Crypto feels the shockwaves from its own “credit crisis”

The deflating bubble in digital assets has revealed a fragile system of credit and influence in crypto, similar to the credit crunch that engulfed the traditional financial sector in 2008.

Since its inception, crypto enthusiasts have promised a future with large personal fortunes and the basis for a new and better financial system, and rejected critics who questioned the value and usefulness of what spreads “RD & D” – fear, uncertainty and doubt.

But these sentiments are now haunting the crypto industry as one-on-one, often interconnected projects that locked in customers’ money, face millions of dollars in losses and turn to the industry’s heavy hits for rescue packages.

“Fear is contagious. That is true in any financial market. . . No one wants to be the last person without a chair when the music stops, so everyone takes out money, says Brett Harrison, president of the crypto exchange FTX US.

The price of bitcoin, the largest cryptocurrency, has fallen more than 70 percent since its peak in November, and the total value of cryptocurrencies has fallen from over $ 3 billion to less than $ 900 billion.

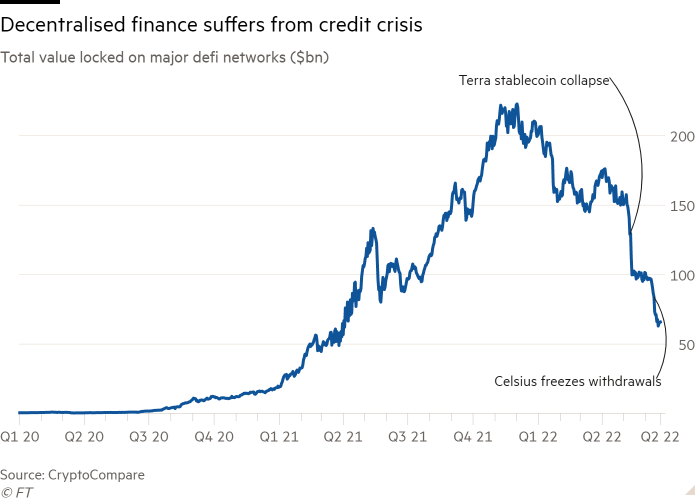

When the market shrinks, the industry squeaks. A token called Luna and sister Terra, a stack coin that tried to use computer algorithms to keep prices stable, collapsed in May; crypto lender Celsius stopped withdrawals earlier this month; and hedge fund Three Arrows Capital met margin requirements.

In recent days, another lender, Voyager, has limited withdrawals while the stock exchange Coinflex has frozen client funds. Trades and investments that seemed safe, liquid and profitable a few weeks ago have become dangerous and impossible to close. Investors are afraid that more dominoes are about to fall.

At the heart of the boom has been the growth of decentralized finance, known as DeFi, a corner of the cryptocurrency world that claims to offer an alternative financial system without central decision-making authorities such as banks or stock exchanges. Instead, users can transfer, lend and borrow assets using contracts defined in data code. Changes are not made by CEOs, but votes from those who own special management symbols, often developer teams and early investors.

The amount of capital circulating in DeFi projects had risen to almost $ 230 billion by the end of 2021, according to CryptoCompare data.

In the last crypto boom, in 2017, buyers simply speculated on token prices. This time, small investors and some funds have also sought high returns from lending and borrowing of cryptocurrencies.

It appealed to both sophisticated crypto traders and to public lending platforms such as Celsius, which took in customer deposits and paid out interest rates as high as 17 percent.

Investors can increase their returns by taking out multiple loans against the same collateral, a process called “recursive lending”. This freedom to recoup capital with little restraint led investors to stack more and more returns in different DeFi projects, earning more interest at once.

“As with the subprime crisis, there is something very appealing about returns, and it looks and is packaged as a risk-free financial product for ordinary people,” said Lennix Lai, director of financial markets at the OKX cryptocurrency exchange.

Economic gymnastics left huge towers of loans and theoretical values on top of the same underlying assets. This continued as cryptocurrencies sailed higher. But then inflation, aggressive interest rate hikes and geopolitical shock waves from the war in Ukraine swept over the financial markets.

“It all worked during the bull run, where the prices of all the assets just went up. When the prices started to go down, many people wanted to take out their assets,” says Marcin Miłosierny, head of market research at the crypto hedge fund ARK36.

As symbolic values fell, lenders called in their loans. The process has led to the removal of more than 60 percent, or $ 124 billion, of the total value locked on the ethereum blockchain since mid-May in a “Great Deleveraging”, according to research firm Glassnode.

The first domino fell in May, when Terra failed, which shattered investor confidence. Then came lender Celsius, who froze customer accounts when they were caught in a serious liquidity mismatch on their books.

Last week, Three Arrows Capital, a large Singapore-based crypto hedge fund, hit the slides after failing to meet margin requirements. Voyager has confirmed that it may be subject to Three Arrows standards. BlockFi and Genesis also liquidated at least some of Three Arrow’s positions, according to people familiar with the matter.

The situation has been exacerbated by the heavy use of loans by crypto traders to increase the upside of their market games. In a falling market, traders face demands for more funds to support their positions.

“It’s a snowball effect. Every time bitcoin goes down in price, more people are obliged to sell bitcoin, which exaggerates the sale,” says Yves Choueifaty, chief investment officer at asset management company Tobam.

But some executives wonder if crypto has already experienced its own “Lehman” moment, with Celsius as the biggest name to fall. They hope the mood shifts to action to stabilize the market.

Without a central bank in crypto, they are fixing their optimism on intervention from the industry’s leading light, especially Sam Bankman-Fried, the 30-year-old billionaire founder of the stock exchange FTX.

Over the past nine days through its companies, Bankman-Fried has provided hundreds of millions of dollars in loans to BlockFi and cryptocurrency lender Voyager to stabilize both companies and increase confidence in the system.

Bankman-Fred’s move to act as a lender in the last resort includes an element of self-interest. His trading company Alameda Research is the largest shareholder in Voyager, with an 11 percent stake after buying shares last month. It will also be the “preferred borrower” for any future Voyager loan.

Over the past week, the price of bitcoin has remained stable at around $ 20,000. But many are wondering if the breath is temporary.

“The risk of infection in the crypto markets remains high,” said Marion Laboure, senior strategist at Deutsche Bank. “A tighter Fed will expose more crypto firms with excess credit risk by withdrawing liquidity and raising interest rates, which will lower the value of the currencies on which many of these schemes depend,” she added.

Bitcoin was invented at the height of the financial crisis in 2008 as an alternative to the financial system, often hailed by fans for being immune to the effects of inflation and politically colored monetary policy.

Many leaders now come to the conclusion that the crypto industry may be exposed to the same booms and busts as other markets.

Global central banks kept interest rates ultra-low for a decade to boost economic growth, pushing this policy even harder in the pandemic. Much of the cheap central bank money had flowed into crypto.

Venture capital firms alone have plowed $ 38 billion into blockchain startups since 2020, according to Dealroom data. Now the tide is moving as the Federal Reserve and other central banks move to tackle intense inflation.

“In an environment of higher prices, the emperor must wear some clothes to survive,” said Taimur Hyat, CEO of $ 1.5 billion asset manager PGIM.

It can force consumers, with little legal protection or transparency about the financial health of the companies behind crypto projects, to withdraw money or show greater caution.

“Everyone who comes into space over the next couple of years… Will have a natural aversion to eternity machines and things that sound too good to be true,” said Sidney Powell, CEO of the Maple DeFi Protocol.

“When people go through a big decline in wealth values and breaches of trust, I think that’s what immunizes people in the next few years, so in that sense it’s like cryptos 2008.”