Blockchain ETF issuers with ‘Crypto Street Cred’ may come out on top

[gpt3]rewrite

Blockchain technology continues to present an exciting promise, one capable of increasing efficiency and transparency, financial executives have said.

Yet blockchain-focused ETFs issued by some of the world’s largest and most influential fund groups have very few assets to show for it.

Investors are not high on BlackRock’s offer

The phrase “blockchain, not bitcoin” has been something of a rallying cry for traditional financiers and crypto-natives — a sentiment that crypto’s underlying technology is more valuable than volatile tokens alone.

Tokenization has been a crypto practice that Wall Street types used to asset-backed securities plays have often championed as a regulated US asset class.

BlackRock CEO Larry Fink went so far as to say that tokenization of securities is “the next generation for markets” during a New York Times summit in November.

The company, which has roughly $9 trillion in assets under management, launched its iShares and Blockchain Tech ETF (IBLC) in April 2022. BlackRock added the fund to its “megatrends” product suite at the time.

But after more than a year on the market, IBLC’s assets under management are a scant 7 million dollars. The fund — whose top holdings include Riot Platforms, Coinbase and Block — is down about 8% from a month ago, but was up 68% year-to-date through Tuesday midday.

Only 21 of BlackRock’s roughly 400 ETFs (including those under its iShares subsidiary) have less assets than IBLC, according to ETF.com data.

A spokesperson for BlackRock declined to comment.

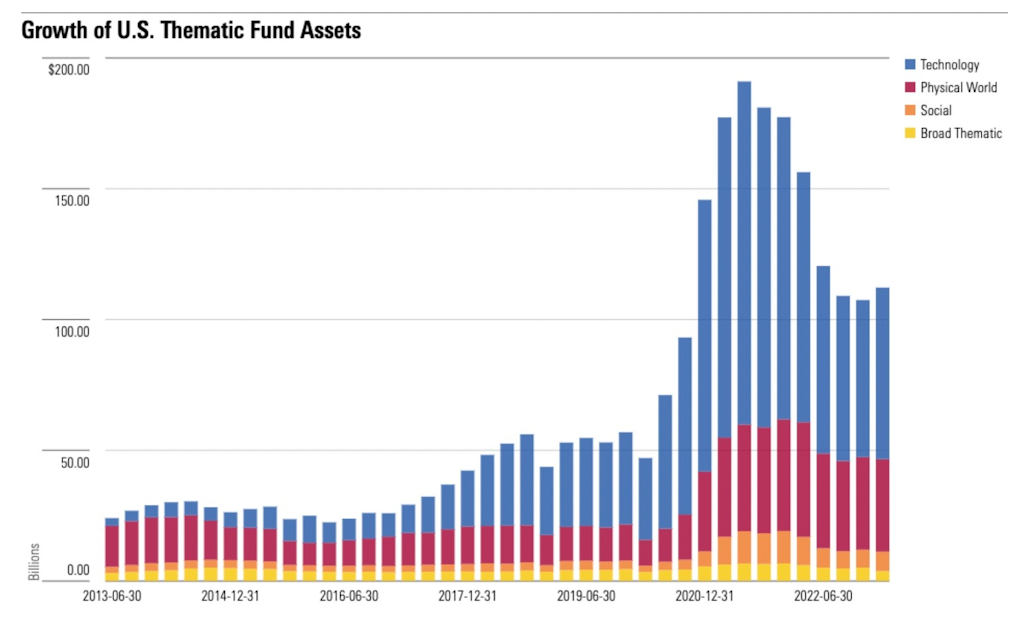

Assets in thematic funds more generally — products that focus on specific trends when it comes to folding — have more than doubled since just before the pandemic, Morningstar data show.

Through April, however, the sector’s assets had fallen, falling around 40% since markets peaked in mid-2021.

Even Ark Invest’s Innovation ETF ( ARKK ) — a popular offering that recently controls up to $7.8 billion in assets — has recorded outflows.

That’s despite annual gains of more than 26%, according to Neena Mishra, director of ETF analysis for Zacks Investment Research.

“Market uncertainty this year has driven investors into safer areas of the market, and investor appetite for risk assets remains low,” she told Blockworks.

Nathan Geraci, president of The ETF Store, said some investors were badly burned during last year’s rout and probably don’t want to be burned again — especially as the SEC has cracked down on crypto.

“I think another subset of investors is simply allocating to bitcoin futures ETFs,” Geraci said. “Ultimately, it is my belief that many investors are still waiting for the real deal: a spot bitcoin ETF.”

Read more: SEC Responds to Coinbase Request for Action: ‘No’

Little grip for Invesco, Fidelity

BlackRock isn’t the only fund giant struggling to gather assets for its crypto-adjacent fund.

Fidelity launched its Crypto Industry and Digital Payments ETF (FDIG) days before the launch of IBLC. After 15 months on the market, it has $30 million in assets. FDIG is up 53% so far in 2023.

“Where our clients invest matters more than ever, and Fidelity’s goal is to provide our clients with choice — a diverse array of products and services that meet their distinct investment goals,” a Fidelity spokesperson told Blockworks in a statement. “As with everything we bring to market, we take a long-term view.”

Before BlackRock and Fidelity launched blockchain-related offerings, Invesco introduced its Crypto Economy ETF (SATO), as well as its Blockchain Users and Decentralized Commerce ETF (BLKC).

The funds launched in October 2021 under a partnership with Galaxy Digital – but the products only have $6 million in combined assets. SATO and BLKC are up 75% and 35% respectively so far this year.

Invesco declined to comment.

While these four ETFs from BlackRock, Fidelity and Invesco have less than $50 million in assets combined, Amplify Investments’ Transformational Data Sharing ETF (BLOK) has a substantial $450 million. It benefited from being a first-mover, launched in January 2018.

BLOK is trading around 28% higher than it was at the start of the year, below several of its peer brands.

Issuers with crypto “street cred” are much more likely to resonate with investors, Geraci told Blockworks.

“Do you want a firm that specializes in crypto to manage and support your ETF or a firm that offers every type of investment theme under the sun?” he said. “While Fidelity has some chops in the space, Invesco and BlackRock aren’t exactly household names in crypto.”

Delistings in sight?

Like investors, fund groups mistime their inputs or outputs.

While providers routinely liquidate products that fail to attract assets, smaller issuers with just a few funds are more likely to close unpopular funds, Mishra said.

Geraci said in November that he expected fund issuers to remove a number of blockchain funds over the coming year.

The Viridi Bitcoin Miners ETF (RIGZ), which launched in July 2021, closed in January.

“Larger vendors can keep even underperforming products alive longer if they see some long-term potential,” Mishra told Blockworks. “I’ve seen some cases where sleepy products come back to life after a period of little interest from investors.”

She cited ETFs focused on clean energy initiatives, as well as uranium products, as examples.

State Street’s SPDR S&P Kensho Clean Power ETF (CNRG) initially struggled to attract assets when it launched in 2018.

It achieved just $7 million in net inflows in 2019, according to ETF.com data.

But the fund went on to bring in $136 million and $242 million in 2020 and 2021, respectively.

Get today’s best crypto news and insights delivered to your email every night. Subscribe to Blockworks’ free newsletter now.

Want alpha sent straight to your inbox? Get degen trading ideas, management updates, token performance, unmissable tweets and more from Blockworks Research’s Daily Debrief.

Can’t you wait? Get our news in the fastest way. Join us on Telegram and follow us on Google News.

[gpt3]