CME Bitcoin Options Expires Today, Will BTC Prices Be Affected?

Bitcoin options contracts on the Chicago Mercantile Exchange (CME) are set to expire. Meanwhile, BTC is facing major resistance at current levels, will it pull back?

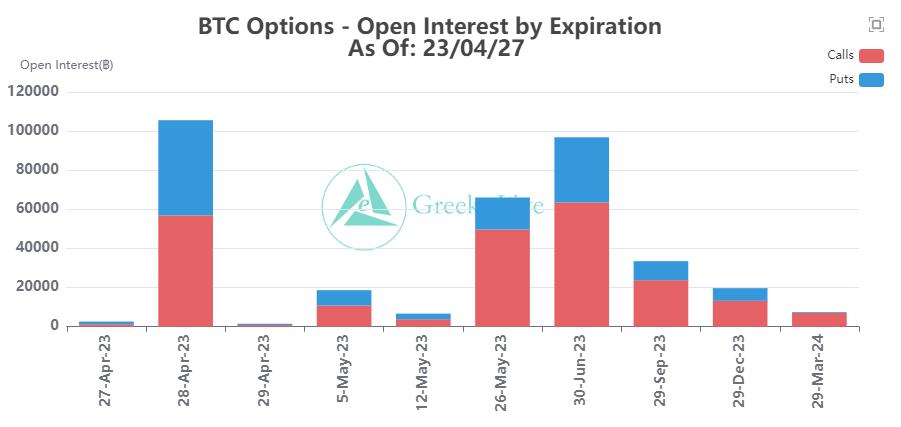

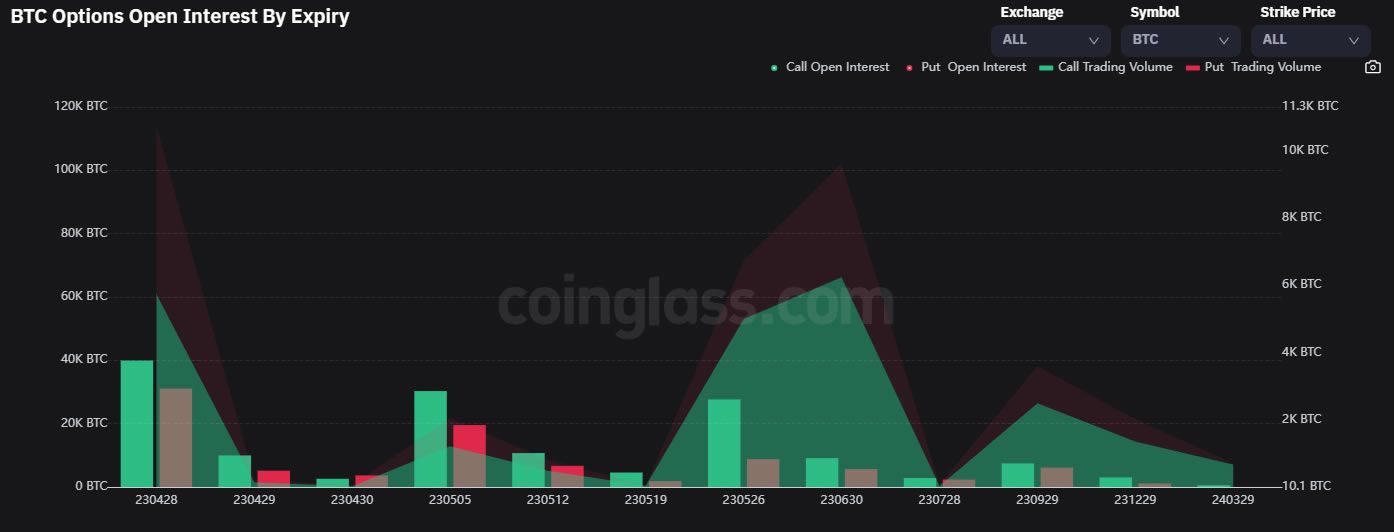

Bitcoin options expiration is approaching again, with 105,000 BTC contracts outstanding on April 28. Additionally, there is a maximum pain point of $27,000 and a face value of $3.1 billion.

Bitcoin options mixed

The current put/call ratio is 0.85, suggesting a neutral to bearish sentiment.

The maximum pain price is the strike price of most open Bitcoin options contracts. It also happens to be the price at which most of the losses would be incurred for the highest number of contract holders at expiration.

Open interest (OI) is 105,000, which refers to the number of outstanding Bitcoin option contracts that have not yet been settled. The next batch of contract expirations with similar OI will be May 26, according to Deribit.

Furthermore, the put/call ratio is calculated by dividing the number of traded put contracts (short) by the number of call contracts (long).

A value of 1 means that trade is evenly balanced between sellers and buyers. However, a value lower than 1 is generally bearish as more speculators short the asset than go long.

In addition, around 807,000 Ethereum options contracts are set to expire on April 28. There is a maximum pain point of $1,850 and a face value of $1.54 billion.

The put/call ratio for ETH options is similar to that of BTC contracts at 0.8.

Options allow speculators to buy or sell assets at a specific price with the “option” to sell the contracts at any time. They are more flexible than futures contracts which have fixed expiry dates.

Bitcoin is currently trading at $29,506, after a 1.4% increase in the last 24 hours. However, it faces major resistance in the $30,000 zone, so it may struggle to overcome this. Also, the expiration of Bitcoin options is unlikely to affect BTC prices over the weekend.

CME Group to extend option expiration

Earlier this month, CME announced plans to expand its suite of crypto options.

The exchange’s standard and micro-sized Bitcoin and Ethereum contracts will have daily expiration options starting May 22.

The new contracts will “provide market participants with greater precision and versatility in managing short-term Bitcoin and Ether price risk,” said Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.