Could the FOMC Meeting Minutes Boost the Cryptocurrency Market?

Bitcoin, the world’s largest cryptocurrency, has failed to sustain its upward momentum and has fallen below $24,000 in the past 24 hours, falling from its peak of $25,100 due to a significant reversal in the cryptocurrency market. Following Bitcoin’s lead, Ethereum has also seen a gradual decline over the past 24 hours.

As the cryptocurrency market continues to experience volatility, all eyes are on the Federal Open Market Committee (FOMC) meeting minutes scheduled to be released today. The outcome of this event is expected to have a significant impact on the market, especially on Bitcoin and Ethereum prices.

Cryptocurrency Market Analysis: A Basic View

The downward trend in the cryptocurrency market can be mainly attributed to the upcoming release of preliminary GDP data and PCE figures from the US, which is expected to increase market volatility.

In addition, the upcoming release of the Federal Reserve’s February meeting minutes is seen as another factor causing investors to hesitate and contributing to Bitcoin’s losses. The central bank is expected to deliver a hawkish stance in the Fed minutes, keeping cryptocurrency gains in check.

In addition, the previously released higher-than-expected US PMI has given the Fed additional economic leeway to raise interest rates, adding to the cautious sentiment in the crypto market.

Risk-Off Wave in the Crypto Market: Eyes on Key US Data

Despite the emergence of several positive regulations for the cryptocurrency market, the global cryptocurrency market has failed to sustain its upward trend and has turned negative for the day. This is likely due to cautious investor sentiment ahead of the Federal Reserve’s meeting minutes in February, as investors await more clarity on US interest rates and the path of monetary policy.

In addition, the upcoming release of the Personal Consumption Expenditure Index is also expected to increase market volatility.

It is worth noting that the Federal Reserve’s February meeting minutes, which are set to be released later today, are widely expected to reiterate the central bank’s hawkish tone.

That means the rising interest rates will limit liquidity, which is not good for cryptocurrencies. Higher returns usually lead investors to withdraw their money from riskier investments.

This week, all eyes are also on Thursday’s report on the price index for personal consumption, which is expected to reveal that inflation remained strong in January. This could provide further justification for the Fed to continue raising interest rates.

New economic data released on Tuesday showed US PMIs for February were better than expected, giving the Federal Reserve more economic freedom to raise interest rates as it has indicated it wants to do soon.

The New York State Department of Financial Services is enhancing its capacity to monitor virtual currency

The New York State Department of Financial Services (NYDFS) has announced that it has enhanced its ability to detect illegal activity related to virtual currency within the entities it regulates. The agency stated that these upgrades are part of its ongoing efforts to remain competitive in the industry and be proactive in addressing issues related to virtual currencies.

The recent improvements made by the New York State Department of Financial Services (NYDFS) to detect illegal activity involving virtual currency among the organizations it oversees are seen as a positive development for the cryptocurrency market.

NYDFS takes proactive steps to stay competitive and keep up with the evolution of virtual currencies. The Department recently announced additional capabilities to detect potential insider trading, market manipulation, and front-running activity related to Department-regulated entities’ and applicants’ exposure or potential exposure to listed virtual currency wallet addresses.

This move is expected to help in the expansion of cryptocurrencies. The NYDFS made the announcement on February 21, but did not provide details about the “new insider trading and market manipulation risk monitoring tools.”

Let’s examine the technical aspect of the market.

Bitcoin price

Looking at the technical analysis of BTC/USD, the pair has broken a crucial support level at $24,500 and has started to fall towards $23,900. However, the double bottom pattern has transformed this level into a significant support level for Bitcoin.

In the 2-hour time frame, an ascending triangle pattern has formed with an upward trend line providing support near $24,000. If Bitcoin falls below this level, the next support level will be around $23,400. The RSI and MACD indicators are in the sell zone, which adds selling pressure to Bitcoin.

Bitcoin’s immediate resistance is at $24,500, and an increase in buying pressure could lead to a breakout above this level, exposing BTC to the next resistance level at $25,200.

