BTC HODLers could be in for a midweek surprise in light of these developments

The Federal Reserve raised interest rates by 0.75 percentage points for the fourth time in a row from last week. This allowed global stocks a brief period of relief, and leading cryptocurrency Bitcoin [BTC]witnessed a slight rise in price.

_______________________________________________________________________________________

Here is AMBCryptos Bitcoin price prediction [BTC] for 2023-24

_______________________________________________________________________________________

Furthermore Glassnode, in a new report, found that the recent rise in the price of the king coin could be attributed to the “price-insensitive HODLer cohort”. These HODLers continue to hold their investments and “the first glimmers of demand are coming back into the system.”

Hang on for dear life

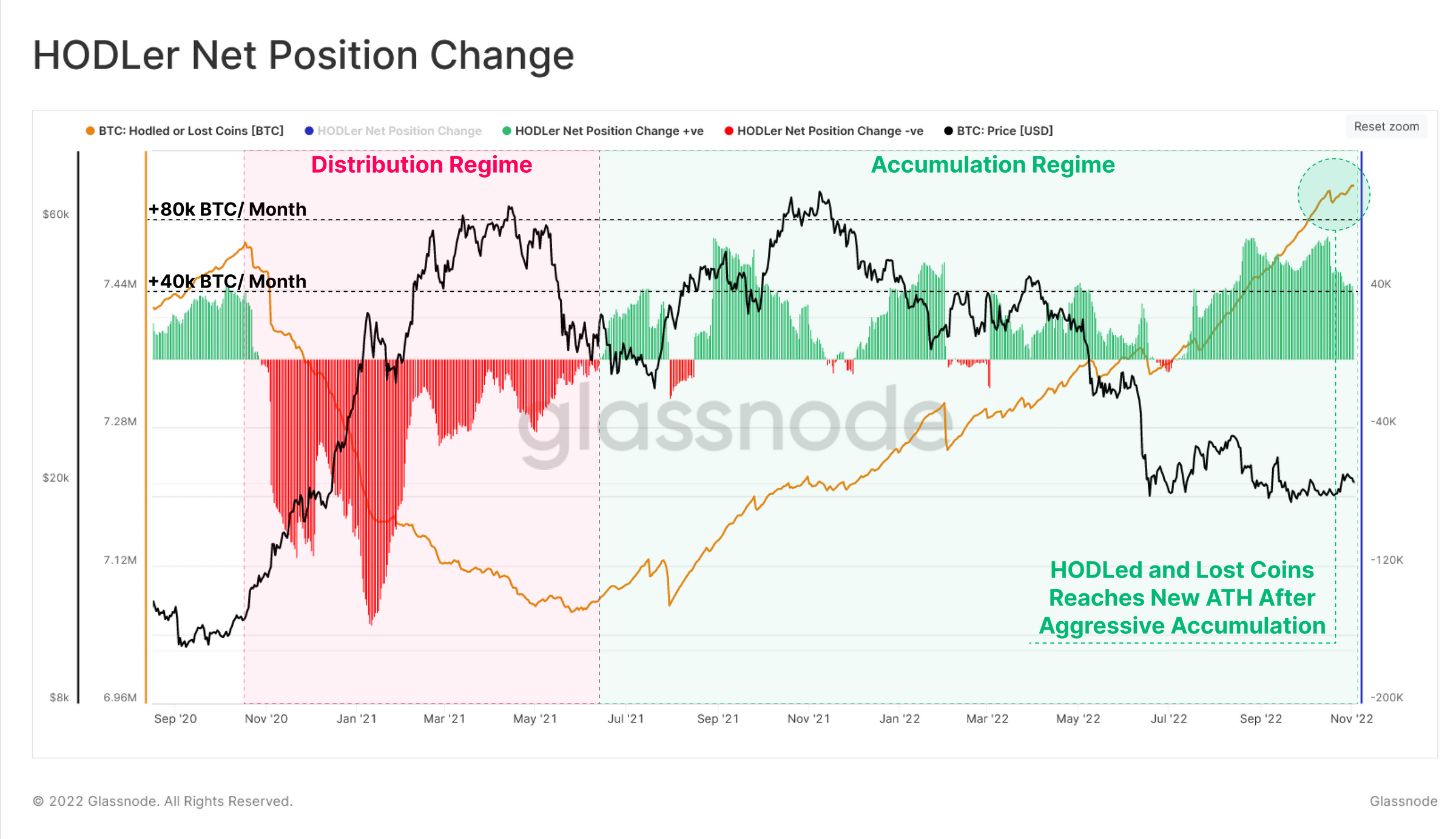

Glassnode considered the HODLer Net Position Change metric, which tracks the 30-day change in HODLed or Lost coin supply (the most dormant on-chain). It found that “aggressive accumulation” by this group of BTC holders pushed the number of dormant coins on the network.

