Crypto finance falls to 2-year low in Q1 2023

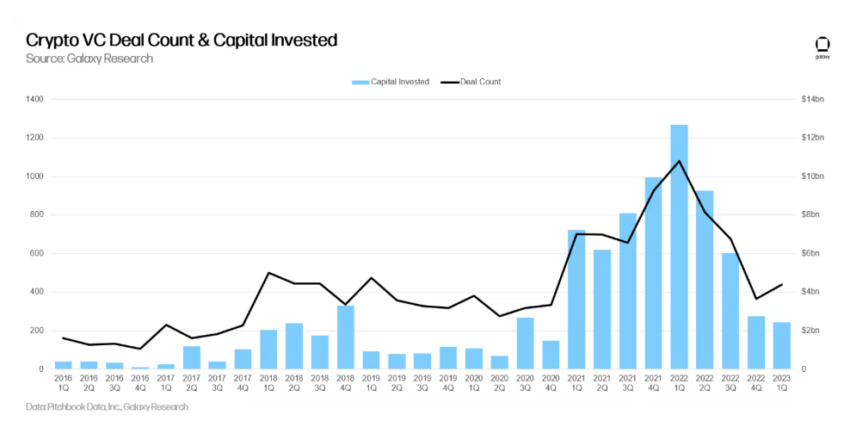

Research from Galaxy Digital suggests that Web3 venture capital investment has fallen to quarterly levels not seen since 2020.

Crypto startups have faced a tougher fundraising environment as the bear market led to an $11 billion drop in venture capital investment.

Crypto mining companies account for the majority of the deals

Despite the low investment, the number of closed financing deals increased to 439 in Q1 2023 compared to 366 in Q4 2022. Companies founded in 2021 and 2022 completed the most deals. Most of the capital went to later financing rounds for the companies founded in 2021.

Mining companies accounted for the largest share of deals aimed at later-stage companies. Companies offering node hosting and staking-as-a-service attracted the most deals among early-stage companies.

In terms of invested capital, the wallet and enterprise blockchain category received the highest allocation to later stages. Companies operating in the broader Web3 space, including NFTs, DAOs and games, saw the least late-stage investment.

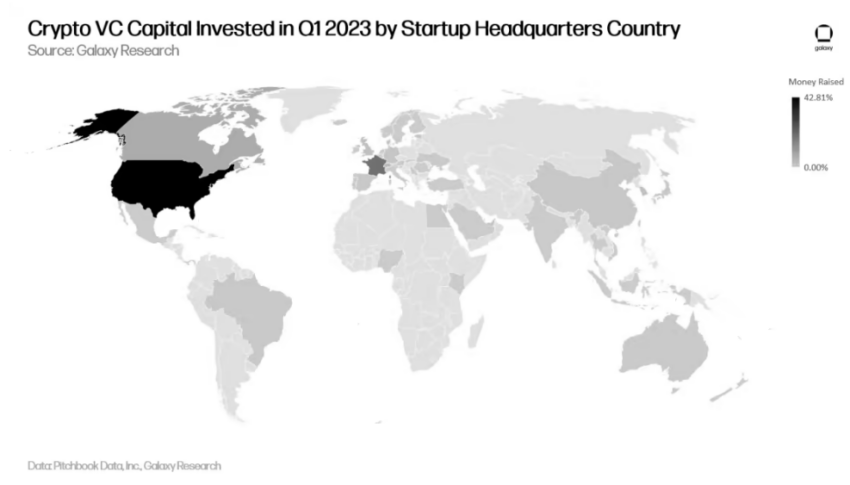

US-headquartered crypto firms secured 42.8% ($1.3 billion) of VC funding in Q1 2023. French firms accounted for roughly $500 million.

A similar picture emerges when looking at the number of closed deals, with 42.3% of fundraising deals completed in the US

While investment at the current rate is set to surpass 2018, Galaxy cautions that founders need to prioritize revenue and business models. They should also be prepared to offer investors more equity and raise funds in smaller rounds.

VC data reflect broader real changes

Galaxy’s report reflects general macro trends among crypto firms and VC investments, at least for now.

BeInCrypto recently reported that the future of the metaverse is teetering on a knife edge.

The income of Decentraland, one of the pioneers in virtual environments, has recently fallen sharply. Active traders involved in the project have also fallen steadily, with only 20 to 30 traders trading virtual lands weekly.

Entertainment giant Disney announced a reduction of metaverse-related employees at the end of March 2023.

Once the poster child for a brave new world of virtual commerce and workplace interactions, Meta recently shelved its metaverse ambitions in favor of artificial intelligence. The firm announced layoffs of thousands of employees starting in early March.

Infrastructure firms that attract the earliest investments make sense considering Ethereum’s imminent upgrade to enable withdrawal of staked ETH.

Developers announced that they would deploy Ethereum’s Shapella fork on the blockchain’s mainnet on April 12. The upgrade would allow entities securing the network to withdraw their staked ETH and accrued rewards.

According to Dune Analytics, institutions account for three of the top five entities with the most ETH stakes, making institutions an attractive investment for VC firms.

While the US dominated capital investment, clearer regulations in regions in Q1 2023 could see investment shift to France and other European areas as the upcoming Markets in Crypto Assets bill nears implementation.

Stablecoin issuer Circle recently opened a branch in Paris, and Chief Strategy Officer Dante Disparte claimed that France is slowly emerging as a global crypto leader.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.