BTC Falls Below $30,000 After Strong Selling Pressure – Cryptopolitan

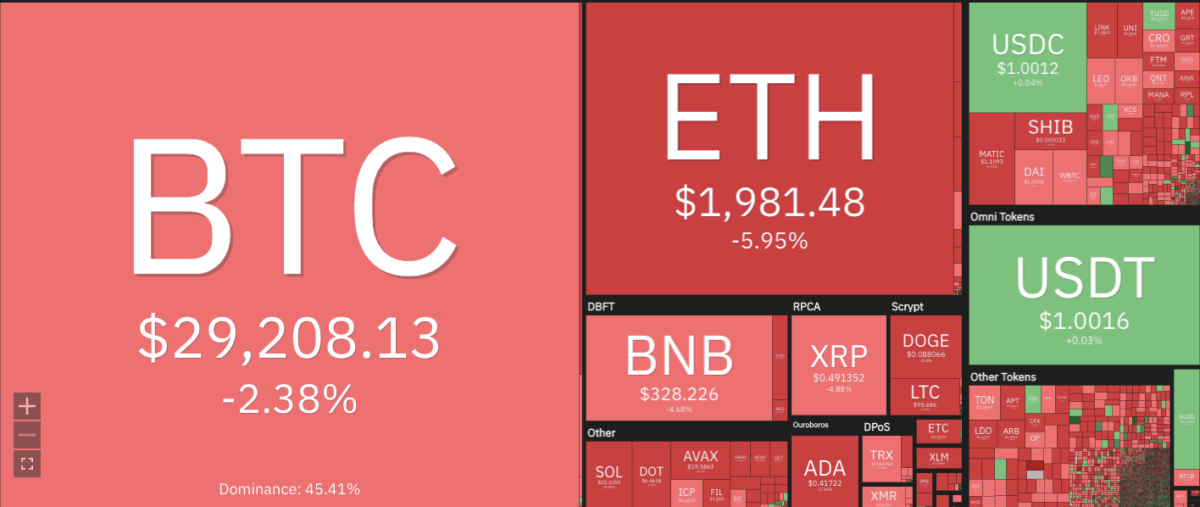

Bitcoin price analysis for today favors the bears as prices continue to bleed downward. BTC fell below the $30,000 barrier after facing strong selling pressure from sellers. The past few days have been particularly harsh for Bitcoin as the bears began to gain control of the market. At the time of writing, BTC is trading at $29,208, a loss of more than 2.38 percent in the last 24 hours.

Key support for Bitcoin prices is seen at $29,102 and any break below this level could increase selling pressure and lead to further losses. If buyers can manage to defend this level, it could lead to a pullback in prices towards the $30,000 psychological mark.

Most cryptocurrencies are trading in the red today, and it is likely that prices may continue to fall further in the coming days. The other top coins, Ethereum and Ripple, are also trading in the red and risk further losses.

Bitcoin Price Action in Last 24 Hours: BTC Hits $29,208 Lows as Bears Rule the Charts

Bitcoin price analysis has been on a downward spiral over the past 24 hours and is currently trading between $29,102 to $30,470, indicating a tight range bound action. The downtrend is expected to continue soon as the bears maintain control over market sentiment according to Bitcoin price analysis. Prices will probably fall further as selling pressure increases in the coming days.

The market cap of the coin has also seen a sharp drop and currently stands at $565 billion, down 2.34 percent in the last 24 hours. BTC dominance has also risen to 45.41 percent as most other altcoins continue to struggle against the dollar. However, trading volume is up 36.33 percent in the last 24 hours to $23.68 billion, indicating strong demand for the coin.

The technical indicators are in favor of the bears and suggest that prices may drop lower in the near future. The RSI is currently at 54.55, showing no signs of a reversal. The MACD indicator is also in bearish territory indicating that selling momentum remains strong. The Chaikin Money Flow indicator is also negative, suggesting that selling pressure is increasing. The moving averages are also in a downward trend and suggest that prices may fall.

Bitcoin Price Analysis on a 4-Hour Price Chart: Recent Developments and Technical Indications

The 4-hour price chart for Bitcoin price analysis shows that the price is going down again after the bears managed to secure ground on the Candlestick chart. The market has been favorable to buyers for most of the last week, but strong selling pressure in the last 24 hours has managed to put a stop to that.

The 50-day moving average is currently at $29.338, and is below the 200-day moving average, which currently stands at $29.339. This suggests that the market may face further losses in the coming days. The MACD indicator has also turned bearish indicating that sellers are in control of the market. The histograms are in red and the signal line is below the MACD, confirming a strong bearish sentiment. The RSI indicator is currently at 36.59 in the oversold region, suggesting that prices may fall in the near future as there are no signs of a bullish reversal yet.

Bitcoin price analysis conclusion

Bitcoin price analysis for today shows that prices are still under pressure from sellers despite a few attempts at recovery. The general trend remains bearish and further losses cannot be ruled out in the near future. Bulls are expected to defend the key support level of $29,102 to avoid a further decline. The technical indicators are all in favor of the bears and suggest that selling pressure may increase further in the coming days.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Polkadot and Curve