Can Bitcoin (BTC) Price Break Higher Levels?

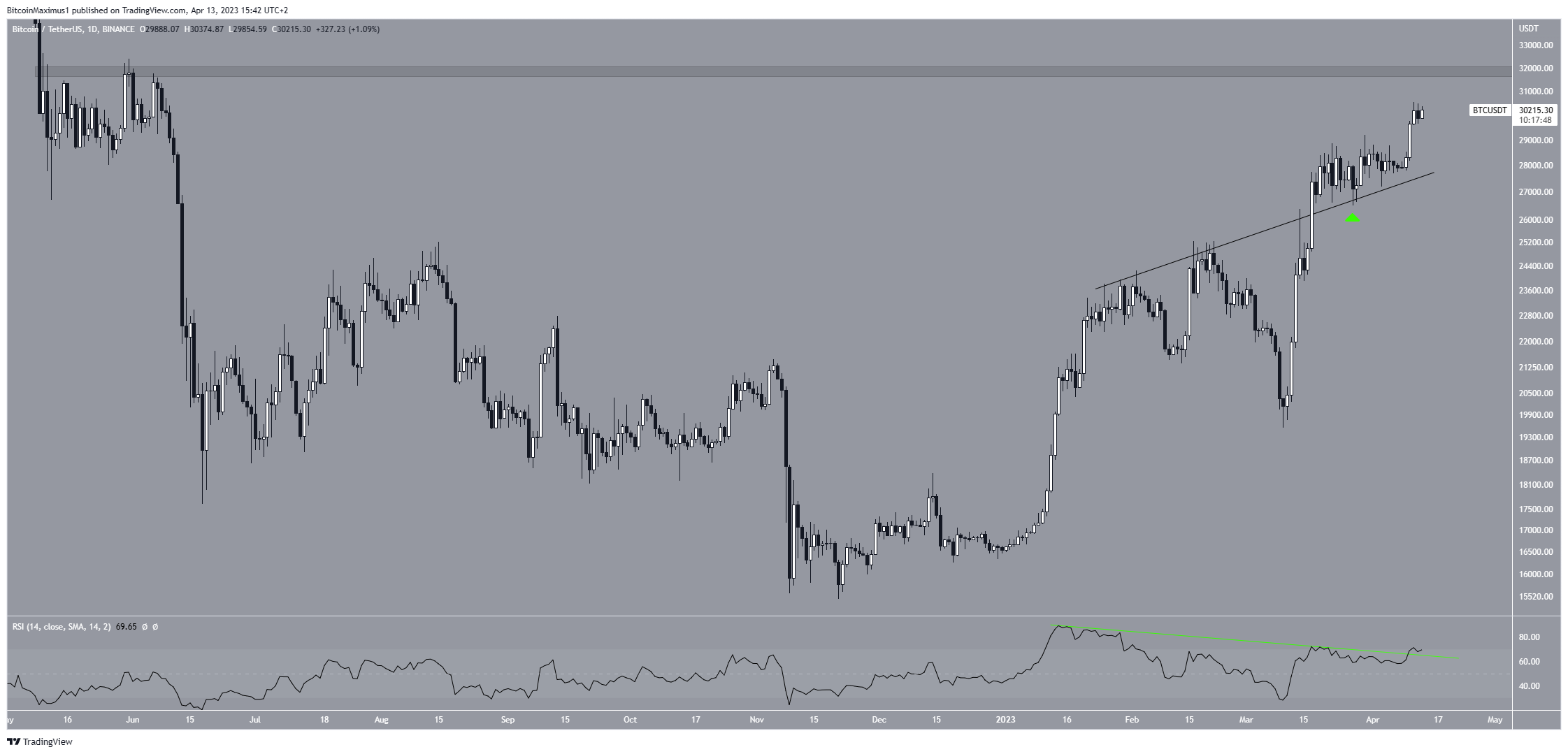

Bitcoin (BTC) price is moving towards a long-term resistance area after finally breaking above $30,000.

The outlook for Bitcoin in the coming week is optimistic for several reasons. One of the main factors is that BTC price has broken out of a downward trend line that had been in place since reaching its all-time high, and this breakout was confirmed by a long lower wick and a bullish engulfing candlestick the following week. . In addition, the weekly RSI has risen above 50 for the first time since June 2021.

As a result, it seems likely that the price of Bitcoin will continue to rise towards its long-term resistance level of $31,700 soon. However, if it fails to break through this level, there is a possibility that the digital currency could fall back to $24,600.

How long will the Bitcoin (BTC) price breakout last?

The analysis of Bitcoin’s daily time frame also provides a positive Bitcoin price forecast, with several indicators supporting this conclusion. One of the most important indicators is the daily RSI movement, which is currently breaking out from a bearish divergence trendline (green), indicating that there is no bearish reversal in sight and the BTC trend is bullish.

