Bitcoin’s general sentiment is decidedly negative

Indicators and Google searches indicate that the overall Bitcoin sentiment is very pessimistic.

Bitcoin’s sentiment trend remains negative

As can be seen from a tweet from Jameson Loopa big Bitcoin supporter and co-founder of Casamost Google suggestions redirect to negative searches:

Bitcoin is. pic.twitter.com/dJoXCPz7ko

— Jameson Lopp (@lopp) 18 September 2022

The first is “Bitcoin is dead“. As of June 18, this keyword had reached an ATH of 100/100, according to Google Trends.

Unsurprisingly, it coincided perfectly with the end of the first major bearish phase, when BTC had retested $19,000 support for the first time since December 2020.

In fact, it is an indicator of 99bitcoins portal that reports the number of Bitcoin deaths over the relevant time period.

a “Bitcoin obituary” is defined as any content that explicitly expresses the end of Bitcoin, such as describing it as useless or worthless.

To date, Bitcoin has died 461 times. The most recent was on July 3, 2022 and was recorded by the following tweet:

There will come a day when you wish you were sold #Bitcoin for $20,000!

Take a look at the historical chart to see how far of a fall is possible, if you’re interested in the risks associated with an unwinding Ponzi scheme.

— Peter ⚒ Spina | Greek mode | Gold and silver Maxim. (@goldseek) 3 July 2022

The phrase that made this statement qualify as an obituary was:

“Bitcoin is a Solving Ponzi Scheme”.

It is no coincidence that this research is back in vogue, just now that the value of BTC has broken a new support, pushing below $18,500.

This could be technical confirmation of a bearish pattern, such as can drag Bitcoin towards $10,000a level praised by many analysts.

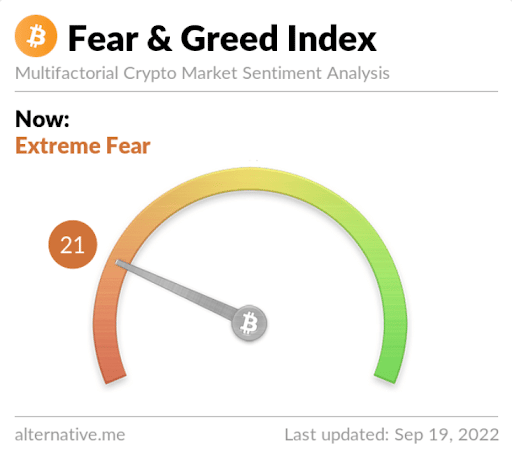

Another important factor that well sums up Bitcoin’s market sentiment is the well-known Fear and Greed Index.

Currently, it stands at 21, indicating extreme fear on the part of investors.

This situation occurs precisely in sustained bearish phases, or after a series of negative events.

The relationship between sentiment and asset price

Unfortunately, people’s views are closely influenced by asset prices. If these fall, it almost immediately results in a loss of investor confidence.

In this case, however, one should, in the same way as one assesses the future potential of a company, analyze the underlying technology and the capabilities of the ecosystem to meet a given need in the market.

This will provide a more or less adequate estimate of the intrinsic value of the asset being assessed and give investment decisions a certain more rational level.

Most people do not do this and let themselves be guided by the strong emotions of the moment, such as the famous FOMO (Fear of missing out), fear, greed or simply uncontrolled general hype.

This explains why almost all retail investors buy when the price is high and sell when the price is low.