Bulls Struggle to Hold Bitcoin Above $22,300 as Industry Experts Predict ‘Crab Walk’

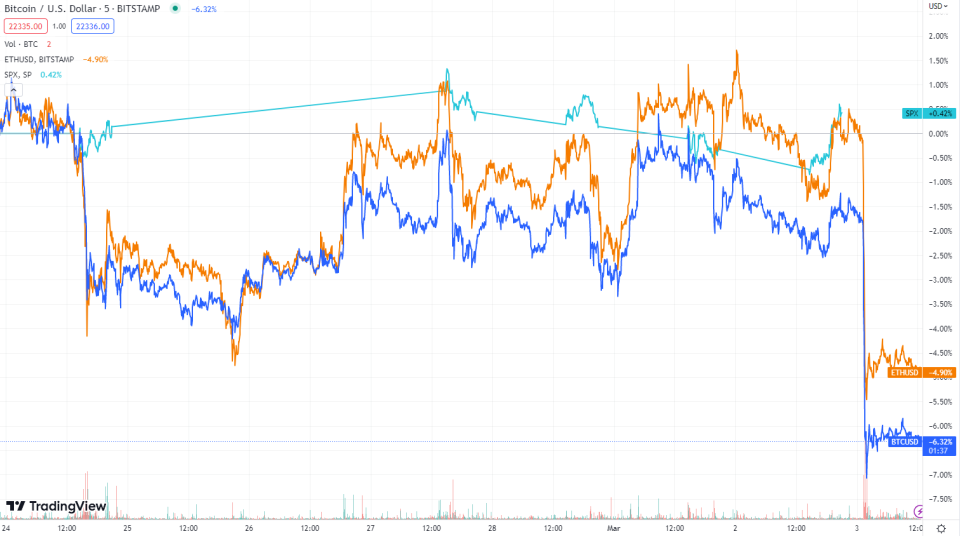

Bitcoin, the world’s largest cryptocurrency by market capitalization, fell 6.57% in the week from February 24 to March 3, trading at USD 22,362 at 8.30pm on Friday in Hong Kong. Ether fell 5.06% over the same period to change hands at $1,565.

“Bitcoin tested the US$22,300 mark this week, the important level I highlighted during my previous analysis. This level has strong support both statically and dynamically,” Aziz Kenjaev, head of partnerships at decentralized crypto derivatives exchange GammaX, wrote to Discard.

“Also see the decline of Bitcoin from USD 22,030 supported by a dynamic support and a lower edge of the parallel channel on January 18,” Kenjaev wrote, referring to the chart below.

“Buyers will try to keep the BTC price above USD 22,300 today and over the weekend, but next week another giant red bar could fill out the Bitcoin chart,” Kenjaev added.

Colin Johnson, CEO and co-founder of Freeport, a platform that brings art investment on-chain, expects Bitcoin’s crab walk to continue.

“I would not expect a pumping BTC price in the near term – even with the upcoming Yuga Labs launch. As has been the trend, we can expect to see BTC continue its crab walk between USD 22,000-24,000 until the uncertainty surrounding the macro elements begins to disappear,” Johnson wrote.

“The markets are likely to feel just like Martian weather – uninviting and picky. We seem to be right in the doldrums with very little on the horizon to indicate a long term rally in the stock market. Crypto will follow, unless there is a significant change in the perception of crypto assets as a hedge against inflation is starting to take hold among major players, which remains a possibility,” Johnson added.

Jonas Betz, a German-based cryptanalyst, told Discard that Mt. Gox exchange’s upcoming bankruptcy filing decision could contribute to Bitcoin’s crab walk.

“Due to fears of a Bitcoin dump due to the Mt. Gox bankruptcy filings as well as a tense macroeconomic situation, I expect Bitcoin to continue its sideways trend in the coming week. Although pessimism among market participants is increasing, a break below 20 000 USD unlikely, as Bitcoin has shown little reaction to bad news in recent weeks. I expect the bitcoin price to continue its sideways trend in the range between US$21,000-25,000,” Betz wrote.

The global crypto market capitalization stood at $1.03 trillion on Friday at 8:30 p.m. in Hong Kong, down 5.5% from $1.09 trillion a week ago, according to CoinMarketCap data. Bitcoin’s market cap of US$431 billion represented 42.1% of the market, while Ether’s US$191 billion accounted for 18.7 percent.

