Crypto Broker Voyager Digital Files for Bankruptcy – TechCrunch

Voyager Digital, a high-profile cryptocurrency broker, has filed for bankruptcy, citing market volatility and the surprising collapse of Three Arrows Capital, just weeks after it suspended withdrawals, trading and deposits on the platform.

The company, headquartered in the United States – and its two affiliates – said in a Chapter 11 bankruptcy filing in the Southern District of New York that it had between $ 1 billion and $ 10 billion in assets and over 100,000 creditors.

Voyager Digital owed $ 75 million to Sam Bankman-Peace’s Alameda Research, which recently gave the broker a $ 485 million lifeline, and about $ 960,000 to Google, it revealed in the archive (PDF). Voyager did not mention other companies they owe money to.

Voyager’s platform was built to empower investors by providing access to cryptocurrencies with simplicity, speed, liquidity and transparency. Arrows Capital’s default on a loan from the company’s subsidiary, Voyager Digital, LLC, that we are taking conscious and decisive action now “, wrote Stephen Ehrlich (pictured above), CEO of Voyager, in a press release.

“The Chapter 11 process provides an efficient and equitable mechanism for maximizing recovery,” he added.

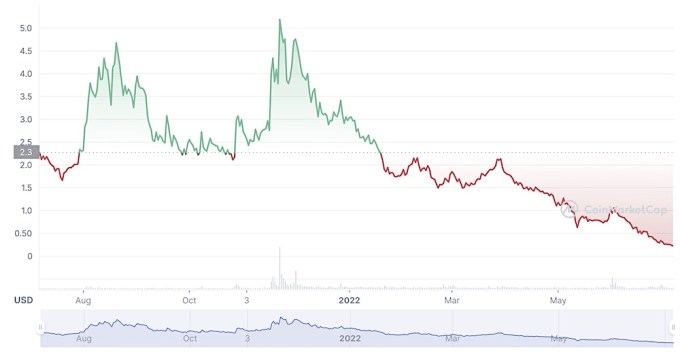

The price of the Voyager token last year. (Data and image: CoinMarketCap)

Voyager said that Three Arrows Capital, a high-profile crypto hedge fund that filed for bankruptcy last week, owed it more than $ 650 million. Three Arrows Capital, founded by Credit Suisse traders Zhu Su and Kyle Davies, managed an estimated $ 10 billion in assets.

Three Arrows Capital owed a number of companies large sums of money. Crypto lender BlockFi, which also had exposure to 3AC, tried to remain solvent after the collapse of the hedge fund and agreed to be acquired by FTX’s US arm for up to $ 240 million last week.

“Voyager is actively pursuing all available remedies for recovery from 3AC, including through law enforcement proceedings in the British Virgin Islands and New York,” Voyager said in the press release.

Voyager’s shares and token value fell on the news of new lows.

“During the reorganization, we will maintain operations. We intend to certain customer programs without interruption. Trade, deposits, withdrawals and loyalty rewards on the Voyager platform remain temporarily suspended, Ehrlich said in a tweet.