Crypto bankruptcies threaten customers’ life savings

Check out what’s clicking on FoxBusiness.com.

Some crypto investors are on the brink of financial ruin after entrusting their nest eggs to two unregulated crypto marketplaces that went bankrupt.

Many put their savings into virtual currency only to see the money freeze while the courts decide the fate of their investments.

Their plight has members of Congress calling for investor education and greater regulation.

Sens. Debbie Stabenow, D-Mich., and John Boozman, R-Ark., introduced a bill Wednesday to give the Commodity Futures Trading Commission new tools and authorities to regulate digital commodities.

CRYPTOCURRENCY LENDERS CELSIUS NETWORK FILES FOR BANKRUPTCY AS PRICE CRASHES

The logo of the cryptocurrency company Celsius on a computer screen on June 14, 2022. (Silas Stein/image alliance via Getty Images / Getty Images)

New laws will come too late for customers of Celsius Network and Voyager Digital.

An investor named Donald said he feels “completely ashamed and embarrassed” for sinking $31,000 into Voyager Digital Holdings.

“Losing this money with no end in sight has been unbearable for my family and me,” Donald said. “I wake up most nights just walking up and down the stairs thinking about my own mistakes and wondering if this will ever end.”

John Dalisay, who is paralyzed from the neck down, sent a letter to a judge saying he is depressed and unable to work after his savings were frozen.

“I have already suffered a tragic loss of my ability to walk again and did my best to be strong and fight to start over with my life,” Dalisay wrote. “I feel humiliated and defeated.”

Dalisay invested money from his $8-an-hour job in the Celsius Network.

“I do not seek luxury, your honor,” he wrote. “I just wanted to be able to afford basic necessities. Please help me get well again since this situation Celsius created is destroying my mental health.”

Voyager customers asked a judge to unlock their accounts. A hearing on the proposal is scheduled for today.

Crypto lender Celsius and crypto broker Voyager Digital filed for Chapter 11 bankruptcy in July, freezing their clients’ assets. Celsius has 1.7 million customers and $6 billion in assets. Voyager counts 3.5 million users and over $5.9 billion in cryptocurrency assets.

CRYPTOCRASHES SHOW NEED FOR TOUGHER RULES: BANK OF ENGLAND

Corporate bankruptcies are typically battles between rival groups of Wall Street investors backed by lawyers who often bill $1,000 or more per hour.

The Celsius and Voyager cases are exceptions. Everyday investors flood the courts with desperate pleas for their money back.

“There’s rarely enough money to cover the investor,” said Melanie Senter Lubin, president of the North American Securities Administrators Association, who testified last week at a Senate Banking Committee hearing on crypto fraud.

“If these investors are considered unsecured creditors, they will be put in the pool with everyone else, and they are usually at the end of the line.”

Safer than a bank?

Celsius and Voyager promoted the safety of their investments.

“Celsius overwhelmingly stated … we’re putting our money in [their] escrow was much safer than keeping it in a regular bank account,” wrote Paul Niehe, who transferred his retirement savings to crypto.

Ryan Hourigan invested a portion of his paycheck in Voyager each month in addition to rolling his savings into his account.

“I used Voyager to replace my savings account when it was advertised as FDIC insured,” Hourigan said. “I am now filled with regret that I did that and fear that I pretty much lost everything for trusting this company.”

“They made astonishing claims, like offering up to 20% interest while claiming they were FDIC insured and citing ‘safer than banks,'” Sen. Elizabeth Warren, D-Mass., said at last week’s hearing. “No risk. Twenty percent return. It was a lie from the start.”

They made astonishing claims, like offering up to 20% interest while claiming they were FDIC insured and quote, “safer than banks.”

This May 4, 2021 photo shows the Federal Reserve Building in Washington. (AP Photo/Patrick Semansky, File/Associated Press)

The Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve have ordered Voyager to cease making false and misleading statements regarding its FDIC deposit insurance status and to take immediate corrective action.

Celsius allowed customers to get loans in real dollars using their crypto holdings as collateral. Customers can also earn interest by lending out the deposited coins, according to the company’s white paper.

Voyager offered a secure way to trade over 100 different cryptoassets using a mobile app and announced rewards in more than 40 cryptocurrencies, the company’s white paper said.

At least one person has turned to crowdfunding for help. Eduardo Dorrance wants to save his family’s animal rescue with a GoFundMe campaign. His family is a month away from losing their business.

Crypto winter

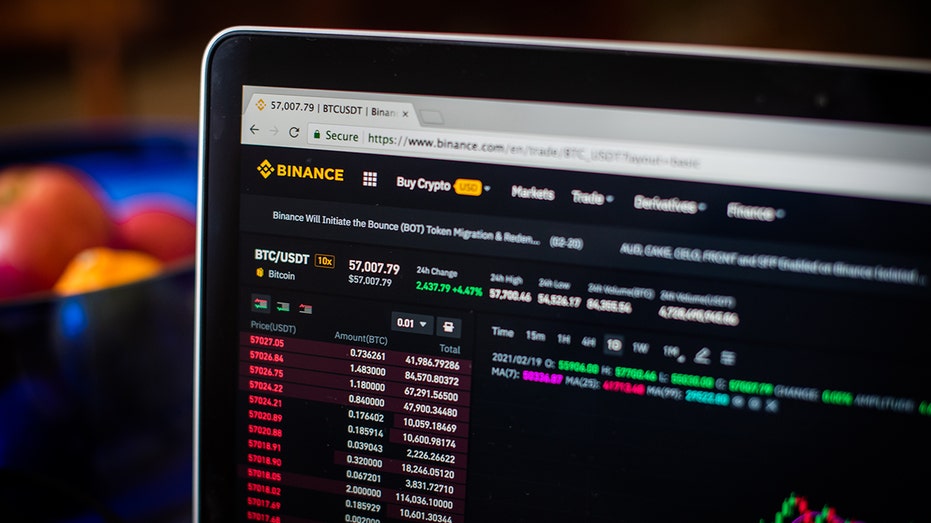

The Binance Exchange website on a laptop held in Dobbs Ferry, NY on February 20, 2021. (Tiffany Hagler-Geard/Bloomberg via Getty Images/Getty Images)

Crypto investors who used other platforms are not immune to losses.

Cryptocurrencies lost an estimated $2 trillion in value since their peak last year in a market collapse nicknamed the “crypto winter.”

Bitcoin, the largest cryptocurrency, peaked at $68,789 per coin on November 10, 2021, before falling to a low of $17,709 on June 18, according to CoinMarketCap data.

CLICK HERE TO GET THE FOX NEWS APP

“It’s very important that people understand how a particular investment works, how they can lose money on the investment, what they’re paying for the investment, and what funds they have,” Gerri Walsh, senior vice president of investor education at the Financial Industry Regulatory Authority, said.

“When this happens outside the regulatory space, it can be difficult to use investors.”

Walsh testified at the Senate hearing.