Tags in this story

Bitcoin’s hashrate remains stronger than ever in the face of crypto winter prices and skyrocketing difficulty – Mining Bitcoin News

Despite the fact that bitcoin miners are making minimal profits per petahash per second (PH/s), and the plethora of headlines showing specific mining operations that have folded since the crypto winter, the network’s overall hashrate continues to deplete at close to 300 exahash per second (EH/s). With lower bitcoin prices and the mining difficulty at an all-time high, the current trends have not pushed bitcoin miners back in the slightest. Meanwhile, the next difficulty retarget scheduled to take place around October 23 shows that another increase will take place.

Bitcoin’s hashrate remains high despite current obstacles

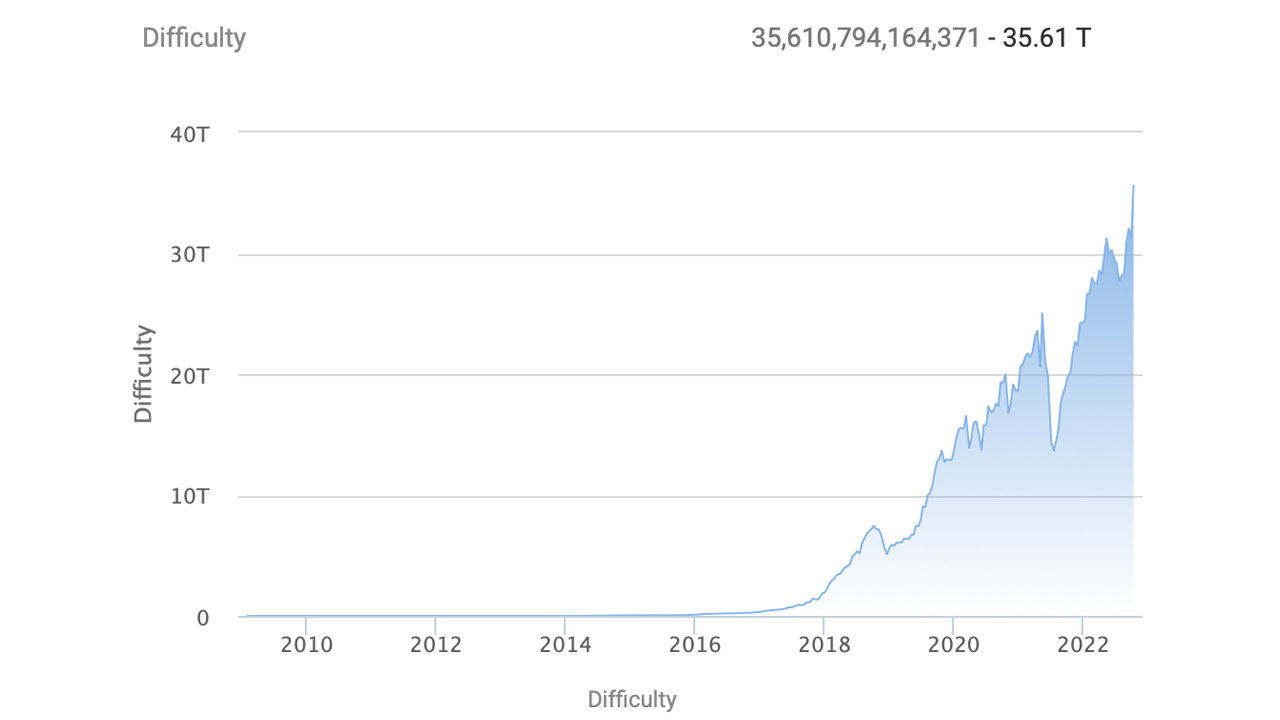

With less than two days to go, it looks like bitcoin (BTC) miners will get another bump up in network difficulty. Currently, Bitcoin’s difficulty is at an all-time high (ATH) of 35.61 trillion and the next change is scheduled to happen in less than two days on or around October 23, 2022.

While the difficulty of ATH makes it much more challenging for bitcoin miners to find a block subsidy, miners still have a lot of hashrate dedicated to the leading cryptoasset’s network security. Today, coinwarz.com statistics show that BTC’s total hashrate in the last hour has been between 290 to 315 EH/s.

The calculation is just below the October 11, total hashrate ATH recorded at block height 758,138. At that time, the total network hashrate reached a lifetime high of 325.11 EH/s.

Current block times on Friday are also less than the ten-minute average, as a few data points show that current block times today have been between 8:30 minutes to 9:35 minutes. Typically, when the 2016 blocks are found faster than the ten-minute average, the retarget date is less than two weeks.

