Consumers to prioritize travel spending supported by fintech services: Amadeus

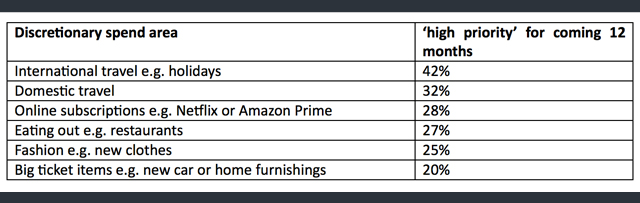

The new Consumer Travel Spend Priorities study, published by Amadeus, indicates a strong desire among respondents to travel despite the economic uncertainty, with “international travel” ranked as the highest priority from a selection of six discretionary spending categories.

The study, which involved 4,500 consumers from France, Germany, Singapore, the UK and the US, aims to understand consumers’ expected spending habits for the coming year.

Forty-two percent of respondents said international travel is a high-priority spending area for the coming year, far ahead of fashion, dining and big-ticket items such as home improvements.

On average, consumers estimate they will spend $2,670 on international travel over the next 12 months, broadly in line with how much they spent in 2019 ($2,780 on average).

Many travelers plan to spread the cost over installments, reducing their exposure to costly foreign exchange (FX) transactions and by dipping into loyalty points collected in the past.

David Doctor, Executive Vice President of Payments, Amadeus, said: “This research clearly shows that consumers are prepared to forgo spending in other areas of their lives to accommodate travel this year. But that is not the end of the story. The industry needs to look ways fintech can make travel costs more transparent, as well as help travelers manage their costs.”

Faced with financial uncertainty, travelers are using fintech to reduce the cost of paying internationally and to flexibly finance their travels.

Three-quarters of respondents (75%) said they are more likely to choose a pay-by-installment option such as Buy Now, Pay Later to finance travel in the coming year. This compares to 44% who are more likely to use a credit card, and 26% who are more likely to turn to “payday loans”, where short-term loans usually carry high interest rates. 47% of travelers said they plan to use previously earned loyalty points to pay for travel.

Travelers are also embracing new fintech options with 48% more likely to try multi-currency prepaid debit cards to avoid foreign exchange fees when paying abroad, and 49% saying they are now interested in co-branded cards that offer loyalty points.

In the current environment, 73% of travelers say they are more likely to consider foreign exchange fees and costs associated with international travel, and 56% are more likely to choose a travel provider that allows them to pay in their own currency, with transparent exchange fees.

The doctor added: “Demand for flexible payment options such as Buy Now, Pay Later when traveling is exceptionally high. The industry is eager to meet this demand, but it should do so responsibly, with thorough risk management in place. Savvy travelers are adapting to limit travel costs. We see in our own data that more travelers are choosing to pay in their local currency across airlines using our FX Box technology.”