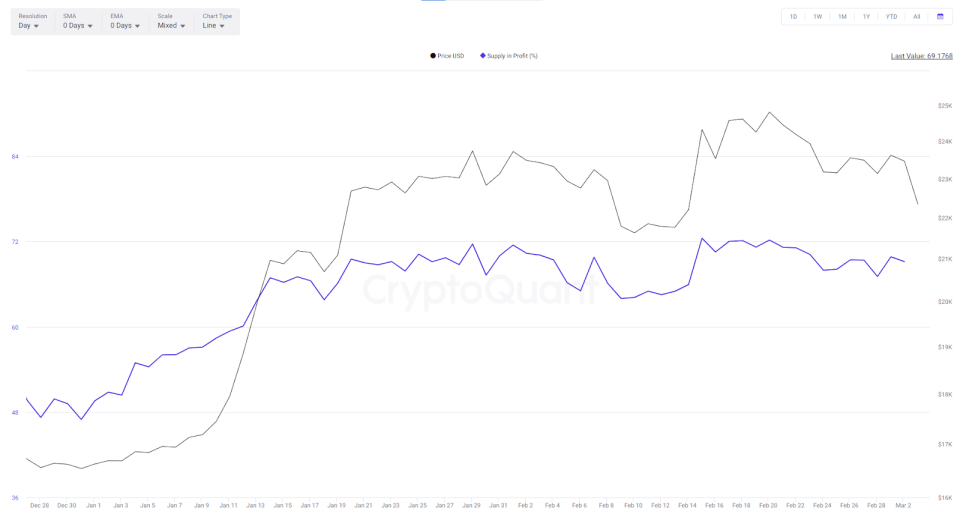

Over 69% of the Bitcoin supply was in profit on March 2, according to on-chain data provider CryptoQuant, up from 49% on January 1. The higher this percentage, the more Bitcoin holders are in profit, increasing the likelihood of investors selling to take profits.

Investment management giant Morgan Stanley warned on Tuesday that the current stock market rally is a “bull trap” and that “March is a high-risk month for the bear market to resume.”

Evgeny Goncharov, director and blockchain advisor at crypto consulting firm BDC Consulting, said an incoming bull trap could be possible.

“The bull trap is real. Chinese money supply ($1.7 million) in the past year affected the investment activities at the beginning of this year. There is a new narrative that is also affecting the crypto market. But Chinese investors copy the behavior of Western investors. That is why we consider this factor as a reinforcement of the traditional market trends and can be switched to different sides,” wrote Goncharov.

Biggest winners: MKR & SSV

MakerDAO’s governance token was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap. The Mkr token rose 25.82% on the weekly chart, to trade at USD 930.16 at 20:30 in Hong Kong. Maker is the largest crypto lending protocol in the decentralized finance space.

The token started to rally on March 1, following MakerDAO’s proposal to enable the use of the governance token as collateral for borrowing the DAI stablecoin.

SSV.Network’s Ssv token was the second biggest gainer, rising 14.72% to change hands at US$44.37. SSV.Network is a project building distributed validator infrastructure and decentralized Ether staking products, which received significant attention at the ETHDenver Hackathon.

See related article: Bitcoin Punks Exceeds 1,145 ETH in Daily Trading Volume as Bitcoin Ordinals Take Off

Next week?

“Pay attention to the ideas from March. Bitcoin is likely to end the month around or possibly just below USD 21,000. Below USD 20,000 means a possible re-test of the USD 16,000-17,000 floor. Above US$25,000 is only possible on macroeconomic news , or a significant shift in sentiment against the US Dollar due to ongoing inflation,” Freeport’s Johnson wrote.

“Confidence reports on inflation, interest rates, the war in Ukraine, China, and possibly the outcome of the student debt relief decision in the Supreme Court,” will be the main factors driving the markets, according to Johnson. “Relief could drive the perception that young Americans will push their newfound ‘cash’ into the crypto ecosystem,” he added.

GammaX’s Kenjaev warned of more potential volatility next week, due to the upcoming testimony of US Federal Reserve Chairman Jerome Powell.

“Bitcoin’s price is also driven by the gains and losses of its main trading counterpart – the US Dollar… We expect high volatility during Fed Chairman Jerome Powell’s testimony on Tuesday and Wednesday. And for the rest of the week, we expect a little rock and roll trajectory since important data on vacancies, NFP (nonfarm payroll report) and unemployment will be released,” Kenjaev wrote, adding that any developments regarding Paxos and Kraken will be significant.

“I expect a retest of US$22,800-22,900 by Monday and another decline to US$21,450 next week. The key level to watch is US$22,300. If there is a daily close below this level, US$21,450 is the next important support to watch. Although I still stand for a drop to USD 19,000, this level for me will be a significant booster level for the next big uptrend,” Kenjaev wrote.

Alex Reinhardt, the founder of PLC Ultima, a firm that builds crypto infrastructure for mass adoption, said the crypto market is mainly driven by the US economy and rising consumer prices.

“So far, data on the state of the US economy and the growth of consumer prices in the US have a more significant impact on the crypto market and the price of Bitcoin. The PCE index published last week turned out to be worse than expected, and this negative effect immediately affected the crypto market . The risk that the Fed will decide to raise the policy rate by 50 basis points instead of 25, as previously expected, has grown after the release of the household consumption index,” Reinhardt wrote, adding that “Bitcoin Ordinals definitely do not compare to the expected effect of the FOMC – the press conference scheduled for March 22.”

Analyst Betz expects more bearish momentum in March. “I can see Bitcoin ending March at USD 22,000. The reason for my bearish price target is that inflation has picked up and the Fed funds rate is likely to be increased after the March 21-22 FOMC meeting. An important price level to watch are the psychological levels of $20,000 and $25,000. A breach of either of these levels would lead to a big price move,” Betz wrote.

See related article: Industry reacts: US cracks down on crypto, India calls for regulatory cooperation