When this trend occurs, the blockchain network’s mining difficulty will increase to make it more difficult for miners to find a BTC block. Satoshi created the system this way so block times would stay within a consistent ten-minute average.

At the time of writing, the difficulty is estimated to rise between 4.03% to 4.6% higher than today’s 35.61 trillion. The projected percentage increase will increase BTC’s mining difficulty up to the 37 trillion range.

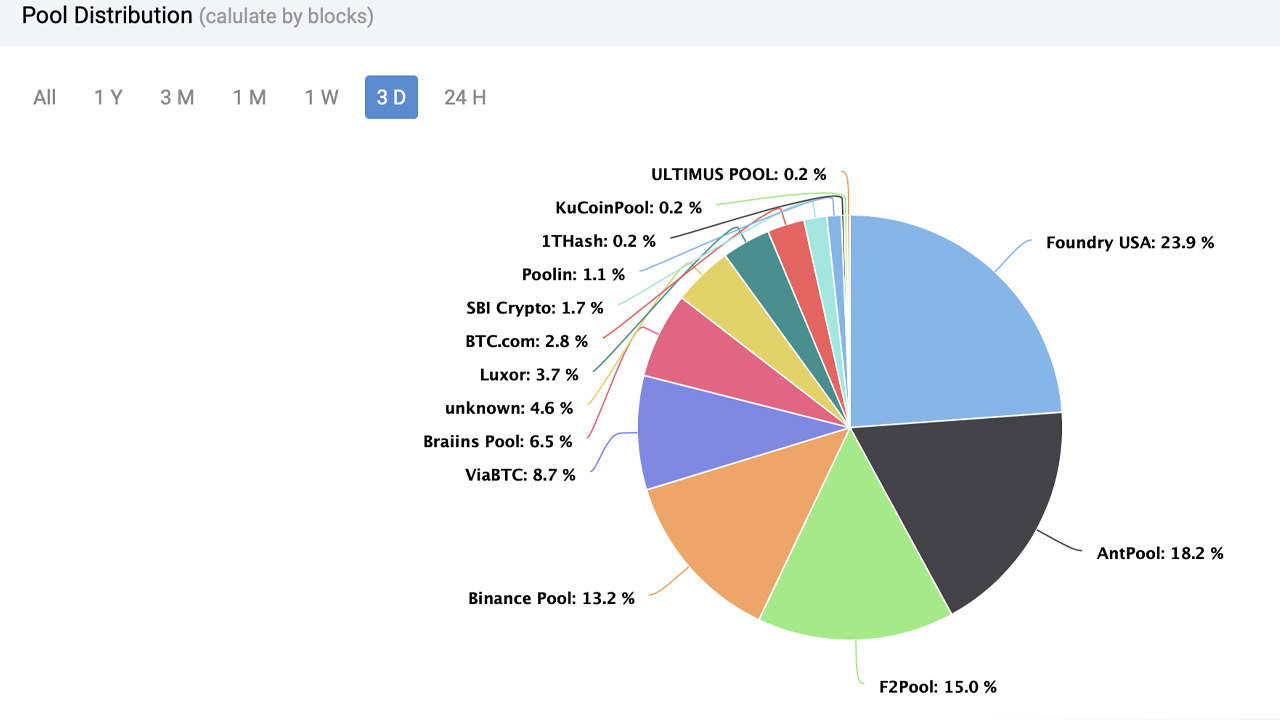

Currently, the largest mining pool today, Foundry USA, has an average of 63.34 EH/s dedicated to the BTC chain over the past three days. Foundry’s hashrate is around 23.86% of the total network’s computing power.

Under the top BTC mining pool Foundry includes miners like Antpool (48.37 EH/s), F2pool (39.73 EH/s), Binance Pool (35.13 EH/s) and Viabtc (23.03 EH/s) when it comes to the top five hashers. There are currently 13 known mining pools dedicating hashrate to the BTC chain, and 12.09 EH/s, or 4.56% of the total network is controlled by unknown miners.

The record high hash rate comes at a time when a few major mining operations have struggled with financial difficulties and bankruptcies. This week, investment bank DA Davison market analyst Chris Brendler downgraded shares of Argo Blockchain (Nasdaq: ARBK ) and Core Scientific (Nasdaq: CORZ ) to neutral.

With the hashrate so high, a person just observing Bitcoin’s computational power would not be able to tell that some BTC miners are struggling. It may be the case that while a handful of BTC mining have faltered, larger operations are simply picking up the slack, ASICs and facilities at discounted prices.

What do you think about Bitcoin’s hash rate remaining high despite the obstacles it faces such as the ATH of difficulty and lower bitcoin prices? Let us know your thoughts on this topic in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.