Investors are closely watching the FOMC meeting minutes, which will be released today at 19:00 (GMT). This event is expected to influence future trends in the financial markets, making it essential to stay focused.

Buy BTC now

Ethereum price

The ETH/USD pair has broken below its choppy range of $1,675 to $1,725 and is currently showing a downtrend. Ethereum’s next support level is expected to be around the 38.2% Fibonacci retracement level of $1,630.

If the downward momentum continues and there is a bearish breakout below the 38.2% Fibonacci retracement level, the downtrend could extend towards $1,600 or $1,565 levels.

If the ETH/USD pair can hold above the $1,630 level, it could lead to a potential price reversal towards the $1,675 or $1,740 level.

Buy ETH now

Bitcoin and Ethereum alternatives

Aside from Bitcoin (BTC) and Ethereum (ETH), there are many other altcoins in the cryptocurrency market that are worth watching. To help investors stay informed, the CryptoNews Industry Talk team has conducted an analysis and compiled a list of the top 15 cryptocurrencies to watch in 2023.

This list is regularly updated with new altcoins and ICO projects, so it is recommended to check back often for the latest additions.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

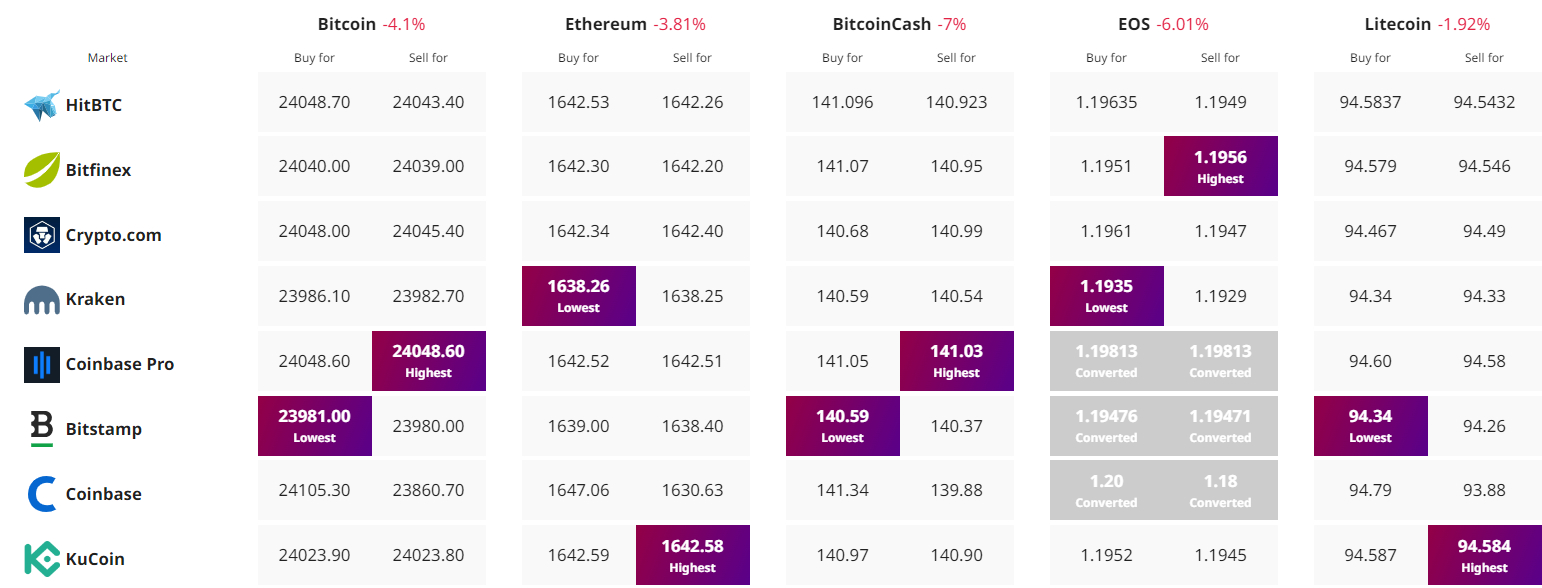

Find the best price to buy/sell cryptocurrency