This led to new all-time highs. Prior to this, HODLers had been aggressively selling their holdings to cash in on the cycle topping formation.

Source: Glassnode

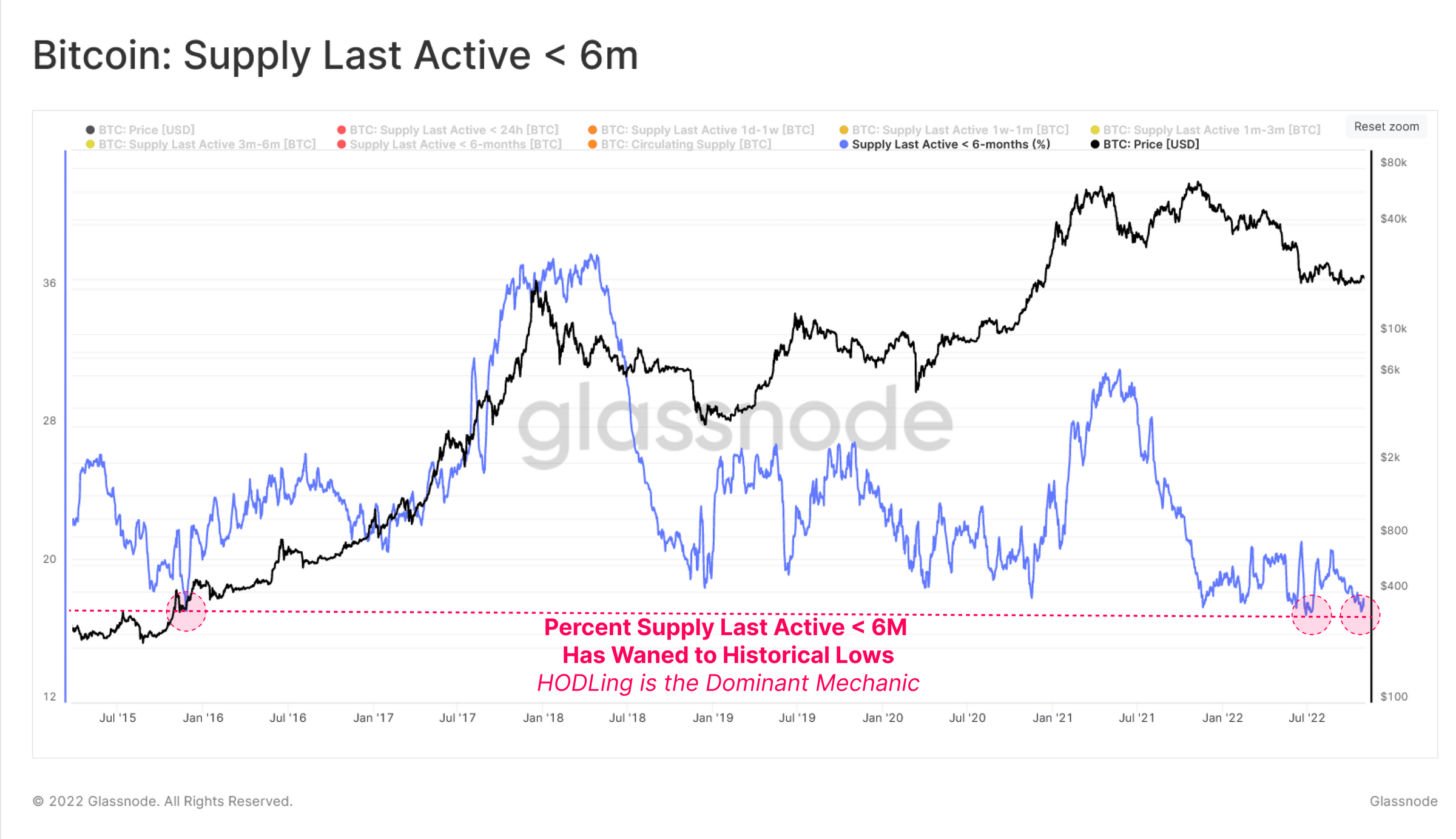

Conversely, hot coins, which are BTC coins used in daily trading, continued to decline, Glassnode found. According to the analytics platform on the chain,

“The supply younger than 6 months old available on the market has remained around historical lows since May 2022 and continues to decline, further reiterating the extreme level of HODLing present in the current market.”

