, senior director of economic indicators at the Conference Board, expectations of inflation and rising food and gas prices drove the CCI down. In October 2022, the surveyed households said they would cut back on vacation plans but plan to buy expensive appliances, houses and cars.

“Looking ahead, inflationary pressures will continue to provide strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers,” Franco said.

CCI numbers can point to crypto recovery

A CCI of 100 or more generally indicates an optimistic economic outlook for households. It indirectly shows that they plan to spend rather than save. With houses, cars and big-ticket items on the list, it’s clear that households are mainly targeting asset purchases in the near future. These plans may indicate that consumers expect the Federal Reserve to ease rate hikes in the coming months. The Fed began raising interest rates when inflation numbers, which have only recently begun to fall, turned red-hot earlier this year.

Hopes of less aggressive tightening by the Fed could also open up consumers to invest in riskier assets like crypto and stocks, accelerating a transition out of the medium-term bear market.

The three major stock indexes have already built on Monday’s gains since reports emerged that Fed members had met to discuss reducing the size of future rate hikes. On October 25, 2022, the Dow Jones Industrial Average was up 0.2%, while the S&P 500 was up 0.8% and the Nasdaq Composite was up 1.4%.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.