Furthermore, the price has broken through a rising resistance line and confirmed it as support (green icon).

If the price increase continues, the closest area of resistance in the daily time frame is at an average price of $31,800. Although this is the most likely future price scenario, a close below the rising support line will invalidate this and could lead to a decline towards $25,000.

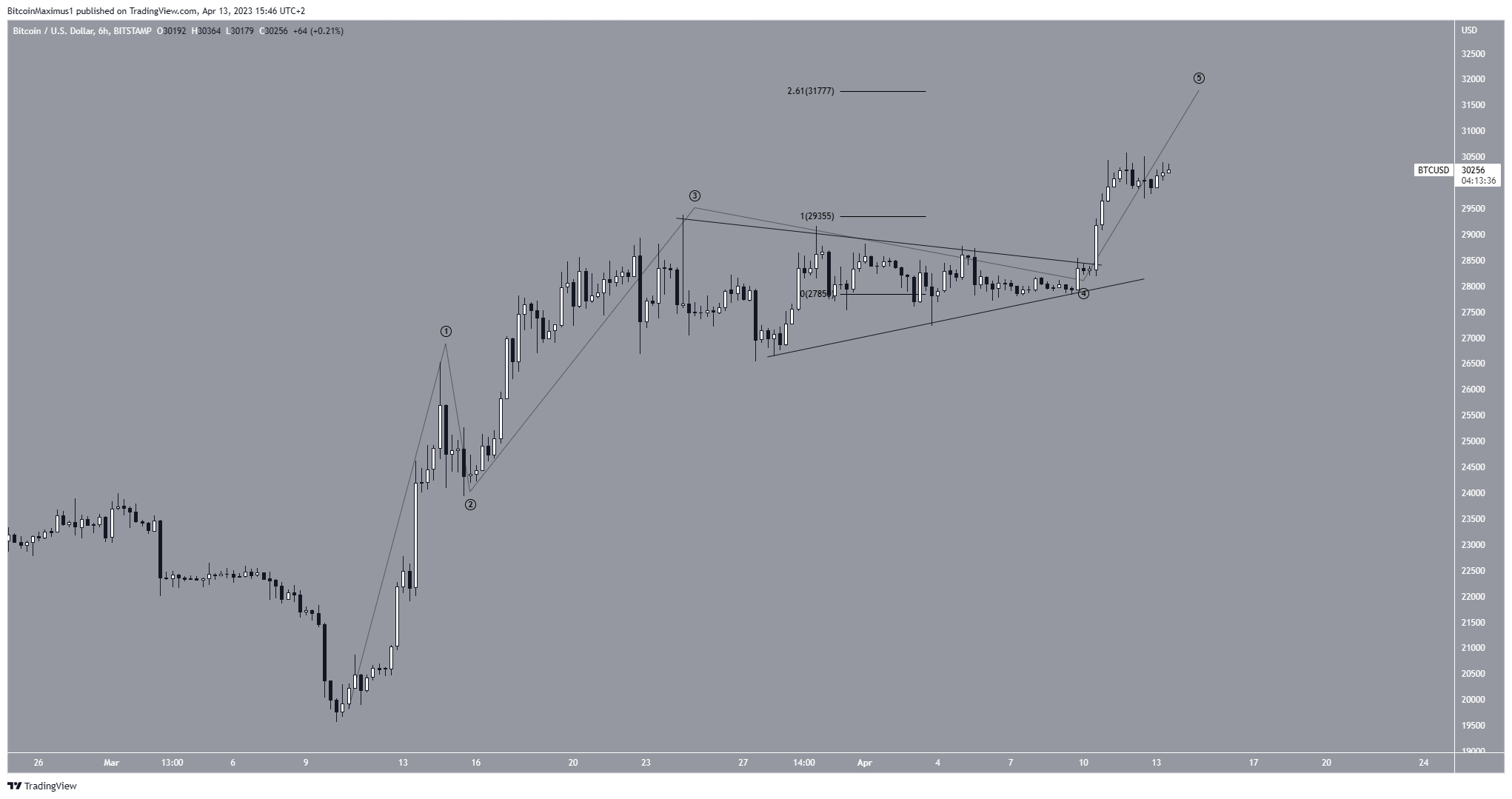

Finally, the short-term wave number also agrees with the upward movement. The BTC price is in the fifth and final wave of an increase that began on March 10. At the same time, it is unclear how this fits with the long-term count. However, the current increase is still ongoing.

The next most likely area for price to top out would be at $31,777, found by the 2.61 external retracement of wave four. Since this is very close to the $31,700 resistance area, it has a high chance of acting as the top.

To conclude, the most likely Bitcoin price forecast is a rise towards $31,800. This would be invalidated by a close below the previous rising support line, which could trigger a drop towards $24,000-$25,000.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.