Source: Glassnode

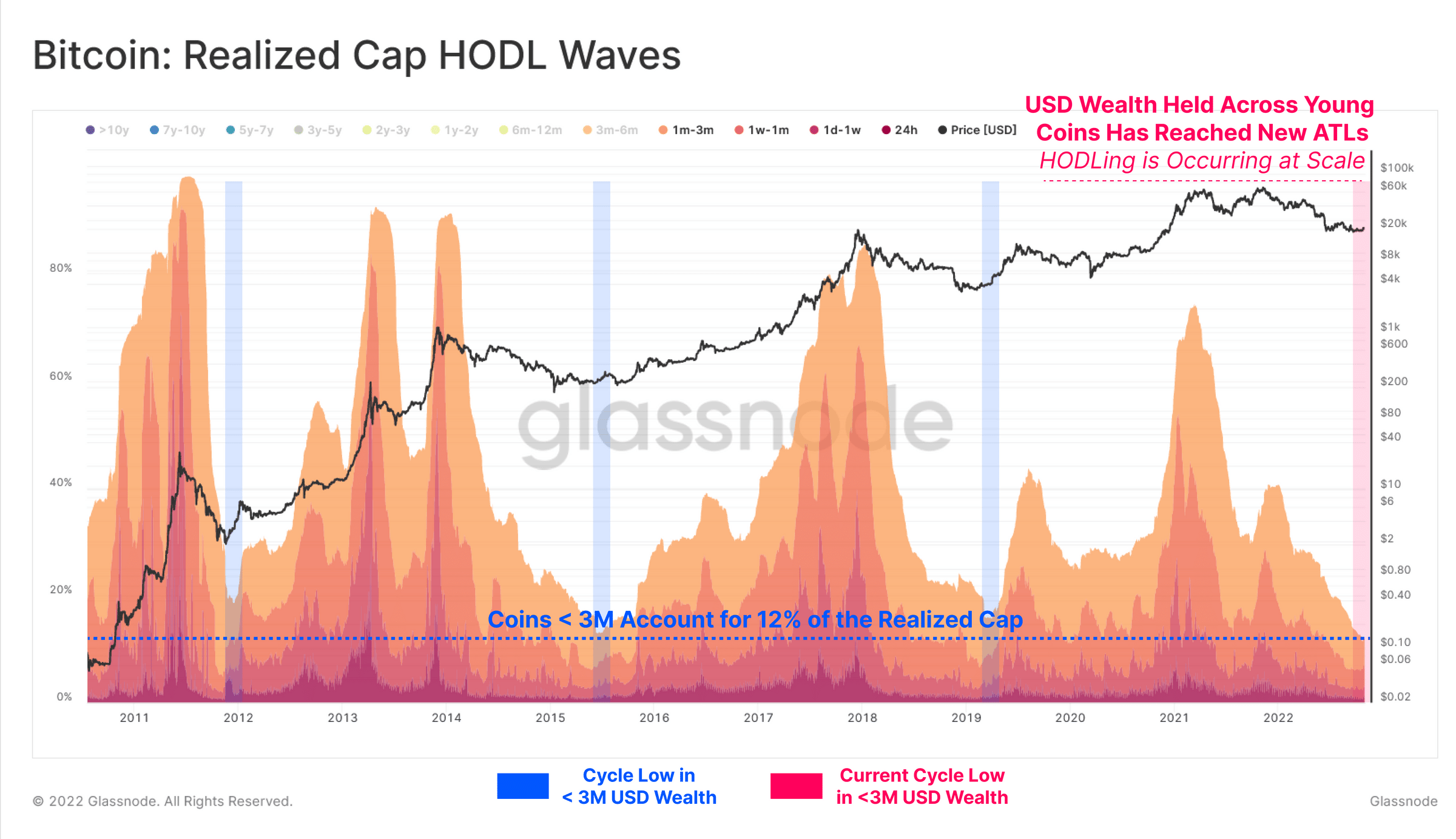

An assessment of the Realized Cap HODL Waves metric revealed that the BTC HODLer cohort was “the most dominant they’ve ever been.” This metric is used to inspect USD-denominated wealth held by specific age cohorts. Glassnode found that for BTC coins younger than three months, USD wealth in this age cohort was at an all-time low.

