Coinbase criticizes Singapore’s crypto regulations

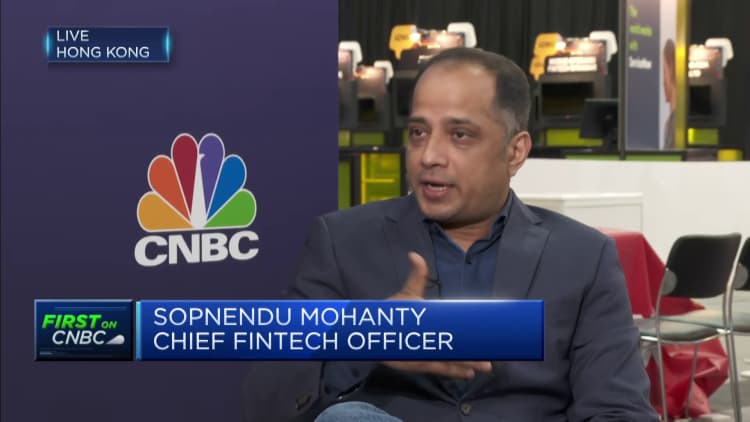

Brian Armstrong, co-founder and CEO of Coinbase chats with Sopnendu Mohanty, head of fintech at the Monetary Authority of Singapore (MAS) during the Singapore Fintech Festival, in Singapore, Friday, April 4. November 2022.

Bloomberg | Bloomberg | Getty Images

SINGAPORE – Co-founder and CEO of the US-based crypto exchange platform Coin baseBrian Armstrong, said that Singapore wants to be a forward-looking regulator, but is not welcoming towards crypto trading.

The city-state has repeatedly warned that cryptocurrencies are highly speculative and volatile after many retail investors lost large chunks of their savings. It has also banned crypto advertising in public areas and on social media.

“Singapore wants to be a Web3 hub and then at the same time say, ‘Oh, we’re not really going to allow retail or self-hosted wallets to be available,'” Armstrong said at the Singapore FinTech Festival 2022. He spoke with Sopnendu Mohanty, Chief Fintech Officer at the Monetary Authority of Singapore.

“These two things are incompatible in my mind and I would like to see Singapore embrace retail and self-hosted wallets,” Armstrong added.

It comes after Coinbase received an in-principle approval from the MAS to offer digital payment token services in the city-state.

So far, Singapore has awarded only 17 in-principle approvals and licenses following a rigorous selection process from 180 applications. Binance reportedly withdrew its application to operate in the city-state earlier this year after being in regulatory limbo for several months.

In response, the Monetary Authority of Singapore’s Mohanty said retail investors today were “exposed to risks they don’t understand they are taking.”

“We believe that Web 3.0 is the future, and what we want to do is make sure that the money that can trade on this ecosystem is considered a safe asset, safe currency. As long as that’s the direction, we’re OK,” Mohanty added.

Mohanty went on to challenge Armstrong to name regulations he believed should be reviewed.

“For centralized exchanges and managers [like Coinbase], I think they should be treated just like other financial services businesses. There should be protection against money laundering. There should be audits that they need to complete, no commingling of funds, appropriate disclosures to clients,” Armstrong said.

“Crypto should not be treated at a disadvantage; they should be treated equally with other financial services rules.”

In response, Mohanty gave an analogy of a customer using a banking app.

“We, as a regulator, do not worry about internet protocols. We only care about the customers who went to the bank. The bank is responsible for ensuring that they protect their customers,” he added.

CNBC has reached out to MAS and Coinbase for further comment.