Bitcoin’s 10% Weekly Drop Gives Bears Control Ahead of Jackson Hole Symposium

Bitcoin (BTC) fell over 10% last week, the biggest drop in two months. Analysts say the price slide has given the bears control ahead of the US Federal Reserve’s annual economic symposium in Jackson Hole, Wyoming, on Friday.

The largest cryptocurrency sold off as the Fed’s July meeting minutes actively pushed back against hopes of liquidity easing in 2023. Talk of Jump Crypto selling ether spurred profit-taking on the native token of Ethereum’s blockchain.

Bitcoin’s fall has broken technical charts and revived the bearish trend, according to observers.

“Last week’s slide has put the bears in the driver’s seat. The market will take a while to turn around and will need good news,” trader and analyst Alex Kruger told CoinDesk, adding that Fed Chair Jerome Powell is unlikely to deliver good news later this. week.

According to David Duong, Head of Institutional Research at Coinbase, bitcoin’s daily technical chart has turned bearish and the cryptocurrency may continue to lose ground in the short term.

“BTC is likely to retest support at $20,830 and $19,230 in the coming weeks,” Duong noted in the weekly market commentary, adding that traders will be closely watching Powell’s comments at the Jackson Hole symposium.

After last week’s Fed report, there seems to be consensus in the market that Powell will lean on the hawkish side during the Jackson Hole Economic Symposium. The annual gathering, sponsored by the Federal Reserve Bank of Kansas City, hosts central bankers, Treasury secretaries, academics and financial market participants.

“Fed Chair Jerome Powell will likely try to take a more measured approach in Wyoming and emphasize that the tightening cycle is not over yet,” Duong noted. The Fed’s monetary policy tightening has devastated the cryptocurrency market this year.

Michael Kramer, the founder of Mott Capital Management, wrote in a weekly market update, “I would expect Powell to lay out quite clearly that the pace of future rate hikes may slow, but that they have much longer to climb and are likely to remain high for some time.”

The Fed said in July that it would be appropriate to slow tightening at some point, triggering an easing uptick in risk assets. However, according to Dan Peng, VP at Singapore-based digital asset management platform Metalpha, monetary policy is operating with a lag. So the central bank is likely to stick to its hawkish script for at least a while.

The effect of higher interest rates on inflation will be evident in about six months. Peng said. “It is still too early to post more calls for bitcoin at this time.”

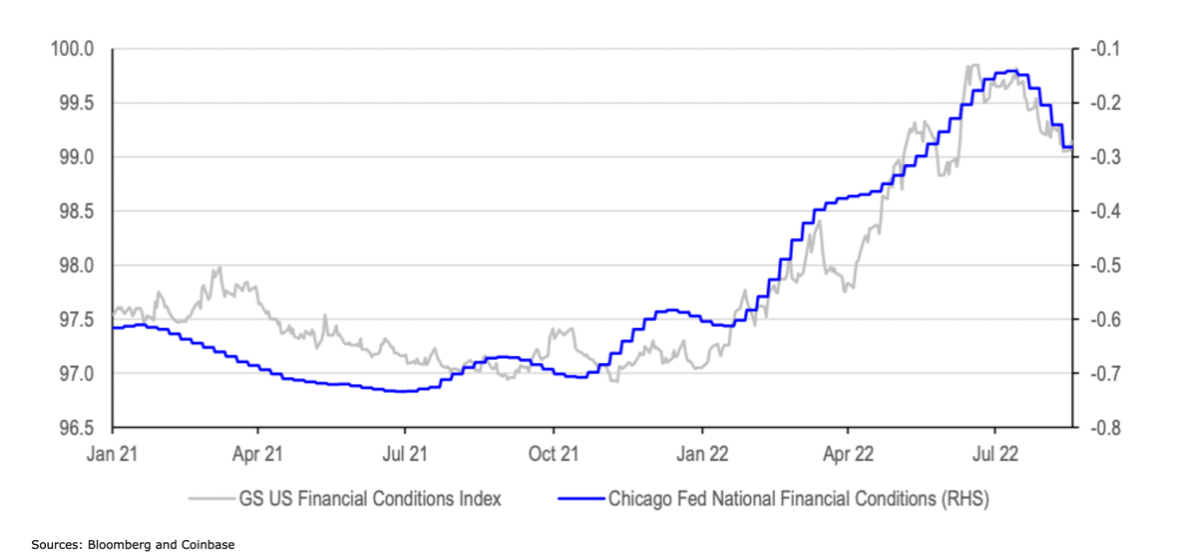

The Fed has plenty of room to maintain the pro-tightening bias for some time, as conditions in most of the US financial markets have eased since mid-June.

Tighter economic conditions are widely seen as a sign of slowing growth and vice versa. The tighter the conditions, the more challenging it is for the central bank to drain liquidity from the economy without limiting growth.

While Bitcoin’s short-term outlook looks bleak, most of the downtrend has likely played out. “Medium to long-term perspective, the current market is at the bottom of the Kitchin cycle, and the bottom-building process will repeat itself in the next few months,” Metalpha’s Peng said.

The figure shows US financial conditions have eased since mid-June. (Bloomberg, Coinbase) (Bloomberg, Coinbase)

While bitcoin’s short-term outlook looks bleak, most of the downtrend has likely played out. “Medium to long-term perspective, the current market is at the bottom of the Kitchin cycle, and the bottom-building process will repeat itself in the next few months,” Metalpha’s Peng said.