On the other hand, for those older than three months, the fortune reached an ATH. This, according to Glassnode, showed “a resounding refusal to use and sell, despite the persistent challenges in global capital markets.”

Source: Glassnode

More tricks up their sleeves

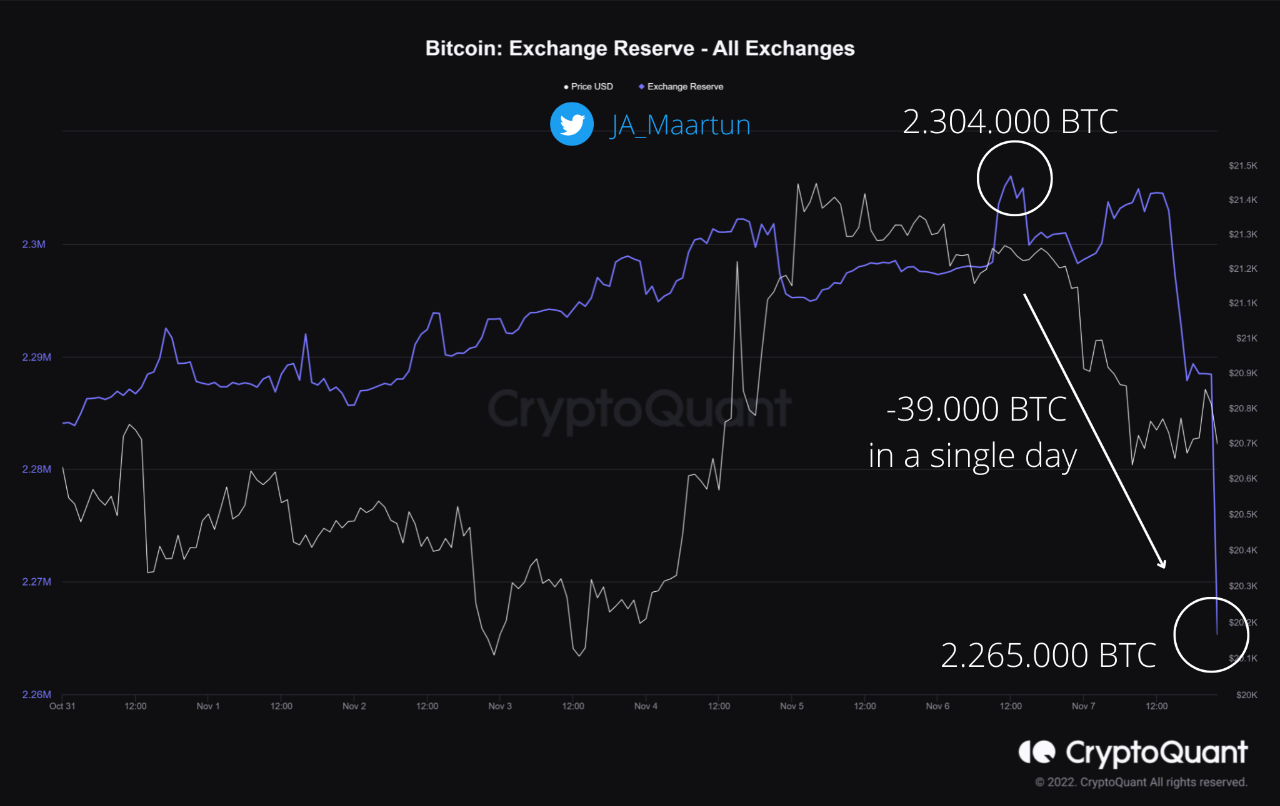

According to CryptoQuant analyst Maartunn, the last few days have been marked by a continued decline in Bitcoin Reserves on Exchanges. During intraday trading on November 7th, a huge amount of BTC moved outside of known exchanges.

Thus leading to a decrease in currency reserves from 2,304,000 BTC to 2,265,000 BTC. Maatuun believed that “this is an absolutely incredible sign of confidence in the Bitcoin network.”

Source: CryptoQuant

A decrease in BTC Exchange Reserves triggers an upward price growth in the long term. Furthermore, it is relevant to note that unfavorable macro factors can contribute to price falls in the short term.